April 22nd, 2025 Jesse Cramer

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: George R.R. Martin’s epic fantasy saga, A Song of Ice and Fire, started in 1996, with Martin publishing the first three books over five years. The books built a cult following thanks to their gritty realism, deep characters, and (let’s be […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Today’s Question Barry wrote in and asked: Jesse – I’ll need about $100,000 per year from my portfolio in retirement. I have $3M in my retirement portfolio. It’s producing about $60,000 in income and dividends for me, meaning I […]

The face of entrepreneurship is changing, with maturepreneurs—the population aged 55 and above—playing a more significant role in reshaping our economy. During my recent podcast episode 165 I had an enlightening conversation with Jannette Anderson, a business development expert with over 40 years of strategic planning and marketing experience. Her passion for helping entrepreneurs make […]

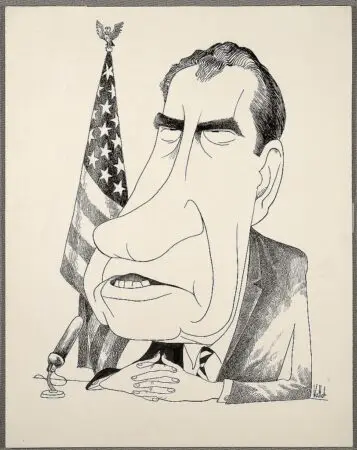

Richard Nixon remains one of the more fascinating and complex figures in American history, embodying well-known deep flaws in parallel with acts of brilliance. His most infamous role was as the puppet master behind the Watergate scandal, ultimately leading to his resignation from the Presidency and scarring his legacy. Some historians point to Watergate as the […]

“If all you have is a hammer, everything looks like a nail.” We’ve all heard that phrase, alongside the concept of having “the right tool for the job.” I submit that many people in the retirement planning community (especially online in DIYer circles) do not have the right tools or mental models for including long-term […]

Much ink has been spilled on the 4% rule, including here on The Best Interest. The short and sweet definition? The 4% rule is a retirement strategy that suggests withdrawing 4% of your portfolio’s value annually, adjusted for inflation, to ensure your savings last for a 30-year retirement. If you’d like to dive deeper on […]

We are often told that we need $-X amount for a 20-year retirement, or that we should contribute $-X amount to our 401(k). Originally Published on https://pointwealthmanagement.com/blog/

Do You Need a Financial Plan? Here’s How to Tell By, Jeremy Reif, CPRS There are a lot of preconceived notions out there about what a retirement plan is and who it is for. Often, people assume that since their financial life is simple, they don’t need a fancy retirement plan. But asking if you […]

Have Your Financial-Procrastination Fallen Prey to? By, Jeremy Reif, CRPS It’s human nature to procrastinate about financial-procrastination. Why do it today when you can do it tomorrow, right? But the question is, when is “tomorrow?” I posted a video years ago giving my thoughts on procrastination as it relates to financial planning. In that video […]

Exploring Key Retirement Questions for a Secure Future By, Jeremy Reif, CRPS Regardless of if you are 30 or 50, the idea of retirement probably crosses your mind regularly. Once we dive into our working years, retirement becomes the ultimate goal. It’s the promise that one day we’ll be able to reap what we’ve sown […]