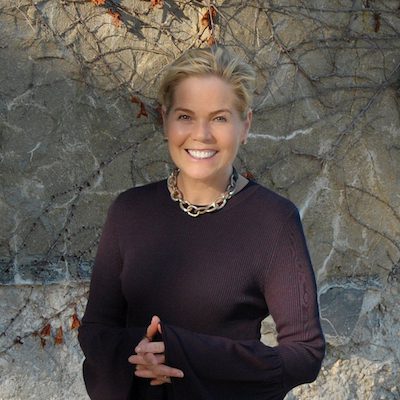

Pam Krueger is an investor advocate, personal finance journalist, and author. She is the founder and CEO of Wealthramp, an advisor matching platform that connects consumers with rigorously vetted and qualified fee-only financial advisors. Pam created and co-hosted the award-winning investor education TV series, MoneyTrack, seen on 250+ public stations on PBS. With over 25 years in the industry, Pam is one of the leading voices on financial literacy and financial empowerment. When she’s not writing about financial planning for Worth, she’s talking about investing strategies on her podcast, Friends Talk Money.

Recent Content

On the latest episode of Friends Talk Money, the crew sits down with IRA and Tax Guru Ed Slott to dive deep into all things Retirement savings.

On the latest episod…

On the latest episode of Friends Talk Money, the crew sits down with IRA and Tax Guru Ed Slott to dive deep into all things Retirement savings.

Expert Brian Gordon explains how a recent law created a clever new way to pay for premiums in case you ever need long-term care.

Expert Brian Gordon …

Expert Brian Gordon explains how a recent law created a clever new way to pay for premiums in case you ever need long-term care.

Taking care of loved one’s with special needs can be incredibly overwhelming, especially if you’re going at it alone. That’s why it’s so important to know where to turn for help. Mary Anne Ehl…

Taking care of loved…

Taking care of loved one’s with special needs can be incredibly overwhelming, especially if you’re going at it alone. That’s why it’s so important to know where to turn for help. Mary Anne Ehlert, founder of Protected Tomorrows, recently joined the Friends Talk Money team to share her personal experience as a Caregiver to her own sister with special needs. Mary Anne shed light on the complexities and amount of work required to financially care for someone who cannot earn an income of their own. She also described what motivated her to start Protected Tomorrows and help families to …

The Friends Talk Money team is joined by Alexandra Armstrong, CFP®, CRPC® who is the chairman and founder of Armstrong, Fleming & Moore, Inc. Alex has worked in the investment field for more tha…

The Friends Talk Mon…

The Friends Talk Money team is joined by Alexandra Armstrong, CFP®, CRPC® who is the chairman and founder of Armstrong, Fleming & Moore, Inc. Alex has worked in the investment field for more than 40 years and back in 1977, was the first person to earn the Certified Financial Planner™ certification in Washington, DC. On this episode, Alex discusses her book On Your Own, a widows guide to emotional and financial well-being and offers useful advice to those who are struggling with becoming a widow.

Our next special guest has undeniably made the most significant impact on your Retirement savings strategy. In this episode, the Friends Talk Money team sits down with Ted Benna, the father of the 401…

Our next special gue…

Our next special guest has undeniably made the most significant impact on your Retirement savings strategy. In this episode, the Friends Talk Money team sits down with Ted Benna, the father of the 401(k) plan. Ted shares the fascinating story of how he conceived this groundbreaking idea, navigated the IRS approval process, and gives us a glimpse into his current projects.

New Social Security Commissioner Cuts Clawbacks!

New Social Security …

New Social Security Commissioner Cuts Clawbacks!

There's nothing more painful than losing your job when you're older and not being able to get a new one. Research says there's a stigma about "older unemployment" - especially when it drags on for mor…

There's nothing more…

There's nothing more painful than losing your job when you're older and not being able to get a new one. Research says there's a stigma about "older unemployment" - especially when it drags on for more than a year! Meet Ben who is going through that right now. He remains optimistic, but details the hazards -- even for those in technology -- when a job disappears. Some helpful perspective for you - or someone you might know and love.

The price of prescription drugs can be enormous when you're on Medicare, so in this Friends Talk Money episode, we offer advice on how to pay the least for your medications. With help from expert Dian…

The price of prescri…

The price of prescription drugs can be enormous when you're on Medicare, so in this Friends Talk Money episode, we offer advice on how to pay the least for your medications. With help from expert Diane Archer of JustCareUsa, we discuss when to use your Medicare Part D plan, what to know about prescription discount cards and programs from drug companies and states that can lower your prescription costs.

