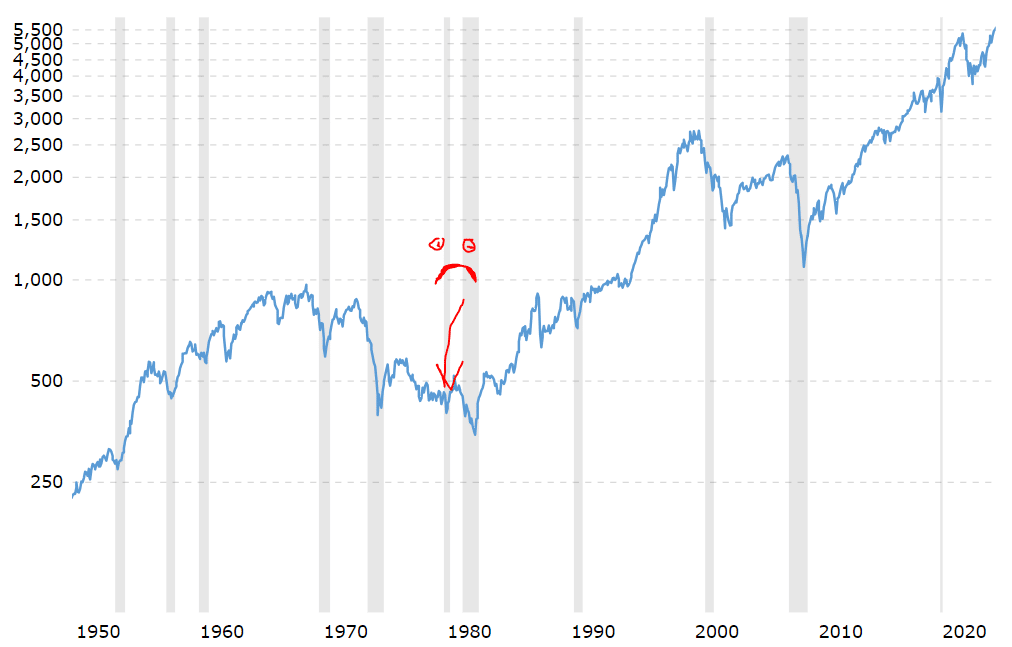

In August 1979, Warren Buffett wrote an article for Forbes attacking the herd instinct of investors. The late 1970s were tough for the American Economy, and the stock market reacted harshly.

Buffett wrote,

“…the future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually, is the friend of the buyer of long-term values.”

Warren Buffett

The future is never clear. Let Buffett’s Wisdom sink in. Uncertainty surrounds us, like fog on the highway. Risk is omnipresent. Say it with me: risk is omnipresent.

Only our perceptions and feelings change, sure. But feelings do not create or change reality.

Some periods feel optimistic and “cheery” – What risk?! Stocks can’t possibly go down! This is nirvana! Many younger investors have felt this in the past 15 years.

Other periods feel woefully pessimistic. “This is the death of equities,” wrote Business Week in the summer of 1979. If you’ve lived through bear markets or all-out crashes, you might know this type of pessimism.

Both of those perceptions are overly emotional. The optimist underestimates risk, and the pessimist overestimates risk.

We need to be prudent realists.

Every time you get in a car, the threat of getting in an accident is real.

According to Esurance, your odds of getting in a car accident are 1-in-366 for every 1000 miles driven. That equates to ~1-in-4 odds for every 100,000 miles driven. Accidents are out there!

Perhaps you’ve never had an accident before. Nevertheless, your future risk of an accident is still very real. I’d bet this person, with their perfect driving record, underestimates how real their future risk actually is.

Or perhaps you’ve gotten in multiple accidents – more than your fair share. I’d wager that person is hyper-aware to their future accident risk. In fact, they’ll likely overestimate their future risk.

Our perceptions of future risk are often shaped by our past experiences. We are pattern-seekers. But many events in this world are entirely decoupled from the past. Other types of events happen too infrequently for patterns to be evident. We get lulled into a false sense of reality. The stock market certainly acts this way.

The perfectly rational driver does the best they can (e.g., drives safely and defensively) yet still understands that future accidents might be waiting for them, regardless of their past driving record.

Is a market crash coming soon? I don’t know, and neither do you.

Our past 15 years of relative stock market bliss do not necessitate a pending crash. None of this is predetermined.

But I do think the past 15 years have lulled many stock investors into a false sense of Security. Many investors are thinking the same way as the accident-free driver. “I’ve never got in an accident. It must be a minuscule risk. Perhaps even zero risk!”

This is dangerous. Just as a driver should always maintain a defensive approach, so should the investor. And going back to Buffett’s inspirational quote:

“…the future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty, actually, is the friend of the buyer of long-term values.”

When our fellow investors get too confident, when they ignore the omnipresent risks, they (incorrectly) believe that further stock ownership is a zero-downside panacea. It’s 10% per year, guaranteed, forever!**

Their demand for more stock ownership drives prices upward and, ultimately, reduces future expected returns. We all pay a price for a cheery consensus.

While a hard pill to swallow, stock buyers would rather have some tumult. We don’t mind buying at slightly lower prices. Uncertainly, as Buffett wrote, is our friend.

My final point, which I hope you’ll agree with…

We should be just as respectful of the omnipresent risks today as we would be during the middle of a stock market correction or even at the bottom of a market crash.

The risk of stock ownership is the same at all points! It doesn’t change. Only our feelings (“making Money rocks!” vs. “losing money stinks!”) are changing. The risk itself is not changing.

If you can internalize that Investing truth, you’ll become “the invulnerable investor.” Emotions won’t sway you.

That is the “little secret” of all great investors.

Thank you for reading! If you enjoyed this article, join 8500+ subscribers who read my 2-minute weekly email, where I send you links to the smartest financial content I find online every week. You can read past newsletters before signing up.

-Jesse

Want to learn more about The Best Interest’s back story? Read here.

Looking for a great personal Finance book, podcast, or other recommendation? Check out my favorites.

Was this post worth sharing? Click the buttons below to share!

Notifications