February 19th, 2025 Jesse Cramer

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: I’m reading Morgan Housel’s recent book, Same as Ever, right now. One of the chapters is called “Best Story Wins.” [While I’m not sure it’s word-for-word the same, this chapter can be read (for free) via Morgan’s blog: https://collabfund.com/blog/story/] Housel’s idea […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Reader Phil wrote in last weeK Jesse – I appreciate everything you have to say on stock investing and low-cost, diversified index funds. I also love all the Warren Buffett wisdom you share. But, at least when it comes to […]

Before the article, here’s what’s happening this week on The Best Interest Podcast: My daughter, Maeve, is about to turn 8 months old. She’s chunky, smiley, and effortlessly sits like Buddha while playing with her toys. No crawling or walking yet. She did recently learn to wave (…flail her arm) to say hi to people. […]

Before the article, here’s what’s happening this week on The Best Interest Podcast: Do you know someone who cheers for a particular sports team simply “because?” They usually have a mundane reason, like “I just liked their logo when I was a kid…so I started cheering for them” or “my dog was named Viking, so […]

Richard Nixon remains one of the more fascinating and complex figures in American history, embodying well-known deep flaws in parallel with acts of brilliance. His most infamous role was as the puppet master behind the Watergate scandal, ultimately leading to his resignation from the Presidency and scarring his legacy. Some historians point to Watergate as the […]

I’ve had a few clients reach out to me over the past couple weeks (the last week of December 2024 & first week of 2025) with similar concerns: “How and why did my account go down at the end of 2024?!” The short answer: accounts are down because the market is down, and the market […]

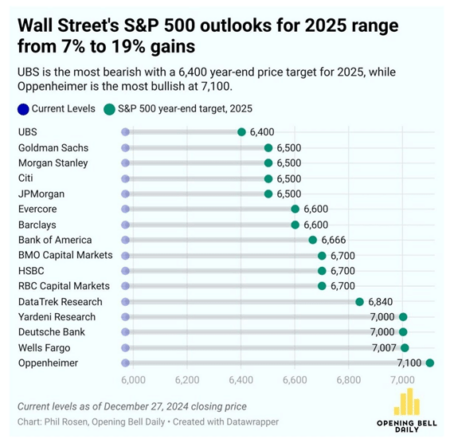

Have you heard this year’s version of Wall Street’s favorite joke? “We’re going to predict how the stock market does this year!“ Woof. Yikes. Why?! 1-year stock predictions are pointless. We’d all be better off accepting that fact. Risk, Reward, Timelines, and More Time and again, I want to ensure every long-term investor understands the […]

Most personal finance experts would tell you that cars are a terrible investment. Cars are a “necessary evil,” a steep price to get from Point A to Point B. You’re leaking money on a depreciating asset. They’d tell you to avoid debt a car as best you can. Owning a depreciating asset is one thing, […]

Friend-of-the-blog Christian has done something remarkable. He’s lost ~85 pounds over the past 7 months, dropping from ~280 pounds to ~195. Kudos, Christian! Inspired by Christian’s success, my own health has sharpened into focus. I have the data to support this – I’ve gained 8 pounds over that same period that Christian’s lost 85. I’ve […]

I met with a family a few weeks ago for an introductory conversation. I’m always interested to learn about people’s history with money. It’s an open-ended question that allows for a multitude of interesting answers. This family explained that ~20 years ago, they received a significant lump sum payment. They reached out to a financial […]