Navigating the Five Financial Phases of Retirement

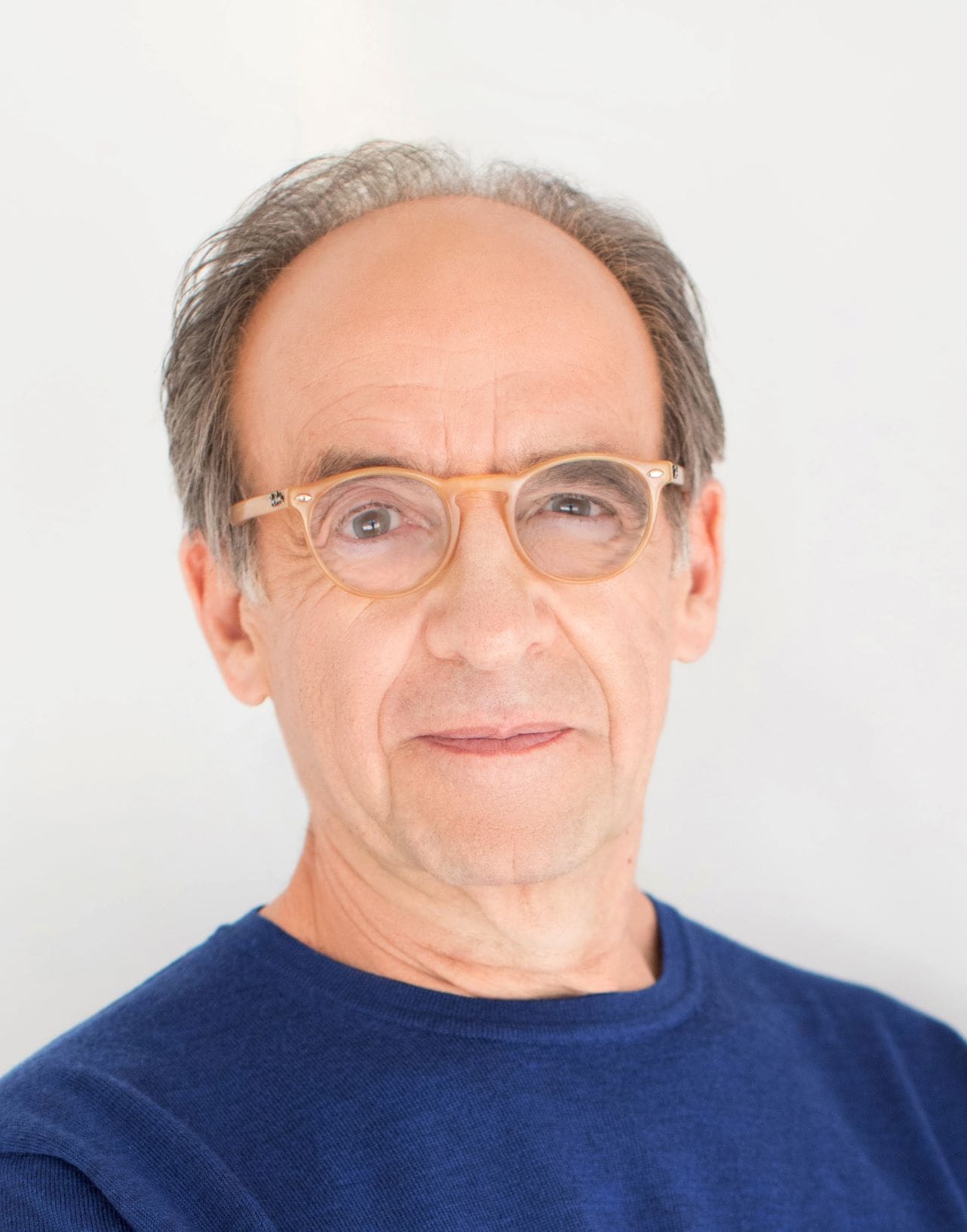

By, Jeremy Reif, CRPS

When we’re in our working years, we think of retirement as this vague future event. We plan for retirement, save for retireme…

Navigating the Five …

Navigating the Five Financial Phases of Retirement

By, Jeremy Reif, CRPS

When we’re in our working years, we think of retirement as this vague future event. We plan for retirement, save for retirement, and dream of retirement, but we often approach it as one single phase of life. But these days, since we are living longer than ever before, our retirement could span 30 years or more. Depending on when you started your career, that’s not much less than the time you spent working.[1]

The journey to and through retirement occurs gradually, like successive chapters in a book. Each chapter has i…