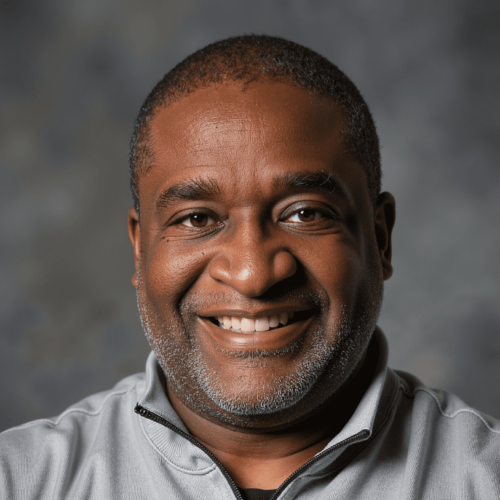

Born during the “Blizzard of ’78’ in Oberlin, Ohio, Adam Koós inherited a mix of Hungarian (his father was born in Györ, Hungary), Irish, and German from his parents, Kim and Stephen Koós. While it looks nothing like it sounds, his last name is actually pronounced kōsh, as in “kosher dill pickles.”

The oldest of four, Adam grew up absorbing the power of deep, meaningful Relationships that his father fostered in his optometry practice. This early exposure to entrepreneurialism sparked his desire to one day own a business where he could significantly impact others’ lives.

In 1996, Adam moved to Columbus for college at The Ohio State University, where he met his future wife, Donna. The couple tied the knot in 2003 and now enjoy life with their two wonderful sons, Karston & Kamden. Besides being a devoted family man, Adam is a passionate car enthusiast and a sports fanatic and is a proud season ticket holder for both Ohio State Football as well as the Cleveland Browns.

Adam’s professional journey began just 10 days before the tragic attack on the World Trade Center in 2001. This timing allowed him to guide his clients through four of the worst market crashes in U.S. history.

He holds several high-ranking certifications, such as the Certified Financial Planner® (CFP), Chartered Market Technician® (CMT), Certified Financial Technician (CFTe), and Certified Exit Planning Advisor (CEPA). He’s also been recognized locally and nationally in publications such as The Wall Street Journal, MarketWatch, Investopedia, Seeking Alpha, FA Magazine, and Proactive Advisor Magazine, just to name a few.

At Libertas Wealth Management Group, Adam utilizes his expertise, focusing on two main areas:

Career professionals who have an interest in utilizing a variety of Retirement, tax, insurance, and Estate planning tools to make work optional — and stay retired.

Business owners and CEOs interested in transitioning their businesses into more profitable, efficient, and Lifestyle-friendly companies with plans to eventually (or immediately) exit, and…

In addition to his financial advisory role, Adam is an accomplished speaker, writer, and educator. He regularly contributes to numerous financial publications and offers financial planning classes and workshops. His dedication to sharing knowledge stems from his family’s background in teaching.

Through these endeavors, Adam continues to make a significant impact on the lives of others, fulfilling the vision he nurtured from a young age, watching his father and absorbing the lessons he was taught about attitude and ethics, and using his knowledge to provide authentic advice, treating clients as if they were his own family.