3 Steps to Prepare for an Out-of-State Retirement

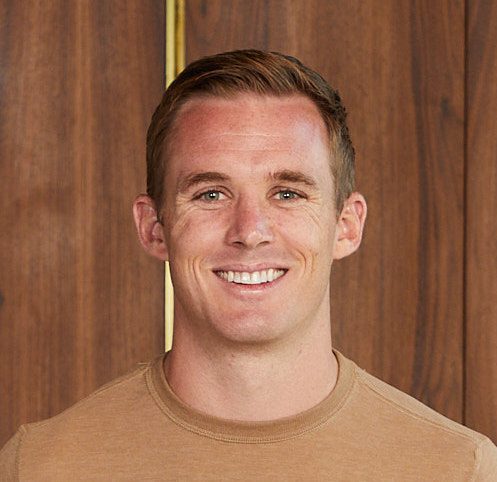

- 3 Steps to Prepare for an Out-of-State Retirement James Conole, CFP® 17:09

Have you thought about what moving to a new state might mean for your retirement budget and Lifestyle? In this Ready for Retirement episode, the focus is on preparing for an out-of-state retirement. James outlines three essential considerations for retirees planning a move:

1. Housing Costs and Expenses: From property values and local property taxes to potential capital gains from selling a current home.

2. Overall Cost of Living: Everything from groceries to utilities varies widely between regions. It’s also wise to consider personal lifestyle goals—like Travel or access to nature—as these can impact ongoing expenses

3. A Solid Tax Strategy: Particularly if moving to a state with different tax laws. Retirees can benefit by adjusting their tax strategy based on the state they’ll be in, potentially saving thousands over time.

These tips offer invaluable guidance for anyone considering a fresh start in a new state after retirement.

Questions answered:

How can moving to a different state impact my retirement expenses?

What tax strategies should I consider if I plan to retire out of state?

Submit your request to join James:

On the Ready For Retirement podcast: Apply Here

On a Retirement Makeover episode: Apply Here

Timestamps:

0:00 – An overview

1:27 – Compare housing costs

4:04 – Moving to higher property tax state

6:32 – Moving to lower property tax state

7:12 – Compare cost of living

10:48 – Dial in your tax strategy

13:44 – Consider state tax rates

14:51 – Summary

Create Your Custom Strategy ⬇️