Here's What Your Retirement Strategy Should Look Like with an $8M Portfolio

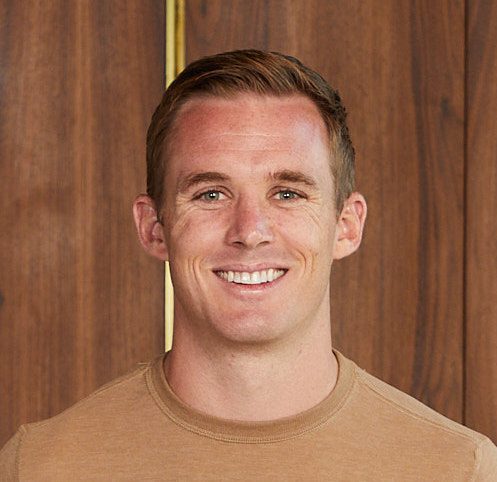

- Here's What Your Retirement Strategy Should Look Like with an $8M Portfolio James Conole, CFP® 30:34

Here’s the thing: retirement isn’t just about hitting a magic number—it’s about understanding what you actually want out of your life once work is no longer in the picture. In their chat, Ari and James dive deep into this question, starting with a listener’s email: “I’ve got $7.8 million, no debt, and I’m 57—can I retire?” Sounds simple, right? Not quite.

The duo walks through their Sequoia system, a framework designed to help people figure out whether they’re ready to retire and, more importantly, how to do it right. It starts with defining your purpose. Are you clear on how you’ll spend your time? Then it’s about crunching the numbers—your cash flow, investment strategy, and how your spending might change over time.

They Stress the importance of avoiding extremes. Sure, you want to make your Money last, but don’t be so cautious that you miss out on enjoying life. Taxes, Estate planning, and protecting your assets round out the process. It’s not just about financial Security; it’s about confidence and living with purpose. As Ari puts it: “If you’re still worried, you’re not wealthy.” Retirement should be freeing, not nerve-wracking.

Submit your request to join James:

On the Ready For Retirement podcast: Apply Here

On a Retirement Makeover episode: Apply Here

Timestamps:

0:00 – The “simple” question

3:08 – Purpose

5:50 – Projecting cashflow

9:43 – Investments/creating income

13:50 – Taxes

18:50 – Strategies for reducing tax bills

20:37 – Insurance and estate planning

24:23 – The Sequoia System

Create Your Custom Strategy ⬇️