November 18th, 2024 Elliot Kallen

The IRS has issued its final regulations, bringing substantial updates to 401(k), IRA Required Minimum Distribution (RMD) rules, and Roth IRA limits for 2025. These rules could reshape how Americans plan for retirement, creating new opportunities to enhance retirement savings, improve employer contributions, and reward personal investments in retirement accounts. It’s time to take a […]

As Warren Buffet wisely said, “Rule No. 1, Never lose money. Rule No. 2: Never forget rule No.1.” Yet, as careful as we may try to be, it’s surprisingly easy to lose track of our hard-earned money. In fact, Americans misplace billions of dollars each year simply by switching jobs to financial institutions and leaving […]

Caleb writes in this week with a SPICY question. The answer surprised me. It might surprise you too. Jesse – I work for a small company that does not currently offer a 401(k) match. Do the numbers still suggest I should utilize it? Caleb What Are We Comparing? We need a point of comparison. If […]

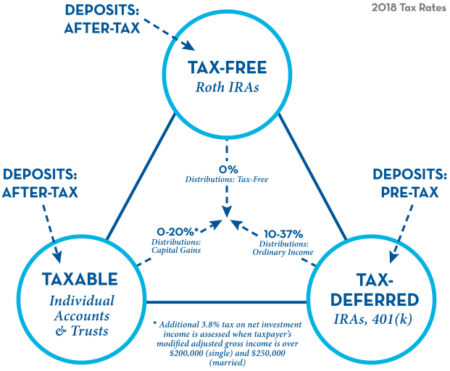

Navigating Retirement Taxes Strategies for Reducing Retirement Taxes By, Jeremy Reif, CRPS Are you one of those people who says you will worry about taxes later? Better yet, you will move to a state where you do not need to pay taxes on your retirement money. If so, this article is for you. Retirement is […]

The Internal Revenue Service (IRS) has announced significant updates for 2024, impacting various retirement plans, including 401(k), Individual Retirement Accounts (IRA), and Roth IRAs. These changes, primarily influenced by cost-of-living adjustments (COLA), offer important implications for individuals and employers in planning their retirement contributions and strategies. 1. 401(k) Plan Contribution Limits For 2024, the contribution […]

Today’s world is evolving rapidly, making it more challenging than ever to attract and hold onto talented employees, particularly senior management. Here are some strategies that might be beneficial, and these require thoughtful conversations: Secure key talent with a Deferred Compensation Plan. Establish a “Split-Dollar” insurance program for your executives. Consider a creative match for […]

Are employee exits burning a hole in your company’s pocket? Employee turnover isn’t just about bidding farewell to a familiar face. It’s about the monetary implications–the real costs of employee turnover– that are both evident and concealed beneath the surface of your business. The modern employee doesn’t just work for today’s paycheck. They’re consistently looking […]

In the world of business management, understanding the roles and responsibilities of various financial professionals is paramount. Particularly when it comes to handling retirement plans like 401(k)s, the expertise brought on board can directly affect the financial well-being of numerous individuals. Two crucial roles in this sphere are those of a 401(k) Fiduciary Advisor and […]

The role of 401(k) plans in an employee’s financial stability cannot be overstated. As such, companies must ensure these plans are structured to provide the best possible outcomes. Superior plan features and design can significantly impact the performance of 401(k) plans, influencing employees’ retirement readiness. Let’s explore the correlation between innovative plan features and overall […]

There is no doubt that retirement planning is important. With many Americans living into their 80s and 90s, it’s more important than ever to ensure that your finances are in order so you can enjoy your golden years. Despite the wealth of saving and financial wellness options created by the retirement industry, there is still […]