One of the services that monitors my credit is with US Bank. While I don’t pay a lot of attention to it because my score is always above 800, I decided to look more closely one day.

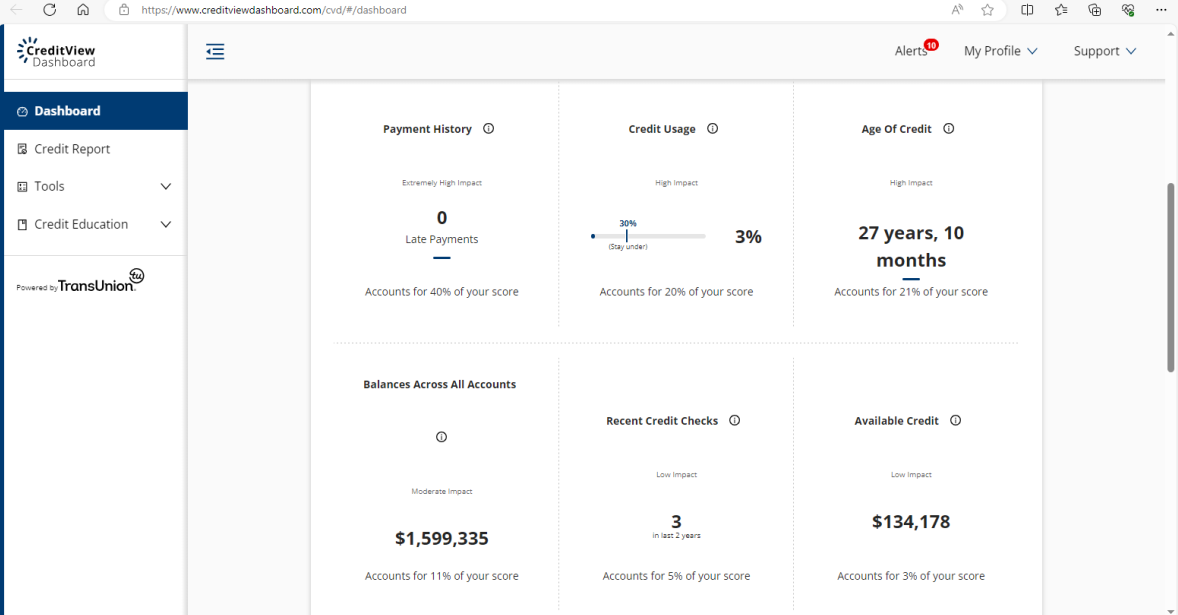

And I found this handy chart that describes what a credit bureau looks at in determining the credit score:

The factors that determine your score are:

As you can see from the above, 81% of your credit score is about how you pay on time, how close you are to your credit limit, and how long you’ve had your accounts.

With 40% of the score based on paying your creditors timely, this is the most important.

Are you monitoring your credit report and usage?

To Your Prosperity,

Rennie

The post Do You Know What Impacts Your Credit Score? first appeared on Rennie Gabriel.

After two divorces and a business failure Rennie went from broke at age 50 to multi-millionaire after learning the three secrets of the wealthy (despite failing high school math). Rennie is a TEDx speaker and he now donates 100% of the profits from his books and online programs to rescue dogs and soldiers. His award winning, best-selling book, Wealth On Any Income has been translated into eight languages.

BabyBoomer.org is an online membership community created by and for the Baby Boomer Generation. Boomers, and those who service and support them, are welcome to join our community accessing all general topics.

Notifications