7 Things You Need to Know About Roth IRAs to Maximize Tax-Free Income

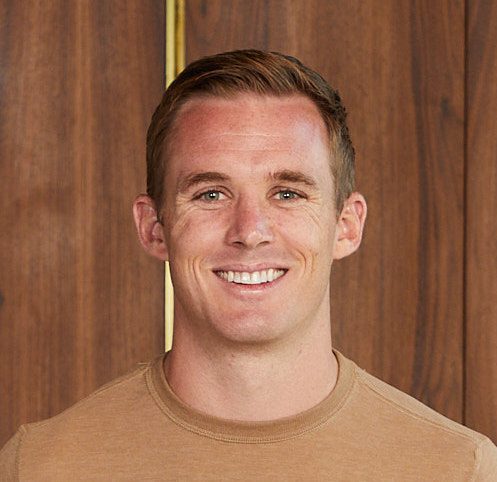

- 7 Things You Need to Know About Roth IRAs to Maximize Tax-Free Income James Conole, CFP® 17:00

Roth IRAs offer great tax-free income benefits, but to make the most of them in Retirement, here are seven things you need to know:

- Contribution Limits: In 2024, you can contribute up to $7,000 annually ($8,000 if 50+), across both Roth and traditional IRAs.

- Access to Contributions: You can withdraw your contributions at any time, tax-free and penalty-free. Only earnings are subject to penalties if withdrawn early.

- The Five-Year Rule: To withdraw earnings tax-free, the Roth IRA must be held for at least five years.

- Income Limits & Backdoor Roths: High earners may not be able to contribute directly, but a backdoor Roth strategy can help. Consult a financial advisor for guidance.

- No RMDs: Roth IRAs don’t require minimum distributions, allowing your funds to grow as long as you want.

- No Impact on Social Security: Roth IRA withdrawals won’t count toward your provisional income, potentially lowering your Social Security tax.

- No Medicare Surcharge: Roth withdrawals don’t affect your adjusted gross income, helping you avoid higher Medicare premiums.

By understanding the points above, you can use a Roth IRA to manage taxes and increase flexibility in your retirement.

Submit your request to join James:

On the Ready For Retirement podcast: Apply Here

On a Retirement Makeover episode: Apply Here

Timestamps:

0:00 – What is a Roth IRA?

1:38 – Free withdrawals

3:15 – The 5-year rule

4:49 – Income thresholds

6:01 – Backdoor Roth contribution

8:18 – No RMDs

9:26 – Not provisional income

12:10 – Not part of IRMA calculations

13:06 – Income requirement nuances

14:49 – Wrap-up

Create Your Custom Strategy ⬇️