July 26th, 2023 Rita Robison

Many people get caught up in credit card debt. In 2022, Americans increased their credit card debt by a record $179.4 billion. The total owed by credit-card holders now is more than $1.1 trillion. However, people in some states charge less on their credit cards than others. WalletHub, a personal finance website, takes a look […]

Another big bank is being exposed for corporate fraud. Bank of America will pay more than $100 million to customers for double-dipping on fees imposed on customers with insufficient account funds, withholding reward bonuses promised to credit card customers, and misusing personal information to open accounts without customers’ knowledge, the Consumer Financial Protection Bureau announced […]

Another large financial institution has been caught gouging customers. Raymond James Financial Services agreed to settle allegations Tuesday with six state securities regulators for charging unreasonable commissions on trades that harmed investors. The broker-dealer will pay at least $8.2 million in refunds to clients, and $4.2 million in penalties and costs. A task force of […]

Financial institutions are increasingly using chatbots, which put out human-like responses using computer programming, to communicate with customers to save money. Chatbots sometimes have human names and use popup features to encourage interaction. Some chatbots use more complex technologies such as “artificial intelligence” to respond to customers. The Consumer Financial Protection Bureau has received hundreds […]

More than three quarters of adults have used a payment app, called a P2P or peer-to-peer or person-to-person app. Widely used nonbank payment apps include PayPal, Venmo, and Cash App. The apps can be used on a computer or mobile device to send money to someone else without writing a check or handing over cash. […]

It’s helpful for consumers to take a look at complaints that are received by agencies and organization to know what to watch out for in their financial lives. The Consumer Financial Protection Bureau monitors consumer complaints to determine risks in consumer financial markets and to prioritize agency action. In 2022, the CFPB found: During 2022, […]

Photo: Minh Nguyen Republicans doing the bidding of Wall Street for years led to the current banking crisis. In 2018, Republicans led an effort, lobbied heavily by the financial industry, that resulted in a law, signed by former President Donald Trump, that gutted the Dodd-Frank Wall Street Reform and Consumer Protection Act’s risk assessment safeguards […]

One of the best consumer actions in recent years is the creation of the Consumer Financial Protection Bureau in 2011. Established after the Great Recession of 2007-08 to set up one federal agency to help consumers with their financial issues, the CFPB has made great strides in improving the position of consumers in the marketplace. […]

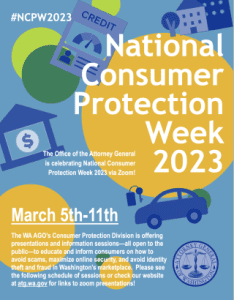

Things are busy, here in my corner of the USA. I’m behind in reporting on what’s happening for National Consumer Protection Week. A lot of my time has been taken up since the first of the year taking part in the Dean Ornish heart health program. It ends Wednesday. I’ll be reporting on its many […]

In 2022, Americans paid more than $120 billion in interest and fees on credit cards. With interest rates going up, that amount is continuing to increase. For consumers to get the best offers on credit cards to keep their costs down, their repayment records need to be reported to credit bureaus. In 2020, the Consumer […]