In Episode 155, Fred Saide discusses five essential steps for Retirement Planning: reliable income, budgeting, risk management, healthcare expenses, and Estate planning. He emphasizes the importance of having multiple streams of income in retirement and the need to properly manage inflation. Fred also explores different strategies for generating income in retirement, such as Social Security, pensions, Real Estate, and dividend-paying investments. He highlights the distinction between the accumulation stage and the de-accumulation stage in retirement planning and the importance of working with a qualified Fiduciary.

Reach Fred at 800-593-8188.

See omnystudio.com/listener for privacy information.

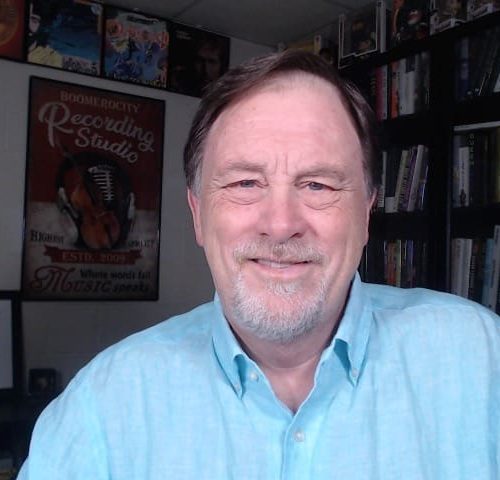

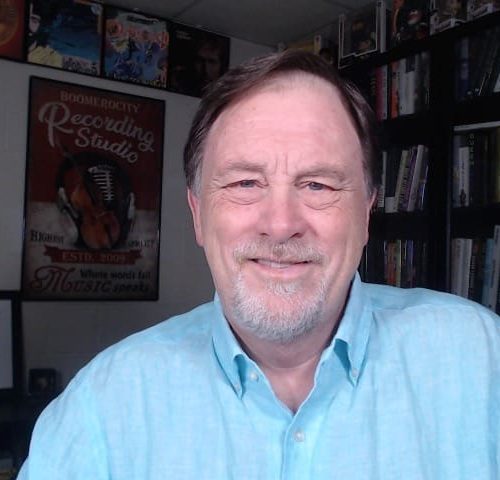

Dr. Saide is a frequent speaker and published newspaper columnist on subjects including Social Security, IRA, 401k’s, retirement plans, strategic (income) tax planning, estate planning with retirement assets. He is a successful podcaster MoneyMattersUSA® with Fred Saide and previously hosted a weekly radio program. His expertise has been well sought after, as he has been published in USA Today and Gannett Media. He has authored several e-books and “white apers” on financial and retirement topics. Additionally, he has been interviewed by many financial publications, TV and cable, and has ghost written for multiple financial websites.

After graduating from Duke University, where Dr. Saide earned his Ph.D., MA, MBA, and his BA from Adelphi University, he went on to earn certificates for studies at Purdue University, The American College of Financial Services, MIT Age Labs, Penn_Wharton.

BabyBoomer.org is an online membership community created by and for the Baby Boomer Generation. Boomers, and those who service and support them, are welcome to join our community accessing all general topics.

Notifications