Be Cool, Honey Bunny

I’m drafting this on August 5, 2024. The S&P 500 is down about 8.5% over the past three weeks. Headlines are screaming at us. CNBC is throwing a fit. Our bowling partner just posted an apocalyptic warning on Facebook – stick to bowling, Frank!

But the seasoned long-term investors remain cool as a cucumber. Or, as our critics would say, cool as a corpse. Are you guys really ignoring this one?!

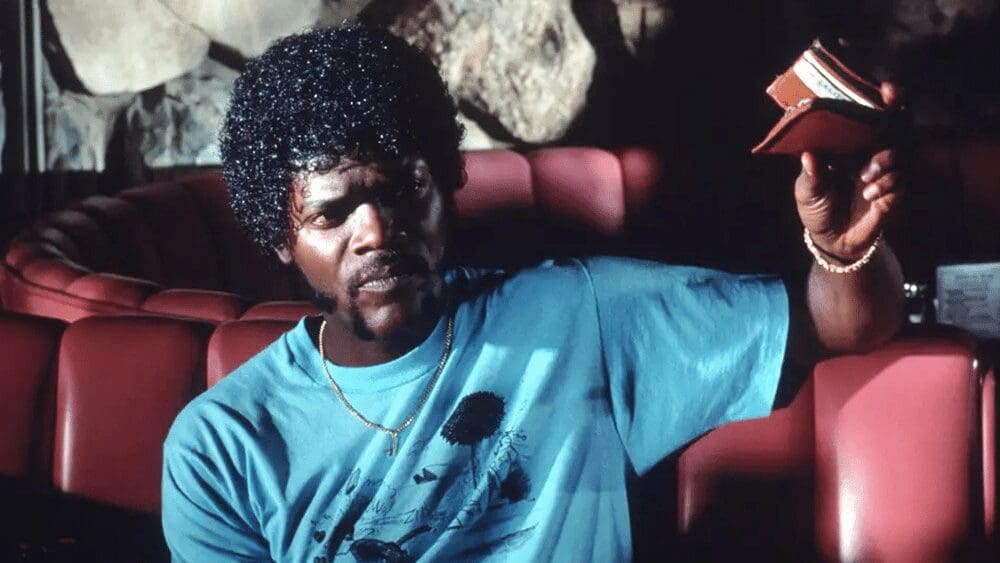

Yes, we are. We’re over here like Jules and “Pumpkin” in Pulp Fiction. There might be some chaos in the diner, but we’re imploring Honey Bunny to “stay cool.”

And here’s why.

Of Course, This One Could Be Different…

Yes – for all I know, we could be feeling the early tremors of an eventual volcanic eruption.

Or they could just be tremors.

We simply don’t know.

And that fact – a big blowup could happen today, tomorrow, or not for another few years…and we simply don’t know – is always true. And has always been true. And will always be true. Always. That risk is always there, and it’s the reason stock investors receive better long-term returns.

These past weeks are no different.

This Happens Every Year!

Volatility is normal. If you haven’t internalized then yet, it’s a good time to start right now.

