Jesse Cramer is the writer of The Best Interest blog, the voice behind The Best Interest Podcast, and works full-time as a Fiduciary financial planner for Cobblestone Capital Advisors in Rochester, NY.

Recent Content

Whether you’re a dedicated DIYer or prefer to lean on professional guidance, the truth is clear: smart financial planning can save you a lot of Money over time.Below, I’ll share some recent e…

Whether you’re a d…

Whether you’re a dedicated DIYer or prefer to lean on professional guidance, the truth is clear: smart financial planning can save you a lot of money over time.Below, I’ll share some recent examples of tactical planning moves I participated in, including how much money was saved.COVID PanicIn March 2020, you could be forgiven for thinking: “the world is ending, and I want to sell everything.”But with proper perspective and an investment policy statement – both hallmarks of sound financial planning – many investors stayed the course.They rode the stock mark…

After a recent podcast episode, a listener asked me to expound on debt’s “silent assassination technique.” Debt is not a cobra that unexpectedly strikes from the undergrowth. It’s a python you…

After a recent podca…

After a recent podcast episode, a listener asked me to expound on debt’s “silent assassination technique.” Debt is not a cobra that unexpectedly strikes from the undergrowth. It’s a python you stupidly take out of the cage and allow to slither around your torso until you suddenly realize it’s squeezing harder than you can handle.In this post, you’ll find some simple math to show you how stifling debt interest can be.Of course, we need a disclaimer. Not all loans are the same. Some loans are perfectly acceptable to hold on your balance sheet. Namely, loans with low intere…

It can be fun to ponder the details of your specific portfolio allocation. Should it be 70% stocks? 75%? Maybe even 80%?! We had a terrific question from reader “Vince” about just this idea:…

It can be fun to pon…

It can be fun to ponder the details of your specific portfolio allocation. Should it be 70% stocks? 75%? Maybe even 80%?! We had a terrific question from reader “Vince” about just this idea:Winning the Game: Retiring at 57 with $4.2MThose conversations move the needle and are essential to an overall financial plan.But there are far more critical portfolio questions to ask yourself. FAR more important. Namely questions like…How would you have acted on September 12, 2001?How about during March and April of 2020?What about during the depths of 2007 & 2008?…

The bachelor party decided to go to the casino. I happily went along for the ride. The behavioral Finance nerd in me was ready to witness fascinating behavior. Gambling can certainly be entertaining, …

The bachelor party d…

The bachelor party decided to go to the casino. I happily went along for the ride. The behavioral finance nerd in me was ready to witness fascinating behavior. Gambling can certainly be entertaining, but it’s not financially savvy. As long as you know that, you’ll be ok – albeit a little lighter in the wallet.This particular casino had an engaging “loss leader.”* They offered $15 in free casino credit to new gamblers. The scheme, of course, is cynical. They hope those free bets hook you, knowing that a regular gambler will surely lose back more than the free $15 over a long peri…

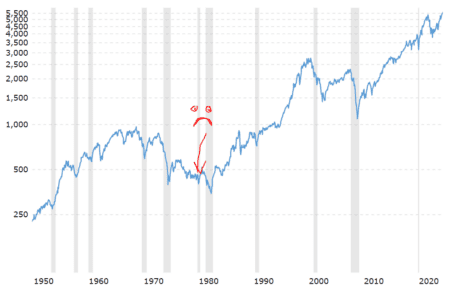

In August 1979, Warren Buffett wrote an article for Forbes attacking the herd instinct of investors. The late 1970s were tough for the American Economy, and the stock market reacted harshly.B…

In August 1979, Warr…

In August 1979, Warren Buffett wrote an article for Forbes attacking the herd instinct of investors. The late 1970s were tough for the American economy, and the stock market reacted harshly.Buffett wrote,“…the future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually, is the friend of the buyer of long-term values.” Warren BuffettThe future is never clear. Let Buffett’s Wisdom sink in. Uncertainty surrounds us, like fog on the highway. Risk is omnipresent. Say it with me: risk is omnipresent. Only our perce…

Friend-of-the-blog Anthony is a personal friend who read my very first articles when I shared them on Facebook. He’s seen The Best Interest grow over time. A couple of years ago, I told him tha…

Friend-of-the-blog A…

Friend-of-the-blog Anthony is a personal friend who read my very first articles when I shared them on Facebook. He’s seen The Best Interest grow over time. A couple of years ago, I told him that The Best Interest wasn’t what I wanted it to be. I felt directionless at the time, and was considering hanging up my writing gloves for good. And, in fact, I did hang up my podcasting microphone for a couple years.He responded, “You know Jess…you can’t see the picture if you’re standing inside the frame. I’m outside the frame. So trust me when I say: You’ve got something sp…

