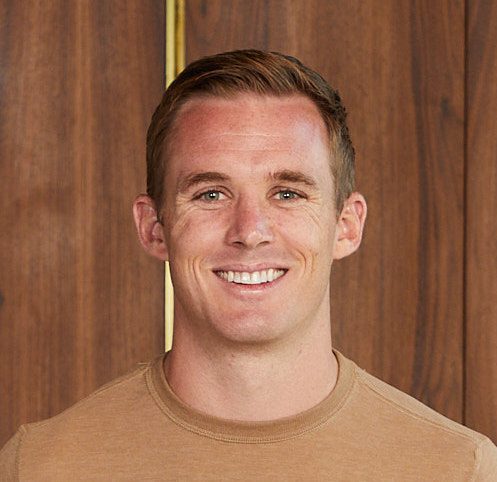

- What's the Right Roth Conversion Amount to Avoid a Tax Nightmare in the Future? James Conole, CFP® 26:40

Sammy, a 51-year-old retiree, is seeking advice on how much she should convert from her traditional IRA to a Roth IRA each year to avoid jumping tax brackets and minimize the taxation of her social security benefits.

James analyzes Sammy's current financial situation and offers guidance on approaching the tax planning aspect of her Retirement strategy.

Learn:

How to determine how much to convert from an IRA to a Roth IRA

Why forward-looking tax planning is essential

The potential consequences of certain financial decisions

Questions Answered:

What factors should you consider in planning Roth conversions?

How can you avoid going into a higher tax bracket?

Timestamps:

0:00 – Sammy’s Roth conversion question

2:29 – The Roth/tax rules today

4:58 – Tax on different types of income

7:24 – Some assumptions

10:19 – Figuring tax and making assessments

12:28 – RMD part 1

15:33 – RMD part 2

17:25 – Caution about tax bracket assumptions

21:58 – Important side note

23:45 – Takeaways

Create Your Custom Strategy ⬇️

Already a Member? Login Here.

Not Yet a Member? Join the Conversation Today!