April 9th, 2025 Jesse Cramer

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Editor’s Note: I published this article on April 9, about 45 minutes before President Trump announced a 90-day pause on tariffs, sending the market **rocketing** skyward. I’ll be surprised if this is the last of the tariff tantrum, and […]

Historians doubt Marie Antoinette ever said, “Let them eat cake.” The apocryphal tale is that upon hearing that French peasants had no bread, she coldly suggested they eat brioche instead – a richer, more expensive pastry. Shame on you, Marie! But historians doubt she ever said it. The quote likely originated decades earlier and was used to criticize […]

My blog inbox and my professional inbox exploded last week with tariff questions. At first, I thought, “Everyone’s already talking about it…do I really need to add my voice to the fray?” But the questions kept coming. And after two terrible red days on Thursday April 3 and Friday April 4, the futures market looks […]

Comedian George Carlin joked, “Have you ever noticed that anybody driving slower than you is an idiot, and anyone going faster than you is a maniac?” What’s your driving style? The Bullet floors it in the left lane, weaving through traffic like Richard Petty, convinced speed limits are merely suggestions. The Oblivious Cruiser plants themselves […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: The world of financial planning comprises many strategies and tactics, some big and some small. Dollar-cost averaging, sequence of returns, tax-loss harvesting, and the list goes on. Depending on who you ask, the process known as “asset location” could […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: I originally wrote this in 2021 (31 lessons in 31 years). But here in 2025, I’ve had a crazy busy week and not enough time to write a brand-new article. Perfect timing though! My birthday is Saturday, so let’s […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Jesse – I’m confused about how “the 4% rule” and other “safe withdrawal rates” can change so rapidly in such a short period of time. If someone had retired in the middle of 2022 (a bear market), their “safe” […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Do you know that scene in Gladiator where Russell Crowe’s character, Maximus, yells to the crowd, “Are you not entertained?!” Yeah, this scene. I’m more interested in Maximus’s next line: “Is this not why you are here?!” You see, the […]

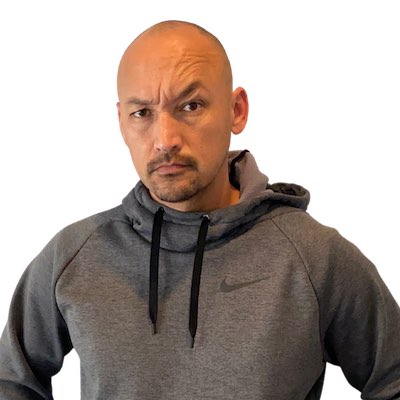

Most readers of The Best Interest do not come here to learn about Ice-T. But here we are. Perhaps you know him best as “Fin” – a mean-mugging detective on Law and Order: SVU. He’s not happy… Or, maybe you remember his West Coast hip-hop days from the 80s and 90s. The fair question to […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: I’m reading Morgan Housel’s recent book, Same as Ever, right now. One of the chapters is called “Best Story Wins.” [While I’m not sure it’s word-for-word the same, this chapter can be read (for free) via Morgan’s blog: https://collabfund.com/blog/story/] Housel’s idea […]