Medicare Annual Enrollment Period: What does it mean to you?

It is that time of year again! Medicare Annual Enrollment is from October 15 through December 7 of each year. During this time, for those already enrolled in Medicare, it is your time to review your plan and make changes if desired.

When I first started my career in the Medicare world, I realized there was a lot of new information I had to learn and found that breaking it down into bite-sized chunks made it much easier to understand. I started by focusing on all the different parts of Medicare.

Here is a breakdown of what I learned to help you understand how Medicare works.

What is Medicare?

Simply put, Medicare is a federal health insurance program for:

- People 65 and older

- People under 65 with certain disabilities

- People with end-stage renal disease

The Medicare program offers basic coverage to help pay for things like doctor visits, hospital stays and surgeries.

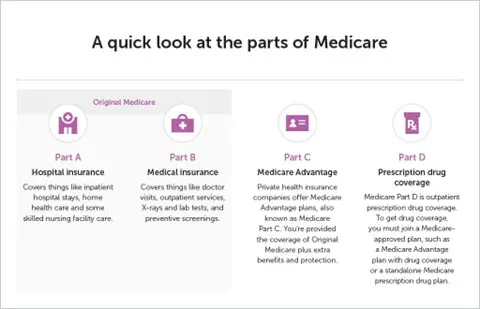

What are the 4 parts of Medicare?

Medicare is broken into four parts.

- Medicare Part A – Hospital Coverage

- Medicare Part B – Medical Coverage

- Medicare Part C – Medicare Advantage

- Medicare Part D – Prescription Drug Coverage

Does Medicare pay for all of my medical bills?

The simple answer is NO! Costs you may pay with Medicare include:

Deductible: A set amount you may pay for covered services before your plan begins to pay.

Copay: A fixed amount you pay at the time you receive a covered service.

Coinsurance: A percentage of the cost you pay for a covered service.

I will give you a breakdown of your out-of-pocket exposure with just “Regular Medicare” as I break down what is and is not covered under each of Medicare’s parts below.

What does Medicare Part A cover?

Part A (hospital coverage) covers things like inpatient hospital stays, home health care and some skilled Nursing facility care. Together, Medicare Parts A and B are called Original Medicare.

Is Medicare Part A free?

Typically, most people don’t pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you don’t qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

What are my out-of-pocket costs with Medicare Part A?

Hospital Stays:

Deductible: $1,600 per benefit period defined as the day you are admitted to the hospital and when you have been out of the hospital 60 days in a row.

Copays: Days 0-60 in the hospital: $0, $400 per day days 61-90, $800 per day days 91+

Skilled Nursing Facilities:

Copays: $0 Days 1-20, $200 per day Days 21-100

Hospice Care:

Coinsurance: Home Hospice patients may pay a small coinsurance amount for inpatient respite care or durable medical equipment used at home.

Copays: Copays during home hospice care may include up to $5 per prescription for pain and symptom management.

Note: With “Original Medicare,” there is no maximum out-of-pocket (MOOP)!

What does Medicare Part B cover?

Part B (medical coverage) covers things like doctor visits, outpatient services, X-rays and lab tests, and preventive screenings.

Do you need Medicare Part B?

The short answer is yes, especially if you’ll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouse’s active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working – whether it’s you or your partner – you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

Is Medicare Part B free?

No, you will pay a Premium in between $164.90 and $560.50depending on your tax reported income from two years prior. Medicare Part B is only free if you have a low income and are enrolled in one of the Medicare Savings Programs for financial assistance. Eligibility for these programs varies by state, and some states make it easier to qualify because of higher income limits or by eliminating the asset requirement.

What are my out-of-pocket costs with Medicare Part B?

Premium: $164.90 – $560.50 either deducted from your monthly Social Security check or that you may pay directly to Medicare.

Deductible: $226 per year

Coinsurance: 20% of covered services. You generally pay 20% of the Medicare-approved amount for the covered services you use, with no annual out-of-pocket maximum. Medicare pays the remaining 80%.

What does Medicare Part C cover?

Part C is also known as Medicare Advantage. Private health insurance companies, like United Healthcare who I represent, offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare. These plans must provide the same coverage as Original Medicare (so you’re not missing out on anything). They can also offer extra benefits, including, but not limited to the following: part D prescription drug coverage, routine dental care, eye exams, eyeglasses or contact lenses, hearing exams or hearing aids, wellness benefits such as gym memberships.

Is Medicare Part C free?

Medicare Advantage Plans, including those offered by United Healthcare, are often premium-free.

What are my out-of-pocket costs with Medicare Part C?

Each plan varies and a Medicare professional, like me, can evaluate your current health and medication needs to determine which plans are best for your individual needs. Your exposure is generally considerably less with a Medicare Advantage plan.

Medicare Advantage Plans are required, unlike Original Medicare, to have annual maximum out-of-pocket deductibles. For 2024 plans offered by United Healthcare, some of these are as low as $3,400 (maximum “MOOP” limit set by Medicare in 2023 is $7,400) not including premium payments, drug costs, costs of extra services like vision or dental.

Where you get care can affect your costs

Many Medicare Advantage plans are coordinated care plans and contract with a network of doctors and hospitals. Some plans require you to choose a primary care provider from their network.

What does Medicare Part D cover?

Part D covers prescription drugs. Only private insurance plans offer it. It’s usually included in a Medicare Advantage plan or you can get a separate Part D plan.

Though Medicare Part B does cover certain vaccines and medications (based on specific health conditions), Part D provides a much wider range of coverage of vaccines and outpatient prescription drugs. Premiums, deductibles, copays, and coinsurance vary by plan. For me, this is the most critical phase of selecting what Medicare product is best for your needs.

Why United Healthcare?

I chose to exclusively represent United Healthcare due to its stability as a Fortune 5 company, its vast network of over 1 million providers, and its consistently high customer service rankings. In my experiences, I have found that most people are best served, both from a financial and preventative health standpoint, are best served on a Medicare Advantage plan. Since they became available in 2003, they have vastly improved, most noticeably in that they did not use to Travel well, but now they do.

Clear as Mud?

Yes, Medicare and all of its options can be confusing and complicated. I am here to help you navigate your way through the Medicare maze. For now, I am licensed only in Ohio but will be adding Florida and Maryland within the next year. I would love to talk to you and help you with this process.