Inside The Mind of a Top Investment Banking Deal Maker

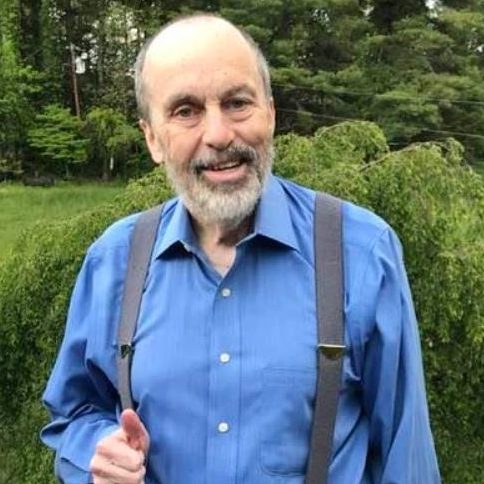

- Inside The Mind of a Top Investment Banking Deal Maker Jon Stoddard 50:48

Learn How to Buy Your First Business – Free ebook https://www.dealflowsystem.net/UNLOCKTHE3DOORS

Summary

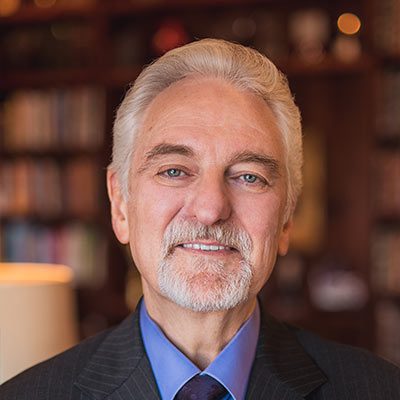

In this conversation, Jon Stoddard interviews Scott Wiebel from Sierra Pacific Partners, delving into the intricacies of investment banking and the business selling process. They discuss the importance of building Relationships for deal flow, the motivations behind selling a business, the due diligence process, and the emotional aspects of closing deals. Scott shares insights on navigating offers and the challenges faced by sellers, providing a comprehensive overview of the investment banking landscape.

Takeaways

Building relationships is key to finding deal flow.

Understanding seller motivations is crucial in the selling process.

Due diligence can uncover unexpected issues in a business.

Navigating offers requires careful analysis and communication.

Emotional factors play a significant role in closing deals.

The process of selling a business involves multiple stakeholders.

Investment bankers must manage expectations throughout the process.

Clear communication with sellers can prevent misunderstandings.

The importance of thorough financial analysis cannot be overstated.

Post-closing involvement can vary significantly among investment bankers.

Chapters

00:00 Introduction to Investment Banking and Business Sales

02:58 Finding Deal Flow and Building Relationships

06:00 The Selling Process: Understanding Seller Motivations

11:48 Due Diligence: Uncovering the Truth

21:37 Navigating Offers and Buyer Interest

29:55 Closing the Deal: Emotional and Practical Considerations