March 8th, 2023 Greg Aler

Even if you love rollercoasters, chances are the rip-roaring stock market isn’t your kind of thrill. Yet time and again, as the market suddenly plunges to gut-turning lows, retirees are advised to stay on the ride; wide-eyed, white knuckled, and praying there won’t be another dip as big as the last. Why? Like so many […]

You don’t often hear the word trillion thrown around, unless we’re talking about the U.S. debt or GDP. But there’s another number that consistently lands in the 12-zero club: the total net assets of the US mutual fund industry. At nearly $27 trillion in 2021, it’s a whole lot of money; and its rapid growth […]

Let’s talk about the alphabet soup that is the financial services industry. Between the CFPs, the CFAs, and MBAs, there’s a whole lot of WTH (heck). Adding some letters to the end of a name on a business card sure sounds important, but should it be important to you when selecting a retirement planner? […]

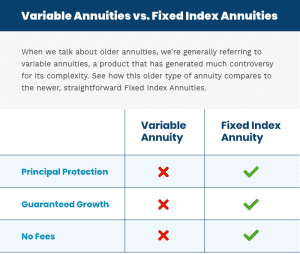

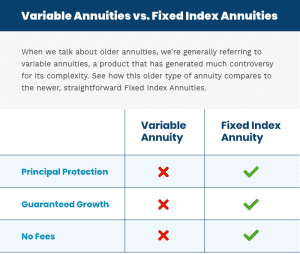

Poll your friends and family about annuities and you’re bound to get a lot of adverse reactions. They’ll likely cite at least one of these three things : They’re expensive and have big fees. They don’t give you access to your money. There’s no growth. While these statements are true of some annuities, they’re not […]

When you work hard for your retirement, you deserve to have someone at the helm of your planning who will work just as hard to safeguard the fruits of your labor. That’s why we’re excited to announce the addition of a new Partner to our team who shares in our passion to make a difference […]

Let’s talk about commissions. For many professions—like real estate agents, sales professionals, brokers and artists—it’s a compensation structure to which we’ve become accustomed. They make money when you make a purchase related to the services they provide. But when it comes to commissions and financial advisors—whoa, hold your horses. We’ve been conditioned to think that […]

Call it the new kid on the block. Fixed index annuities (FIA) are a more recent offering in the world of annuities and we think they’re worthy of your attention. Now, before you run off, we know annuities have become something of a dirty word. And frankly, they’ve earned the reputation. Historically, some haven’t been […]

We recently heard a large, national firm use the slogan, “We do better when you do better,” and we couldn’t help but scratch our heads. On the surface it may seem agreeable; after all, if they’ve helped you build wealth, why not reward them, too? But when you think about what that means, it becomes […]

We’ve written extensively about the risk of long-term care, but most people don’t want to consider the possibility that they’ll need it. Unfortunately, statistics tell us there’s a 70% chance that you will need long-term care if you’re 65 or older. If that’s surprising to you, it’s because the prevailing strategy for preparing for the […]

No one likes extra fees, especially when they are hard to understand or being intentionally hidden. You know the ones: the stealthy “service fee,” the suspicious sounding “surcharge,” or the “handling fee,” which is always a head scratcher. There are two fees we think all retirees should know about: investment fees and advisor fees. Granted, […]