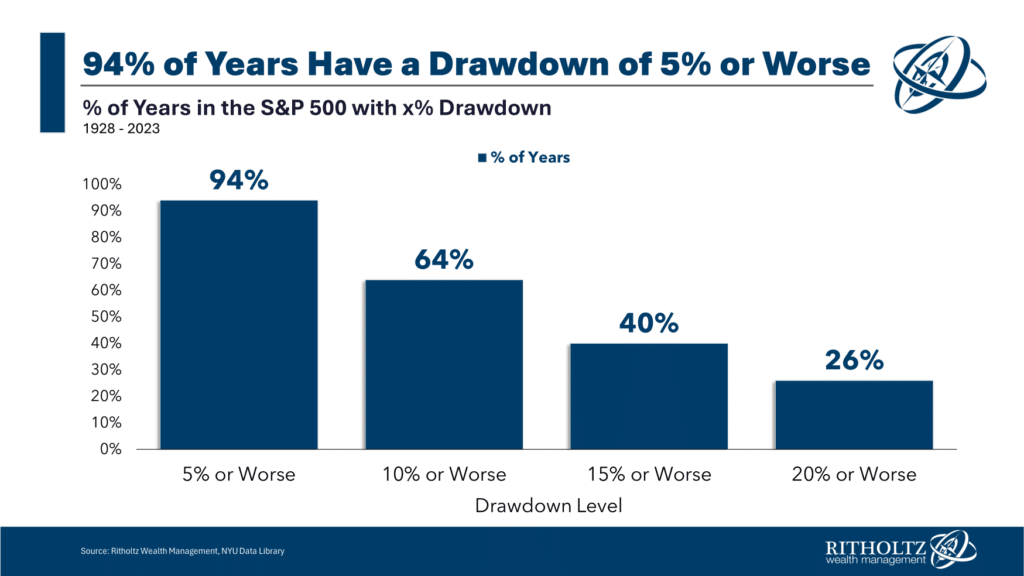

As Ben Carlson shared on his blog, the stock market experience 5-10% drawbacks in most years. In fact, the market suffers a 15% pullback roughly half of all years.

This is common. As a recent example, we had an 8% and a 10% pullback in 2023, yet the market finished the year up ~24%.

Zoom Out

Shout-out to my colleague Zach Mullally, CFP, who created this chart.

Each red block represents a period from 1970 until today when the market experienced a 10% (or greater) drawdown.

I see a lot of red.

And yet, here we are. The Economy is alive. The market is alive. Our portfolios are stronger than ever, if we stayed the course for the long run.

You want to sell? Fine. Are you ready to time the market to get back in? You need to be right twice. And you need to tamp down your emotions while doing so. Good luck, Robot!

A full PDF download of Zach’s chart and some data is below.

What’s Your Personal Stock Timeline?

Why do you own stocks? Are you saving Money for next week? If so, well, yeah, I’d be freaking out a little bit too. But I’d also say, no offense, you’re doing it wrong.

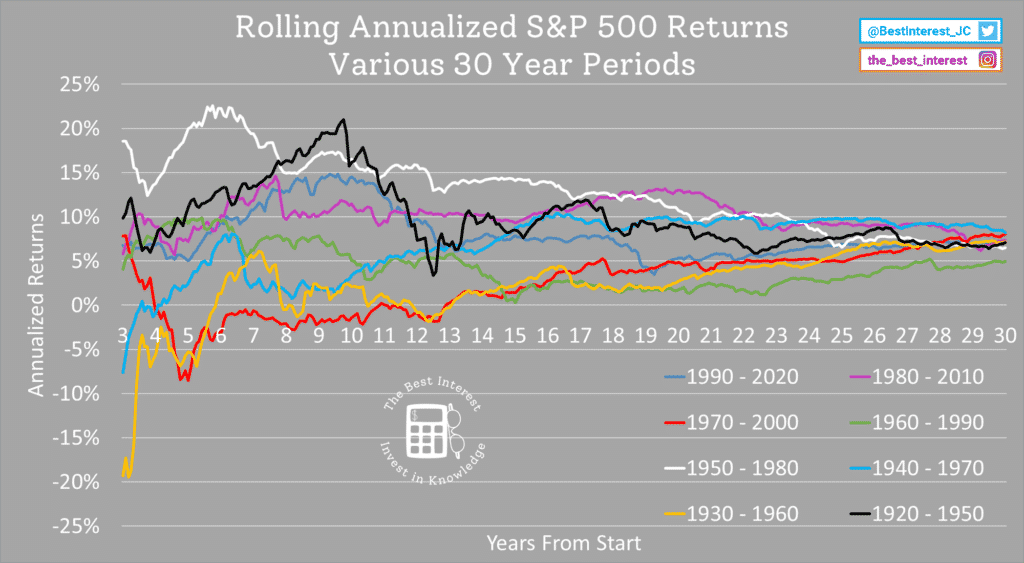

Stocks are a 10+ year investment asset. Not a “next week” investment. I have many old links to share on that topic, but here’s one of my favorite charts showing why. In short, it shows that the market has and certainly might again provide negative or minimal real returns over 15+ year timelines.

