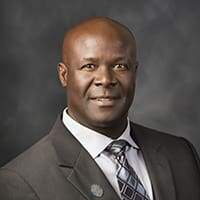

Nearing retirement and feeling unsure about your finances

It’s important to recognize that achieving a fulfilling Retirement doesn’t require substantial wealth. Wealthy people are not the only ones who have enjoyable retirements. They know how much Money they need for retirement and live within their means.

Nearing retirement and feeling unsure about your finances, try these ideas:

Consider making retirement financial literacy your primary focus. Begin with the fundamentals. Learn about personal Finance during retirement through books, courses, newsletters, and workshops. Check with your employer or financial institution for retirement help. Before retiring, it’s important to understand retirement systems, like pensions, government benefits, and savings. Also, recognize the role your home plays in your retirement finances. Don’t be discouraged if these concepts seem unfamiliar at first—most individuals over 50 are in the same boat.

Review your eligibility for age pensions. Familiarize yourself with how much you can access. For example, in Canada, you may access up to 33% of your pre-retirement income through programs like the Canada Pension Plan and the Old Age Security program. In Australia, a full pension can provide annual income amounts for couples and singles. Gaining this understanding is key to planning your retirement financial strategies.

Making a budget for retirement needs a special approach. You’ll need to delve into your living expenses, knowing that your daily routine won’t revolve around work. Also, consider those special Bucket List items you’ve always wanted to experience. Some people list their living expenses and bucket list goals in their budget and then compare it to their expected retirement income. Once you have your budget in place, assess how you can live within its confines. If you find it challenging to include all your desired activities, prioritize what matters. Also, take advantage of any available discounts or concessions.

Practice Living on Your Retirement Budget for a time This step is often overlooked, but beneficial. As you approach retirement, try living on your projected retirement budget for a month or two gives lets you understand what you will face when you retire. This Exercise allows you to gauge the feasibility of your financial plans and make any necessary adjustments. It’s an opportunity to fine-tune your spending habits and ensure a seamless transition into retirement. Imagine the confidence boost if you end the month with money to spare.

Always remember, building financial confidence for retirement isn’t about the size of your savings; it’s about how effectively you manage them. Make your retirement less stressful by understanding your pension and benefits, budgeting, and practicing your retirement Lifestyle.

Originally Published on https://boomersnotsenior.blogspot.com/