You're probably familiar with financial literacy, which entails having the skills, knowledge and behaviors to make decisions about money. But how's your longevity literacy? Not sure what we're talking…

You're probably fami…

You're probably familiar with financial literacy, which entails having the skills, knowledge and behaviors to make decisions about money. But how's your longevity literacy? Not sure what we're talking about? In this episode Pam, Terry and Richard break down longevity literacy, and explain the impact, especially when it comes to your Retirement readiness. Guest expert, Surya Kolluri, who is the head of the TIAA Institute joins the Friends Talk Money crew to uncover the importance behind longevity literacy and why he believes more Americans should focus on improving theirs.

In this episode Pam, Terry and Richard talk about what’s like to be the most important financial decision you’ll ever make… what to do with your 401k money when you’re ready to retire? The Dep…

In this episode Pam,…

In this episode Pam, Terry and Richard talk about what’s like to be the most important financial decision you’ll ever make… what to do with your 401k money when you’re ready to retire? The Department of Labor says any Retirement advice you get a work should always be in your best interest. The question is… is it? Pam leads the discussion about the DOL’s new proposed Fiduciary Rule and includes special guest Kevin Walsh of Groom Law Group and break down why the DOL’s so worried.

Advice on lowering your debt load and credit card rates, plus pros and cons of Filing bankruptcy. With Bruce McClary, Senior Vice President of Media Relations & Membership at the National Foundati…

Advice on lowering y…

Advice on lowering your debt load and credit card rates, plus pros and cons of Filing bankruptcy. With Bruce McClary, Senior Vice President of Media Relations & Membership at the National Foundation for Credit Counseling.

Retiring abroad can be appealing, with lower costs and great weather. But here are some things you also need to consider before making a move.

Retiring abroad can …

Retiring abroad can be appealing, with lower costs and great weather. But here are some things you also need to consider before making a move.

In this episode, the Friends Talk Money team discusses how you can help set up your grandchildren for financial success beyond the traditional 529 college saving plans. Tune in as Pam, Richard and Ter…

In this episode, the…

In this episode, the Friends Talk Money team discusses how you can help set up your grandchildren for financial success beyond the traditional 529 college saving plans. Tune in as Pam, Richard and Terry share helpful tips and savvy money strategies that they’ve learned from their own personal experiences.

The rules for RMDs have changed and you will want to know how much you must take out of your Retirement plans and when. We explain it all on this episode of Friends Talk Money, including year-end advi…

The rules for RMDs h…

The rules for RMDs have changed and you will want to know how much you must take out of your Retirement plans and when. We explain it all on this episode of Friends Talk Money, including year-end advice.

The Friends Talk Money podcasts talk about why many of us aren't bestowing inheritances to heirs the right way and not helping our parents make inheritances properly. We also talk about how financial …

The Friends Talk Mon…

The Friends Talk Money podcasts talk about why many of us aren't bestowing inheritances to heirs the right way and not helping our parents make inheritances properly. We also talk about how financial advisers could be more helpful to families so they handle inheritances wisely.

Social Security is clawing back $21 billion in mistaken overpayments — impacting retirees and the disabled. Terry Savage and Larry Kotlikoff have written a new book —Social Security Horror Stories…

Social Security is c…

Social Security is clawing back $21 billion in mistaken overpayments — impacting retirees and the disabled. Terry Savage and Larry Kotlikoff have written a new book —Social Security Horror Stories— revealing the shocking abuse. Last weekend they were featured on CBS - Sixty Minutes speaking with Anderson Cooper about this issue. In this episode, Larry joins Terry, Pam and Richard to take a deeper dive into problem and what you should do to ensure you get what’s rightfully yours.

What to know about Medicare Open Enrollment for 2024. What’s new and how to shop wisely for coverage.

What to know about M…

What to know about Medicare Open Enrollment for 2024. What’s new and how to shop wisely for coverage.

Not everyone looks at their personal financial future through rose colored glasses. In fact a recent Gallup poll shows Americans not yet retired are more worried than anytime in the past ten years. Di…

Not everyone looks a…

Not everyone looks at their personal financial future through rose colored glasses. In fact a recent Gallup poll shows Americans not yet retired are more worried than anytime in the past ten years. Discouraged savers who see the glass-half-empty may actually need different financial strategies just based on their outlook. We give you solid financial planning tips that can make your outlook.