Have you heard this year’s version of Wall Street’s favorite joke?

“We’re going to predict how the stock market does this year!“

Woof. Yikes. Why?!

1-year stock predictions are pointless. We’d all be better off accepting that fact.

Time and again, I want to ensure every long-term investor understands the relationship between risk and reward.

A guarantee – a.k.a. zero risk – comes with the least reward. That “zero risk asset” is a short-duration US treasury note or a high-yield bank account.

As we seek out more reward, we must take on more risk. For many of us, stocks eventually enter that conversation. Stocks promise more expected reward, but come with far more uncertainty. Even a highly diversified stock portfolio is far more volatile than a simple bond.**

**Now, “risk” and “volatility” are not the same. But they’re cousins. This fact is a long-standing schism in the Investing world. We won’t solve that schism here on The Best Interest.

This is why timelines matter so much in your financial plan, and why I harp on them. Your unique financial goals have a timeline associated with them. That timeline informs your investing period. Different asset classes – with different risk profiles – are appropriate or inappropriate for different investing periods. Further reading: the RRTTLLU framework.

This is all a preamble to why a 2025 stock market prediction is so stupid. A one-year performance prediction is simply antithetical to the proposition of stock investing.

It’s as if we had an annual chess championship for dogs, where the announcers seriously tried to convince you that German Shepherds are particularly sharp at playing the Berlin Defense. Perhaps a few people would fall for it. But most of us know the truth: dog can’t play chess. It’s just the nature of the beast. No matter how much training we give them or how many years we hold the competition, you can’t alter that nature.

Similarly, nobody can skillfully, repeatedly make a 1-year prediction about the stock market.

If they could make that 1-year prediction, then stocks would suddenly be a reasonable 1-year investment. Such predictability would be akin to a performance guarantee – or, in other words, a dramatic decrease in investing risk. And with that decrease in risk would come a dramatic reduction in expected return.

You see? The very reason why we use stocks for our long-term financial goals is the exact reason why 1-year predictions are silly. It’s the nature of the beast!

Yet here we are again, with the biggest names on Wall Street exhaling the fog from within their crystal balls.

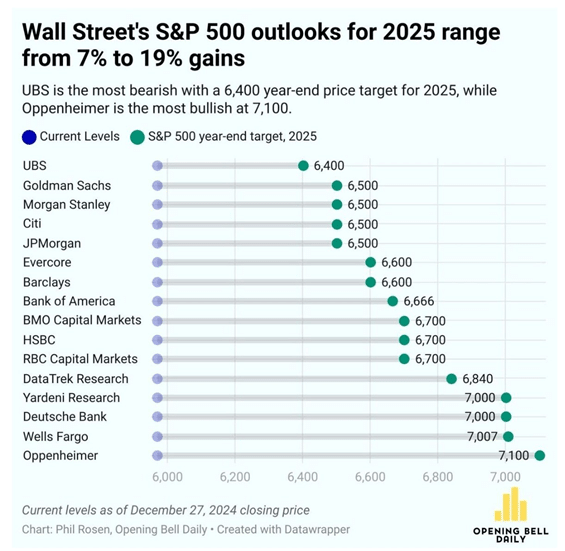

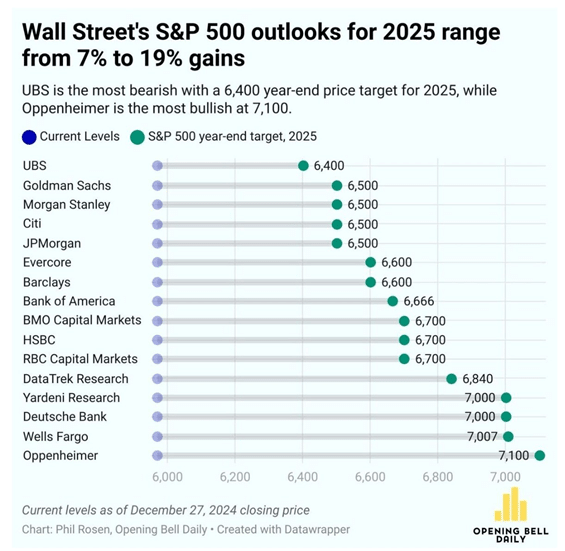

All 16 of these groups predict the S&P 500 will finish up on the year. Their predictions range from +7% to +19%. This is a remarkably tight range of forecasts, considering the stock market loses value in roughly 25% of all years and grows by +20% in roughly 30% of all years. Yet none of these prophets believe either of those two outcomes will occur this year?

If we had 16 independent thinkers, surely at least a few would have picked one of the outcomes that occur 25% or 30% of the time – right? It’s literally more improbable than if all 16 of them flipped a coin that landed heads…which is about 1-in-150000.

The conclusion, therefore, is that these are not independent thinkers at all. This is herd mentality. I’m not the first to point this out. Just think about it.

So, you get lemmings.

The chart below continues on this point. Look at the 1-year performances of the S&P 500 (the gray bars). It’s all over the place. Sometimes negative, sometimes hugely positive. But none of the experts see that as a possibility in 2025?

Strange!

Surely, though, the wizards of Wall Street must have a good track record? After all, why would we continue listening to them?

Let’s look at that track record. The chart below shows the past ~25 years of Wall Street predictions (in purple and pink) against the actual market performance for that year (in black).

I count 11 years where actual market performance was outside the entire range of forecasts. In fact, 4 of the past 5 years fit that bill, with 2023 barely ruining what would have been a laughably imperfect 5 out of 5.

So here’s my 2025 stock market prediction and rationale:

Thank you for reading! If you enjoyed this article, join 8500+ subscribers who read my 2-minute weekly email, where I send you links to the smartest financial content I find online every week. You can read past newsletters before signing up.

-Jesse

Want to learn more about The Best Interest’s back story? Read here.

Looking for a great personal Finance book, podcast, or other recommendation? Check out my favorites.

Was this post worth sharing? Click the buttons below to share!

Notifications