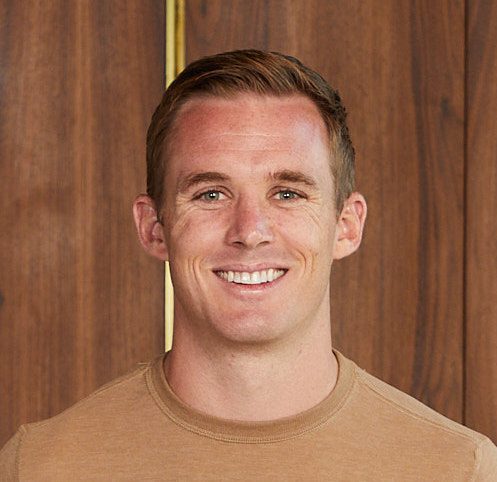

- Maximize Your Early Retirement: Should You Save to 401k or Brokerage Accounts? James Conole, CFP® 32:08

Typical Retirement strategies assume a Retirement age of over 60. With an earlier Retirement goal, a careful look is required to determine what strategies will create the best outcome. James responds to a listener’s question about where to invest as he anticipates an early Retirement. James walks through the steps of Root’s Sequoia System to explore options for early Retirement scenarios.

Questions Answered:

How does early Retirement impact traditional Retirement planning strategies, such as the 4% rule?

When deciding between Retirement accounts (e.g., 401k) or brokerage accounts for pre-60 funds in early Retirement, what factors should be considered?

Timestamps:

0:00 – Question about early Retirement

2:21 – Is early Retirement possible?

3:30 – Why the 4% rule doesn’t apply

6:08 – Assessment of Juan’s situation

8:11 – The Sequoia system Step 1 – purpose

10:16 – Step 2 – Retirement income

12:49 – Relying on SS benefit?

14:09 – Withdrawal strategy

15:32 – Sourcing funds from age 50-59

17:20 – Brokerage vs 401K

20:22 – A part-time income scenario

23:04 – Consider how expenses might change

25:14 – Step 3 – investment planning

28:09 – Steps 4 & 5- taxes and protection

Create Your Custom Strategy ⬇️

Already a Member? Login Here.

Not Yet a Member? Join the Conversation Today!