Call it the new kid on the block. Fixed index annuities (FIA) are a more recent offering in the world of annuities and we think they’re worthy of your attention. Now, before you run off, we know annuities have become something of a dirty word. And frankly, they’ve earned the reputation. Historically, some haven’t been so great, while others have been downright terrible. BUT FIAs are the breakaway exception. And retirees who have been using them are loving them.

Why are FIA’s Different?

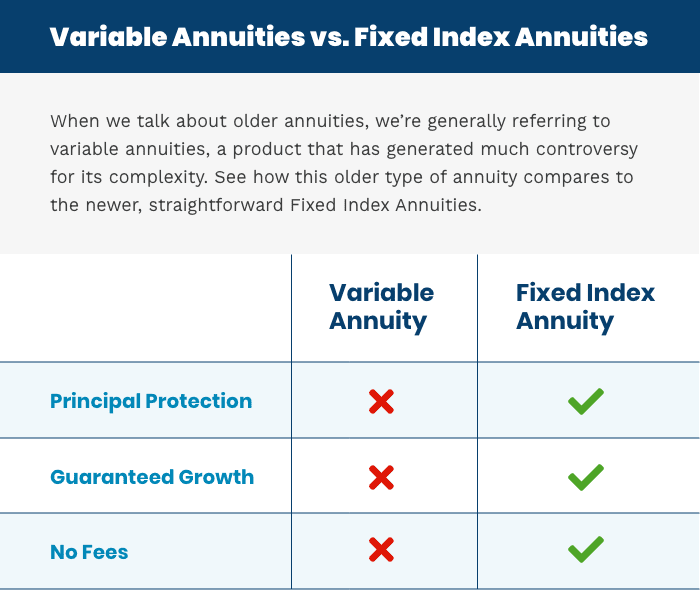

So what exactly is a FIA, and what makes it stand apart from other annuities? The FIA was first introduced in 1995, making it a relatively new option for retirees. Like other annuities, a FIA is a contract you enter into with an insurance company. However the main difference with a fixed index annuity is that it carries no fees, is tied to the performance of a stock market index and you’re guaranteed not to lose principal. How is that possible? The policy sets limits for gains and losses. This enables the insurer to pay for that protection.

Why Not Just Invest in a Mutual Fund?

You certainly could just invest in a mutual fund directly, but remember, there are no guarantees of performance. And further, you’re taking on all the risk. So, if the stock market tanks, so too does your investment. You could just ride out the market and hope to gain back your losses; but if you’re in Retirement, you don’t really have the luxury of time. Plus, don’t forget that it will take longer to recover your Money when you take into account the mutual fund’s fees. That’s what makes a FIA so attractive for many retirees: losses are limited and there are no fees.

How Are FIAs Beneficial?

We created the chart above to provide a quick idea of how Fixed Index Annuities stack up to the order style Variable Annuities that most people think of when they hear “annuity”, but that just scratches the surface. Let’s take a closer look at the benefits:

Bond Replacement: Bonds can go backwards. (Case in point- they’re down this year.) In a rising interest rate environment, they’re really not a great place to be. A fixed index annuity is a good alternative. It’s actually safe, can’t go backwards, while still having opportunities for your money to grow.

CD Replacement: While CDs are safer than bonds, the returns are very small, with no access to your cash. Annuities provide that access, but with the potential for much larger returns.

Tax-Deferred Growth: Like a traditional IRA, your gains are tax-deferred, which may enable you to take advantage of a lower tax bracket in retirement when it comes tome to pay Uncle-Sam.

Control Over Your Money: In addition to the valuable principal protection, you’ll also have access to your money should you need it. In the event of a financial emergency, or any reason at all you are typically allowed to withdraw a percentage of your premium without penalty. For a larger amount, there is a surrender fee, but the good news is the charge usually decreases the longer you hold your annuity.

Death Benefit: When you pass, your beneficiaries can receive either the current value of your annuity, or the minimum guaranteed surrender value (the amount your annuity is worth if you cancel before the Surrender Period ends), whichever is greater.

Long-Term Care: Some FIAs will waive surrender charges in the event you need a Nursing home.

To be clear, a FIA isn’t for everyone, but it is a great choice for most retirees. Unfortunately, part of what has given annuities a bad rap is unscrupulous advisors recommending annuities that don’t meet their clients’ needs, or worse–annuities that clearly don’t meet anyone’s needs and shouldn’t be recommended at all. We won’t do that.

We created Golden Reserve to fix a broken financial planning system that’s failed retirees. Providing straight talk on annuities is one of the ways we do that. So, bring all your questions. We will help you find what truly works for you.

Notifications