My son is so great, he remembers conversations we had years ago and finds something that reminds him of that. For example, he just sent to me an X (Twitter) post on ROH.

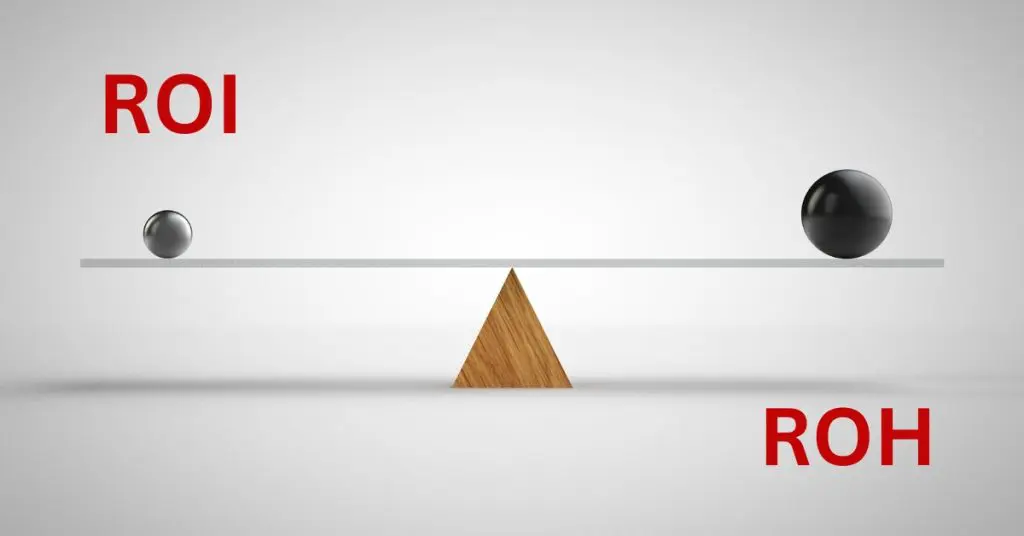

You are likely already familiar with the term ROI (Return On Investment) when you need to get a certain, or desired, return on the Money you invested, or put into an interest-bearing account.

The returns we have on our various investments (ROI) range from a low of 6.5% per year to 24.5% per year.

So, what is ROH? This stands for the Return on Hassle.

How much hassle will it take to get the return on your investment?

How much time and brain drain will it take?

How will it impact your taxes and create even more brain drain?

What would you rather be doing, especially if your time is worth $100 or $1000 per hour?

An example of calculating the ROH would be:

Are you trying to fine-tune your taxes so the government has none of your money interest-free? Or is over-paying your taxes and having the peace of mind worth missing out on an extra $100 interest in a year?

While the right business structure can save a fortune in taxes, researching the best business structure, corporation, partnership, or LLC, really might not make a difference when you are just starting out. Instead of procrastinating while researching the best structure, just get started on the project. If it does not succeed the structure might not matter.

Many years ago I looked at the purchase of a $10M apartment building. After speaking with my son and evaluating the ROH, he helped me see adding an additional $1M to my net worth was not worth the Return on Hassle.

Are you using both the ROI and the ROH to evaluate your investments or projects?

To Your Prosperity,

Rennie

The post ROI versus ROH first appeared on Rennie Gabriel.

Notifications