There’s no short-term guarantee on stocks. But over many decades, things look good.

We should hold stocks for decades. That should be our personal Investing timelines.

We shouldn’t zoom in on individual days, weeks, or months.

The Viper and the Farmer, or “It’s the Nature of the Beast”

Do you know Aesop’s fable about the Viper and the Farmer?

In short, a farmer found a viper freezing to death in his field on a frosty morning. Feeling pity for the dying snake, the farmer took the viper to his bosom and warmed him back to life.

With vitality anew, the viper promptly bit the farmer.

As the farmer lay dying, he realized his mistake. It’s the nature of a poisonous snake to lash out at a perceived threat. The viper didn’t care about good or bad intentions—it’s the nature of the beast.

Similarly, this is the nature of the stock market.

Aesop’s moral is, “Don’t befriend evil or bad people…they won’t give you special treatment. They’ll screw you over like everyone else.”

The market isn’t evil. But it is volatile. It doesn’t care who you are or why you’re investing. You will suffer its volatility just like everyone else.

If you can’t handle that, it’s ok. But don’t permit the stock market a place in your portfolio. It’s not if it will strike, but when.

And Where Do Gains Come From?

Risk and reward are tied at the hip.

And there’s no such thing as a guaranteed, high-return investment.

Stock market gains are created by this volatility and rewarded to those who can stomach it.

Objective vs. Subjective

Diving in a bit further, a company’s stock price can be thought of as the function of two variables: its earnings, and the “multiple” that investors will pay for those earnings.

Earnings are objective facts. What did the company earn last year or last quarter, and what does it think it will earn in the future?

The “multiple” is more subjective, a function of investors’ sentiment, their other investment options, and much more. It’s a witch’s brew.

Whenever the market burps, it’s helpful to ask, “What’s changed? Did earnings fall or fail to meet expectations? Or have the market’s emotions simply shifted, and they’re no longer willing to pay the same high multiples this week as last week?”

Objective earnings have always maintained a slow, steady march up and to the right, with small hiccups here and there.

Subjective investor feelings, on the other hand, have always oscillated between overzealous optimism and unfounded pessimism. It’s Ben Graham’s “Mr. Market” metaphor.

Ignore the subjective feelings. They only serve to distract you.

What About 13 Weeks Ago?

As of this writing, the market is exactly where it was in early May 2024, about 13 weeks ago.

Were you panicked and pessimistic at that time?

If you’re jubilant at “S&P = 5200” on the way up, but panicked at “S&P = 5200” on the way down, you need to ask yourself why.

What If I Told You…

What if I told you in August 2014 that you’d have ~12.5% annualized returns over the next 10 years?

Would you take that deal, sight unseen? More importantly, would you care if that decade happened to end with an ~8% downward bump?

Well, that’s what we’ve got. I would take that deal every day of the week! The negative feelings we might be feeling today are pure recency bias.

What Does Morgan Think?

Morgan Housel has a great quote for times like these.

This is the biggest market decline since the last decline you don’t remember or care about anymore.

Morgan Housel

He’s right. Let’s face it. Most of us don’t remember that this has happened every other year forever. This is recency bias again. We care extra because it’s in our face right now.

Give it a year or two. It’ll fade like a bad dream upon waking.

