315.Year End Moves for a Lower Tax Bill with Tatiana Tsoir

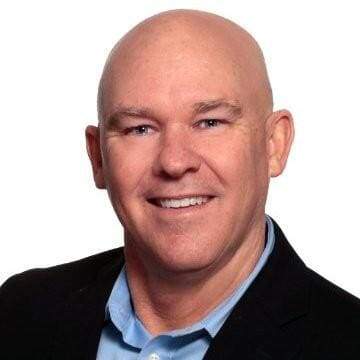

- 315.Year End Moves for a Lower Tax Bill with Tatiana Tsoir Deborah Johnson 48:06

The word “taxes” makes many break out in a cold sweat, feeling stressed. But it doesn’t have to be that way with the proper planning and the right information. In this conversation, I speak with my friend Tatiana Tsoir, an award-winning accountant and business turnaround advisor about the topic of taxes and planning. We will uncover some insights that will help all of us with our end-of-the year planning as well as create a strategy for the future.

Takeaways:

1-Taxes are not a once-a-year event. Be proactive all year with accounting.

2-There is a “taxpayer bill of rights.” Are you familiar with it?

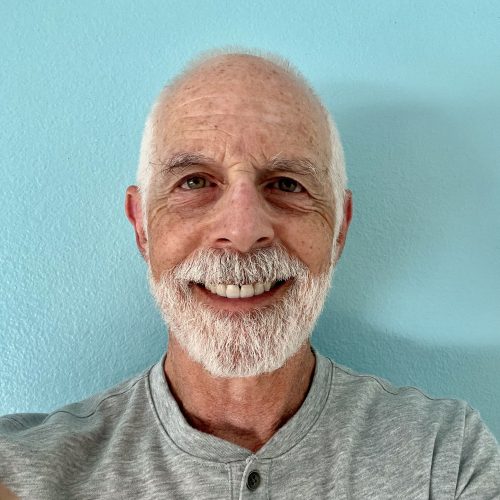

You can reach Tatiana at: https://www.linzacpa.com and tatiana@linzaadvisors.com

Full article here: https://goalsforyourlife.com/lower-tax-bill

Get all our free weekly articles here: https://goalsforyourlife.com/newsletter

Resources with tools and guidance for mid-career individuals, professionals & those at the halftime of life seeking Growth and fulfillment: http://HalftimeSuccess.com

#organizingtaxes #yearendtaxplanningtips #howtofileyourtaxesasabusinessowner #yearendtaxplanningstrategies #yearendtaxstrategy

CHAPTERS: 00:00 – Introduction 01:20 – Tatiana Tsoir 05:22 – Pre-planning Strategies 07:18 – Tax Planning for Small Businesses 11:31 – Understanding the Taxpayer Bill of Rights 12:18 – Importance of a Tax Strategist 21:40 – CPA vs. Tax Strategist: Do You Need Both? 30:40 – Special Training for Tax Professionals 31:15 – Year-End Tax Preparation Tips 34:07 – Importance of Updating Financial Records 35:31 – Cash Basis Accounting Explained 38:50 – IRS Safe Harbor Procedure Overview 40:15 – Author’s Journey: Why Write a Book? 43:16 – Key Takeaways for Viewers 44:54 – How to Contact Tatiana Tsoir 45:50 – Outro