If you earn too much to contribute directly to a Roth IRA, a backdoor Roth IRA might seem like the perfect workaround. But before you jump in, there are two critical considerations you need to be aware of.

1. Pro-Rata Rule: This rule may impact how much of your Roth conversion gets taxed. If you don’t account for it, you may receive an unexpected tax bill.

2. Record-Keeping: Keep detailed records and file the appropriate tax forms to avoid overpaying in taxes.

Is a backdoor Roth conversion the right strategy for you? The answer is it depends.

Consult with a financial or tax professional for guidance on your unique circumstance and goals.

Subscribe to my channel for more helpful videos on Retirement and Investing:

▶️ @therealpeopleadvisor

Need a financial planner? Let’s talk! Book a call with me today:

▶️ www.sensibleportfolios.com

Instagram ▶️ https://www.instagram.com/sensibleportfolios/

Facebook ▶️ https://www.facebook.com/SensiblePortfolios

#retirementplanning

#rothconversion

#rothIRA

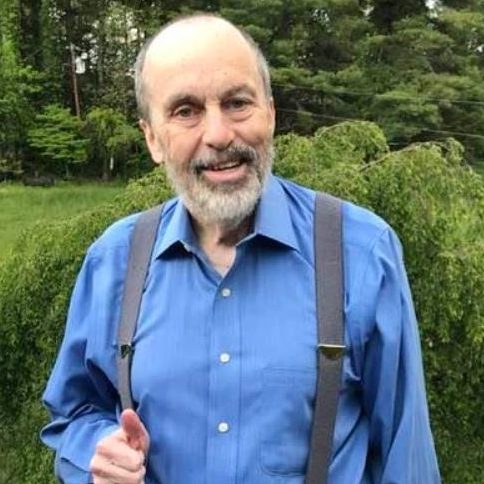

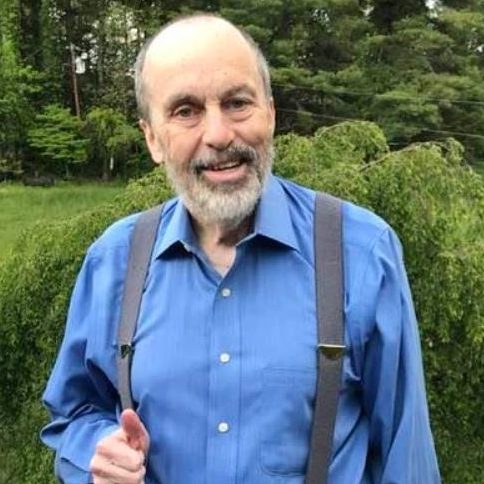

My mission is to make investing simple and affordable for real people, everyday investors like you.

You deserve access to the tools and resources you need to build a better financial future. That's why I'm committed to providing high-quality content that is accessible to all.

I work at Sensible Portfolios, a family-run, financial advisory firm that has served hundreds of clients for almost 30 years. At Sensible, we follow a few basic rules: Be nice to people, keep investing simple, and don’t charge high advisory fees.

So what are you waiting for? Join my community of sensible investors and start building the wealth you deserve!

BabyBoomer.org is an online membership community created by and for the Baby Boomer Generation. Boomers, and those who service and support them, are welcome to join our community accessing all general topics.

Notifications