One of Charlie Munger’s famous speeches is “How to Live a Life of Misery.” Rather than tell graduates how to live happily, he delivered the opposite message. Because if you avoid life’s surefi…

One of Charlie Munge…

One of Charlie Munger’s famous speeches is “How to Live a Life of Misery.” Rather than tell graduates how to live happily, he delivered the opposite message. Because if you avoid life’s surefire miseries, what’s left but happiness? Right!?Munger was famous for quoting famous mathematician Carl Gustav Jacobi (as in, “Jacobians” in vector calculus) who said,“Invert. Always invert.” JacobiSome math problems, quite simply, are easier to solve if you turn them inside-out.Today we’ll do the same, but for personal finance and Investing. What follows are my be…

I’m drafting this on August 5, 2024. The S&P 500 is down about 8.5% over the past three weeks. Headlines are screaming at us. CNBC is throwing a fit. Our bowling partner just posted an apocalyptic w…

I’m drafting this …

I’m drafting this on August 5, 2024. The S&P 500 is down about 8.5% over the past three weeks. Headlines are screaming at us. CNBC is throwing a fit. Our bowling partner just posted an apocalyptic warning on Facebook – stick to bowling, Frank!But the seasoned long-term investors remain cool as a cucumber. Or, as our critics would say, cool as a corpse. Are you guys really ignoring this one?!Yes, we are. We’re over here like Jules and “Pumpkin” in Pulp Fiction. There might be some chaos in the diner, but we’re imploring Honey Bunny to “stay cool.”And here’s…

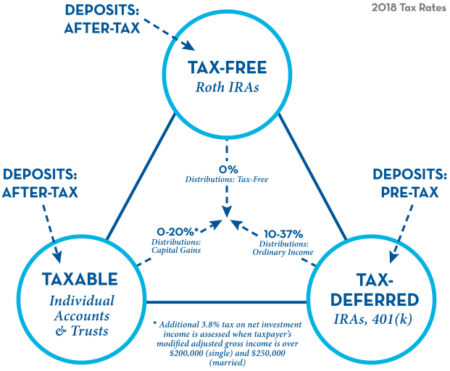

Caleb writes in this week with a SPICY question. The answer surprised me. It might surprise you too.Jesse – I work for a small company that does not currently offer a 401(k) match. Do the numb…

Caleb writes in this…

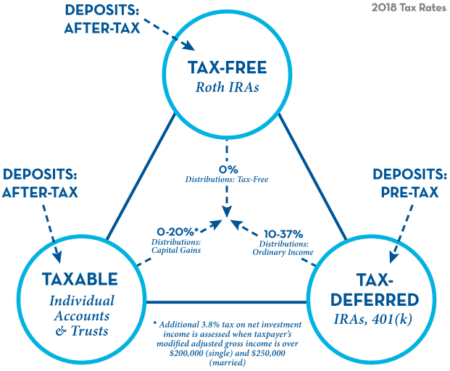

Caleb writes in this week with a SPICY question. The answer surprised me. It might surprise you too.Jesse – I work for a small company that does not currently offer a 401(k) match. Do the numbers still suggest I should utilize it? CalebWhat Are We Comparing?We need a point of comparison. If Caleb doesn’t use his company 401(k), we’re going to assume he contributes money into a normal taxable brokerage.As you’ll see, I analyzed various “employer match” percentages (100%, 50%, 0%) and also looked at skipping the 401(k) to use a taxable brokerage.The Expectatio…

You need to understand your willingness, need, and ability to take portfolio risks. It’s an idea that straddles the line between personal preference and objective truth.Let’s break down each …

You need to understa…

You need to understand your willingness, need, and ability to take portfolio risks. It’s an idea that straddles the line between personal preference and objective truth.Let’s break down each of the three constituents, then put it all together with an example.NeedYour need to take risks relates to the amount of objective investment Growth required to meet your financial goals.Understanding need starts with a comprehensive financial plan showing your projected cash flow over the next 10 or 20 years. Money in, money out, and most pertinent to today’s topic, your projec…

Friend of the blog Matt sent in a great question this week:Hi Jesse – do you have any recommendations when it comes to life insurance? I know Term is the way to go, but that’s about all I go…

Friend of the blog M…

Friend of the blog Matt sent in a great question this week:Hi Jesse – do you have any recommendations when it comes to life insurance? I know Term is the way to go, but that’s about all I got…I scanned your blog posts and didn’t see anything too specific with it but if you have any guidelines for pricing or coverage recommendations, please let me know! MattMatt’s Right. We Want Term!Matt’s right. Term life insurance is the best option in 99.99% of cases.Other types of life insurance (Whole, Variable, Universal, etc.) are bloated products that are “pushed�…

