Top 5 Most Avoidable Retirement Mistakes

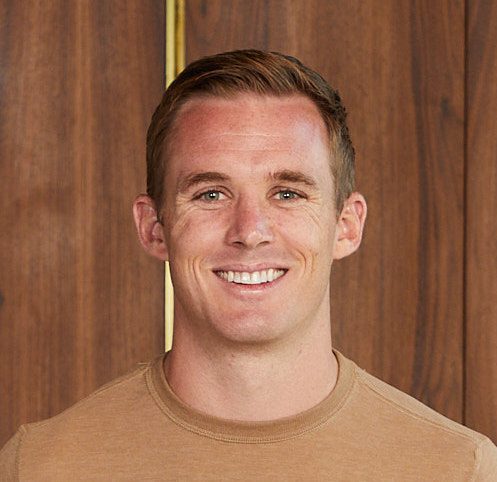

- Top 5 Most Avoidable Retirement Mistakes James Conole, CFP® 17:28

James breaks down five common retirement mistakes and how to avoid them for a secure and fulfilling future:

- Spending Wrong: Overspending risks running out of Money; underspending misses out on life.

- Bad Timing: Retiring too early strains finances, while retiring too late sacrifices experiences.

- Ignoring Risks: Overlooking inflation or focusing only on market volatility hurts long-term stability.

- Over Helping Kids: Excessive financial support can jeopardize retirement Security.

- No Strategy: A lack of planning for taxes, investments, and withdrawals leads to inefficiency.

Plan wisely to balance financial security with an enjoyable, purposeful retirement.

Questions answered:

1. How can retirees avoid common financial pitfalls to ensure a secure and enjoyable retirement?

2. What steps can retirees take to balance responsible spending with meaningful life experiences?

Submit your request to join James:

On the Ready For Retirement podcast: Apply Here

On a Retirement Makeover episode: Apply Here

Timestamps:

0:00 – Spending the wrong amount

4:13 – Retiring at the wrong time

7:08 – Focusing on only one risk

9:58 – Too much support for adult kids

12:43 – Not having a strategy

Create Your Custom Strategy ⬇️