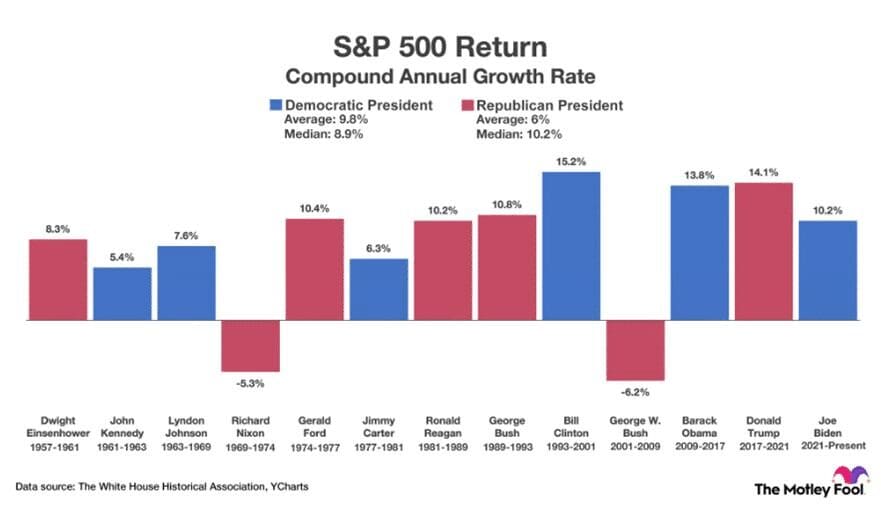

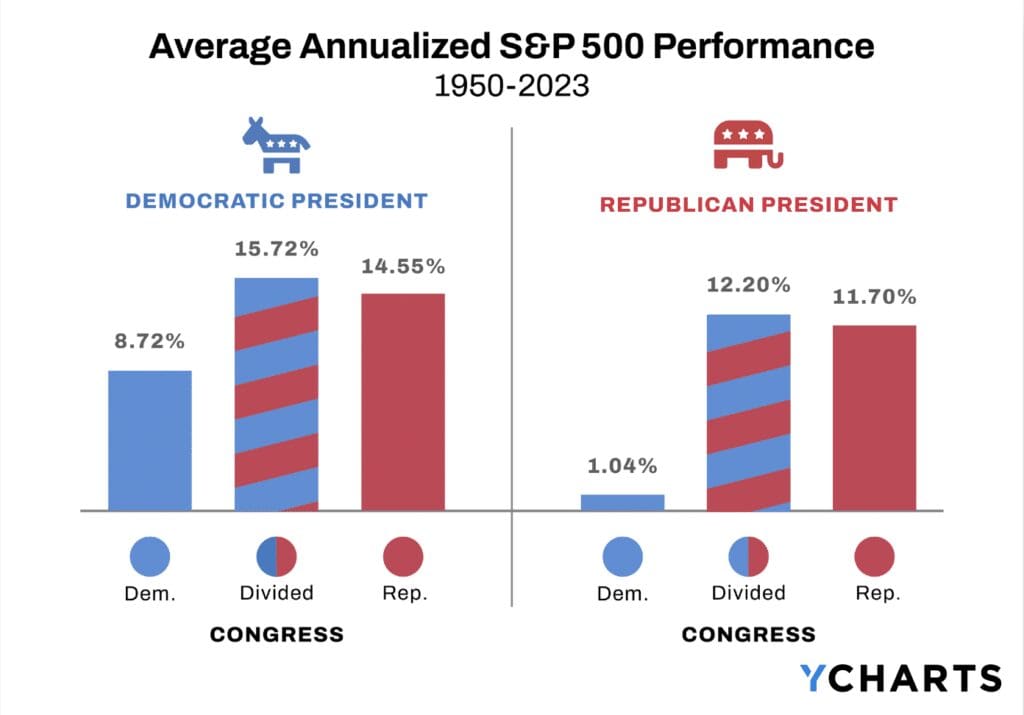

Oh – You Think This Is Political?

I know we’re all getting worked up for the election. Are those tremors, or is an eruption on the way? I don’t know.

So instead, I consult facts.

“It’s The One That Says ‘Bad Mother…’”

Maybe I’m not as cool as Jules. My wallet is simple. No cuss words imprinted on it.

But during these volatile times, I think about the reasons above and I stay cool.

Thank you for reading! If you enjoyed this article, join 8500+ subscribers who read my 2-minute weekly email, where I send you links to the smartest financial content I find online every week. You can read past newsletters before signing up.

-Jesse

Want to learn more about The Best Interest’s back story? Read here.

Looking for a great personal Finance book, podcast, or other recommendation? Check out my favorites.

Was this post worth sharing? Click the buttons below to share!