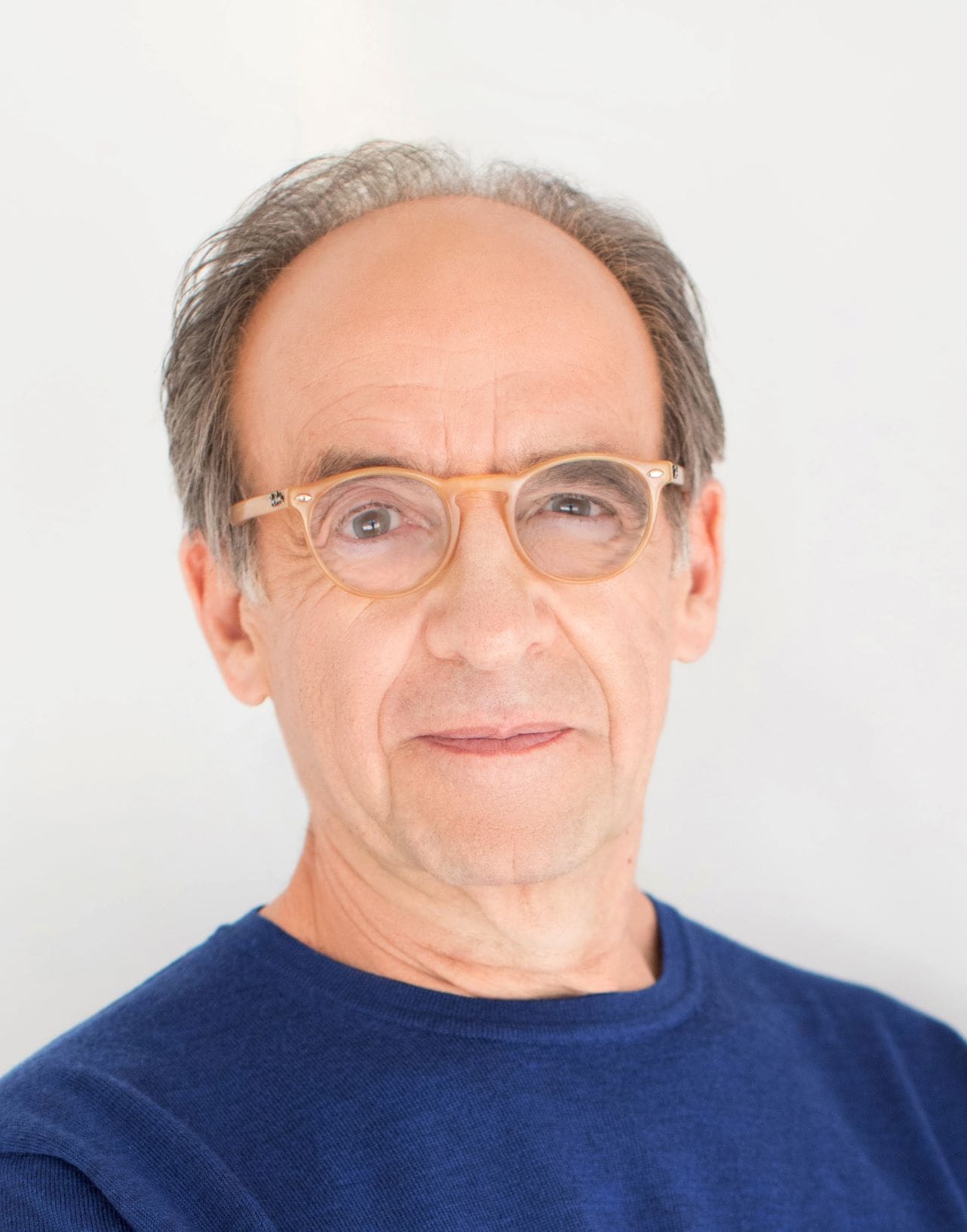

In this episode, financial experts Beth and Matthew Blecker discuss the similarities between managing your physical and financial fitness. Listen in as Matt leads the discussion by emphasizing the i…

In this episode, fin…

In this episode, financial experts Beth and Matthew Blecker discuss the similarities between managing your physical and financial fitness. Listen in as Matt leads the discussion by emphasizing the importance of goal-setting, planning, and discipline in achieving success in both areas. Together Matt and Beth share insight and strategies about staying equipped with the right financial products to help you stay disciplined, create a plan, and overcome financial obstacles. Beth and Matt discuss:How to stay disciplined when it comes to financial fitness even when “life” happens The most i…