April 17th, 2025 Adam Koós

The latest No-Huddle Market Update provides insights into the current market conditions, comparing historical trends, analyzing volatility, and assessing the potential for a major downturn. Here’s a breakdown of the key takeaways: The No-Huddle Market Updates are released when market conditions cause heightened investor concern. Recently, an increasing number of people have been reaching out […]

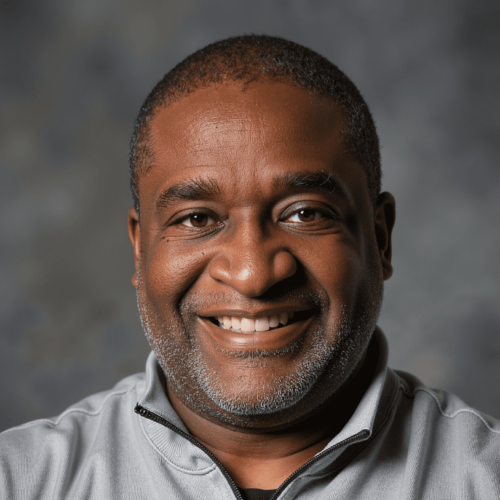

Life insurance is a critical component of financial planning, yet it often feels overwhelming due to the many policy options and factors to consider. In this Cash Podcast episode, financial expert Adam Koós and insurance professional Dan Brookman break down the key elements of life insurance, including term and permanent policies, how to determine the […]

Estate planning can often seem complex and daunting, but it is one of the most important steps to ensure that your legacy is preserved and your loved ones are taken care of. Recently, on The Retirement Fiduciary Podcast, host Adam Koós sat down with Dan Baron of Baron Law to discuss various aspects of estate […]

The financial markets have recently undergone a significant shift with the implementation of new trading rules. These changes impact the way securities are traded, affecting investors, traders, and financial institutions alike. This blog post will break down the key aspects of these new rules, explain their implications, and offer insights into stock, bond, and ETF […]

Welcome back to the Retirement Fiduciary Podcast, your no-nonsense classroom for financial education. This episode, hosted by Adam Koós, President and Portfolio Manager at Libertas Wealth Management Group, delves deeper into the murky waters of financial scams and unethical practices. From questionable designations to misleading sales tactics, Adam unpacks how to protect your wealth and […]

An in-depth review of market dynamics, trends, and investment opportunities for the year ahead. The financial world enters 2025 with mixed optimism and skepticism. While fear mongering dominates headlines, this analysis explores key indicators, trends, and investment strategies that define the current market landscape. Let’s break down the major sectors, asset classes… Source

In a recent episode of The Retirement Fiduciary Podcast, Adam Koós welcomed Suzanne Campi, a life coach specializing in navigating life transitions. With a background in psychology, fitness, and recruitment, Suzanne shared invaluable insights on managing change gracefully and thriving through life’s uncertainties. Change often induces panic, especially when it’s unexpected. Source

An In-Depth Look at the Recently Podcast Interview with Adam Koós Adam Koós’s career began with aspirations of becoming a trauma surgeon. A pre-med student at Ohio State University, Adam had a life-altering realization in his senior year: the medical field wasn’t his true calling. With encouragement from his father, Adam pivoted to financial advising. […]

Navigating the complexities of retirement planning and investment strategy requires a nuanced understanding of market dynamics. In the latest episode of the Retirement Fiduciary Podcast, Adam Koós, president of Libertas Wealth Management, explores three essential components of market analysis: momentum, volume, and relative strength. These concepts provide investors with the tools to evaluate… Source

The latest episode of the Retirement Fiduciary Podcast, hosted by Adam Koós of Libertas Wealth Management, provides a deep dive into two foundational elements of investment strategy: price and trend. Whether you’re preparing for retirement or refining your portfolio management approach, these concepts are essential for navigating market complexities and making sound financial decisions. Source