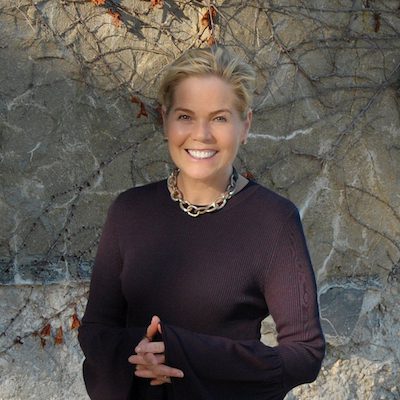

“The Failure Gal – Failing Forward Toward Compassion”Imagine achieving success – buying your dream home, owning investment and rental properties, establishing expertise as a wealth coach, all in the height of an economic boom and a bull market. Now… imagine losing it all – ALL: propertie…

“The Failure Gal – Failing Forward Toward Compassion”Imagine achieving success – buying your dream home, owning investment and rental properties, establishing expertise as a wealth coach, all …

“The Failure Gal – Failing Forward Toward Compassion”Imagine achieving success – buying your dream home, owning investment and rental properties, establishing expertise as a wealth coach, all in the height of an economic boom and a bull market. Now… imagine losing it all – ALL: properties, home, savings, credit rating, reputation – reduced in the collapse of the subprime mortgage meltdown.In this insightful and joyously exuberant episode, Kate Phillips – a Money Mindset Coach and Women’s Wealth Coach, shares her experiences and insights on financial failures. She highlights t…