If you told and asked the average American, “The former President and current presidential candidate was shot in the ear on Saturday in an attempt on his life. What will the stock market do on Mond…

If you told and aske…

If you told and asked the average American, “The former President and current presidential candidate was shot in the ear on Saturday in an attempt on his life. What will the stock market do on Monday?“Doug Mills, The New York TimesI doubt many people would answer, “Ehhh – basically nothing. The market won’t care.” But the market had an unnoteworthy, “basically nothing” day on Monday, July 15. It was up 0.28%. Whoop-dee-doo.Why?Most people misunderstand what the market cares about. While individuals are undoubtedly concerned about how this assassinati…

It’s breakfast time, you’re hungry, and I’m offering you two options:A healthy, adult henTwo dozen eggsYour first thought is probably: “Seriously? It’s just breakfast. I don�…

It’s breakfast tim…

It’s breakfast time, you’re hungry, and I’m offering you two options:A healthy, adult henTwo dozen eggsYour first thought is probably: “Seriously? It’s just breakfast. I don’t want a live chicken running around my house.”Forget that thought for now.If you’re like me, your mind next asks, “If I do choose the chicken, how many eggs can I expect over time? What’s the risk the chicken doesn’t get to two dozen eggs? Am I willing to wait for two dozen – or hopefully more – eggs to arrive?”When we know those answers, we can make a smart decisio…

Imagine you’re a gardener. You spend a weekend building a few raised beds, planting sunflowers and corn, etc. It’s a nice little hobby. Your first summer Gardening ends up successful and fulfillin…

Imagine you’re a g…

Imagine you’re a gardener. You spend a weekend building a few raised beds, planting sunflowers and corn, etc. It’s a nice little hobby. Your first summer gardening ends up successful and fulfilling.You come back for Year 2 with vigor! You want to expand. You spend a month preparing your beds and double the size of your garden. You plant new veggies and a few flowers, and all goes well.You rinse and repeat for a few more years. Not only is your garden blooming, but its size is blooming. After years of doubling in size, it occupies a couple acres in your side field (we’re putt…

Who knew a lack of proper estate planning would throw the entire realm into war? That’s the lesson I garner from HBO’s House of the Dragon. If you’re unfamiliar (as I was) with the series, here�…

Who knew a lack of p…

Who knew a lack of proper estate planning would throw the entire realm into war? That’s the lesson I garner from HBO’s House of the Dragon. If you’re unfamiliar (as I was) with the series, here’s an uber-quick primer to catch you up.[SPOILER ALERT!]It takes place in the same universe as Game of Thrones. Semi-medieval, very political, heavy on violence and sex. House of the Dragon is set roughly ~200 years before the Game of Thrones timelineThe show chronicles the early history of House Targaryen, focusing on the events leading up to and during the Targaryen Civil War (…

I spent 6 years in college studying mechanical engineering, and then 7 years working at an aerospace contractor where my colleagues and I designed, built, tested, and launched satellite-based telescop…

I spent 6 years in c…

I spent 6 years in college studying mechanical engineering, and then 7 years working at an aerospace contractor where my colleagues and I designed, built, tested, and launched satellite-based telescope systems.One of the features of all engineering design is the concept of “factors of safety.” Simply put, factors of safety are margins built into designs to ensure the end product can withstand physical loads beyond the expected maximum and still survive.Some typical factors of safety might include:Material Properties: Variations in material properties due to manufacturing…

Friend of the blog DT wrote in and said:In regards to your recent “When to Take Social Security” article, you left something out. You can take Social Security early (say, age 62), then inves…

Friend of the blog D…

Friend of the blog DT wrote in and said:In regards to your recent “When to Take Social Security” article, you left something out. You can take Social Security early (say, age 62), then invest that money, and your investment will end up better than if you had waited on Social Security until age 67 or age 70.Interesting! But does the math work? Let’s dive in. Should you take Social Security early and invest it?What Kind of “Returns” Do You Get For Waiting on Social Security?Let’s start by looking at Social Security. What kind of “return on investment” do yo…

I’m now 30 months into my new career, and I’m loving every single day.As a lifelong learner, I find the nuanced topics of financial planning and investment management to be a limitless sandbo…

I’m now 30 months …

I’m now 30 months into my new career, and I’m loving every single day.As a lifelong learner, I find the nuanced topics of financial planning and investment management to be a limitless sandbox, or perhaps more like an underground cave system. Where’s the bottom?! Nobody knows!Despite that complexity, my colleagues and I help clients with many common issues that are not the strict domain of experts. These are topics you don’t need CFPs, CPAs, or attorneys to help you with. And that fact – that even experts focus on getting the basics correct – is an important lesson.…