Many professionals find that retiring isn’t just about having enough Money—it’s about feeling ready to leave behind the structure, identity, and comfort of a career. In this Root Financial podc…

Many professionals f…

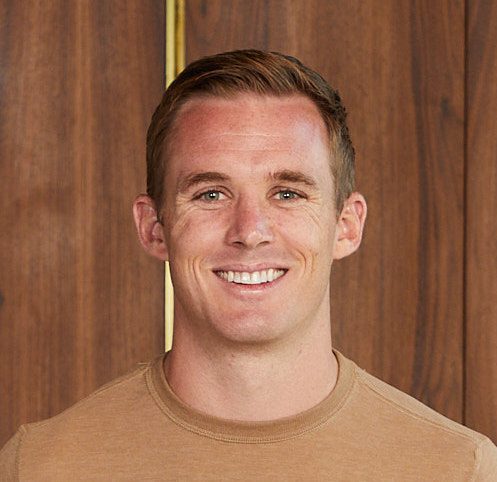

Many professionals find that retiring isn’t just about having enough money—it’s about feeling ready to leave behind the structure, identity, and comfort of a career. In this Root Financial podcast episode, James and Ari explore the emotional hurdles of retiring from a high-paying, high-Stress job, even when financially prepared. They highlight the value of aligning retirement with your future self’s goals and priorities, not just your current fears. Submit your request to join James:On the Ready For Retirement podcast: Apply HereOn a Retirement Makeover episode: Apply Here Timestam…