Should I Use My 401(k) Without a Match?

Caleb writes in this week with a SPICY question. The answer surprised me. It might surprise you too.

Jesse – I work for a small company that does not currently offer a 401(k) match. Do the numbers still suggest I should utilize it?

Caleb

What Are We Comparing?

We need a point of comparison. If Caleb doesn’t use his company 401(k), we’re going to assume he contributes Money into a normal taxable brokerage.

As you’ll see, I analyzed various “employer match” percentages (100%, 50%, 0%) and also looked at skipping the 401(k) to use a taxable brokerage.

The Expectations

I’ve always believed that “you need to get your employer match.” (Spoiler alert: it’s still true! It’s free money!)

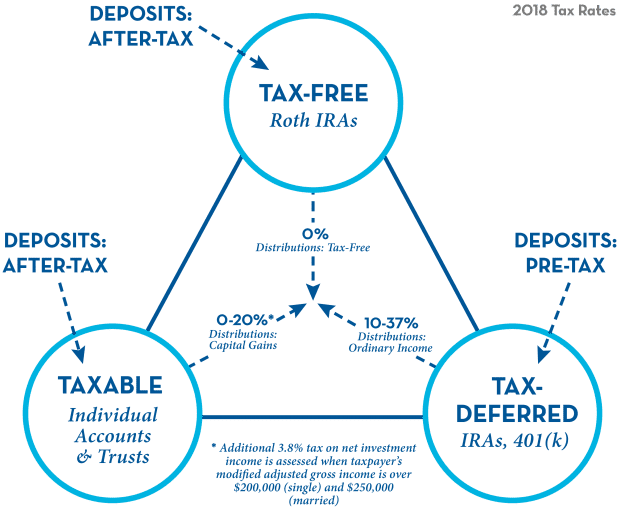

But I’d wager many people also believe that the tax-deferred nature of a 401(k) is a huge selling point. Even without a match, I bet they simply gush over the tax deferral.

But I’m going to show you that tax-deferred Growth doesn’t move the needle without an employer match.

The Numbers

We need to agree on some numbers. You can view my assumptions on this Google Sheet. Feel free to go to File –> Make a Copy to play around with it yourself. As with any anaylsis, the assumptions make all the difference! I assumed the following:

- Caleb’s current marginal tax rate = 24%

- Caleb’s future marginal tax rate = 22%

- Caleb’s future capital gains rate = 15%

- 401(k) match percentage = variable

- Investment growth rate (inflation-adjusted) = 6% per yearI

- 401(k) plan fees = 1.00% (source)

- Brokerage investment fees = 0.05%

If I had to argue with myself, the two assumptions I’d push back on are the future marginal tax rate and the future capital gains tax rate. With smart financial planning, those two variables have the capability of being significantly lower than 22% and 15%, respectively. But I’m ok where they’re at for now. Again – please Make a Copy of the Google Sheet if you’d like to play around.

The Results

Over a ~25 year Investing horizon, I calculated final portfolio values for our various cases. These values are net of all taxes, providing an “apples-to-apples” comparison.

- 401(k) with 100% Employer Match = $430K

- 401(k) with 50% Employer Match = $323K

- 401(k) with 25% Employer Match = $269K

- 401(k) with 0% Employer Match = $215K

- Taxable Brokerage Account = $225K

A 401(k) with 0% Employer Match underperforms a simple taxable brokerage account. Not to mention: the 401(k) is intentionally illiquid prior to Retirement, while the taxable brokerage account can be flexibly used.

Who would intentionally sacrifice liquidity and ~5% of their overall return? Sounds like a raw deal!

That’s why a 401(k) without a match is a bad deal for the investor.

Thankfully, most online sources suggest that anywhere from 90% to 98% of all 401(k) plans offer some level of match. But as the Results show above, the size of the match is important. The match makes a 6-figure difference, even when “only” contributing $5000 per year.

I also don’t want to overlook the important behavioral value of a 401(k). In short, illiquidity has it’s benefits. Quoting myself (I know, I know…):

The mere ability to buy or sell an asset tempts investors to do so at the worst possible times.

401(k) accounts make it difficult for investors to do the common dumb things that cost them money. That’s an important behavioral benefit. On the other hand, taxable brokerage accounts can easily be tapped into ASAP for that new yacht.

Nevertheless, if you’re the kind of disciplined investor I’m used to interacting with here on The Best Interest, then I say this:

A 401(k) without a match is a raw deal! You can do better using a simple, taxable brokerage account.

Thank you for reading! If you enjoyed this article, join 8500+ subscribers who read my 2-minute weekly email, where I send you links to the smartest financial content I find online every week. You can read past newsletters before signing up.

-Jesse

Want to learn more about The Best Interest’s back story? Read here.

Looking for a great personal Finance book, podcast, or other recommendation? Check out my favorites.

Was this post worth sharing? Click the buttons below to share!