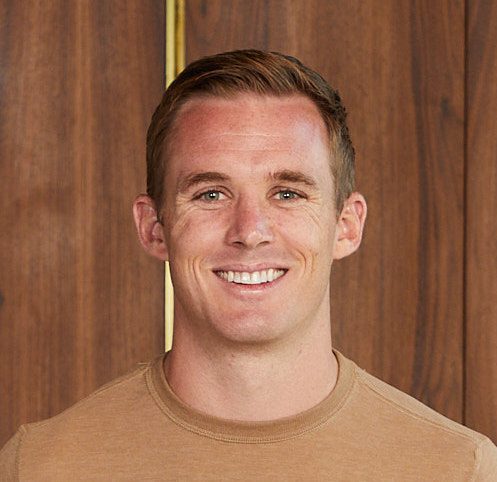

- Should I Fund my Retirement Needs by Purchasing an Annuity? James Conole, CFP® 19:17

Jason and his wife face a crucial decision: whether to purchase an annuity or pursue traditional investments as they prepare for a full-time, slow-travel Retirement.

With a diverse array of income sources, including pensions, 401k, property sales, and Social Security, they estimate their monthly expenses at $7,500. James analyzes their situation, emphasizing the balance between annuity stability and investment flexibility.

He highlights the security of annuities and explains their limitations, guiding the couple towards a tailored approach that aligns with their goals and circumstances.

Questions Answered:

What are the pros and cons of annuities?

How can I effectively balance the stability of annuities with the flexibility of traditional investments?

Timestamps:

0:00 – Jason’s question

3:07 – Pros and cons of annuities

6:32 – Assessing Jason’s situation

9:52 – The role of Jason’s portfolio

11:40 – Annuity alternatives

13:23 – Support your Retirement vision

16:54 – Integrate financial plan and portfolio

Create Your Custom Strategy ⬇️

Already a Member? Login Here.

Not Yet a Member? Join the Conversation Today!