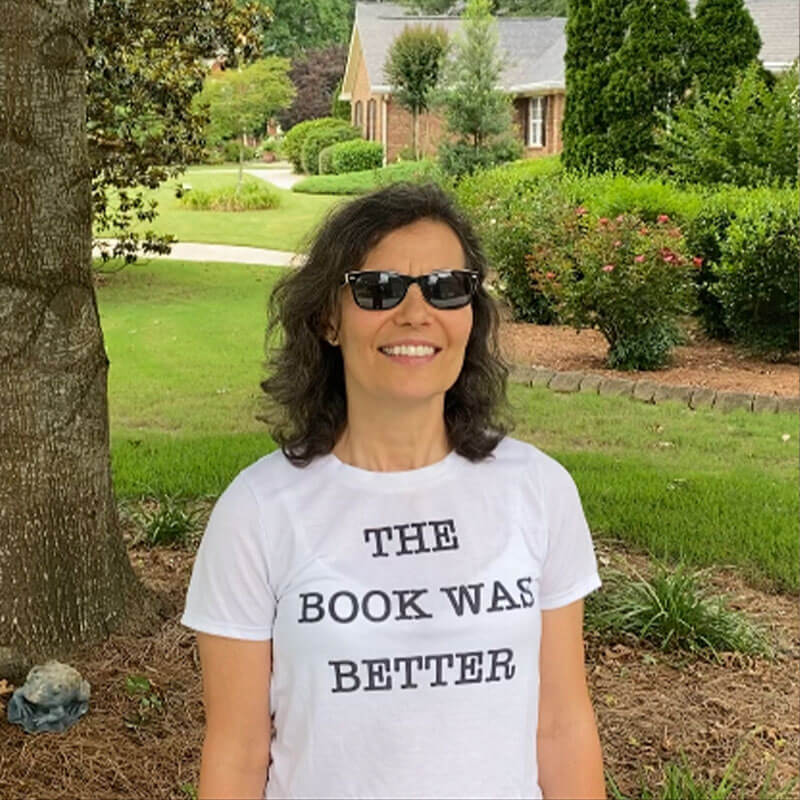

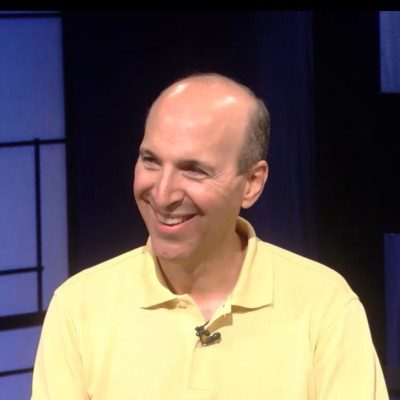

Gordon Stein is an international keynote speaker, blogger, personal finance expert and author of Cashflow Cookbook - $2 Million of Financial Freedom in 60 Easy Recipes. He delivers transformational talks that help people crush their number one stress – their finances.

His mission is to improve financial wellness and help his audience regain focus, balance and joy in their lives. Gordon combines his trademark wit and storytelling style to speak with employee and association groups, financial advisors and the media about a breakthrough path to financial wellness with no risk, minimal effort, minimal sacrifice and no budgeting.

In his spare time, he is an avid sailor, aging downhill ski racer and not yet great (or even good) guitar player.

Books Authored By Gordon Stein

Recent Content

Good night holidays, good morning New Year’s resolutionsAhh the joy of the holiday season as friends and family gather around the tree, menorah, kinara or Festivus Pole. A chance to get caught up …

Good night holidays,…

Good night holidays, good morning New Year’s resolutionsAhh the joy of the holiday season as friends and family gather around the tree, menorah, kinara or Festivus Pole. A chance to get caught up with everyone, dust off some board games and remove the tinsel from the carpet before the cats do. Turns out that Aunt Eunice’s bunions are still troublesome and Uncle Jeffrey got turned down for the big promotion at work. On the plus side, only a couple of relatives stretched their stay beyond the New Year and your mother-in-law brought a Bundt cake this year. And, as often happens, the holiday…

It would be great to find a low cost gym membership. But why just lower the cost? Why not design the perfect gym membership? Here’s my perfect gym wish list:Low cost membership Zero commute time F…

It would be great to…

It would be great to find a low cost gym membership. But why just lower the cost? Why not design the perfect gym membership? Here’s my perfect gym wish list:Low cost membership Zero commute time Fully adjustable workouts – easy to grueling A personal coach who can appear or disappear on command Full control over the music type and volume No deodorant-abstaining members Clean private shower rooms stocked with your favorite soap and shampoo As many towels as you like Beautiful views A chance to learn while working outIn other words, there is a lot of room for improvement! What did I miss…

Everyone is looking for a way to save on gas. That’s a big change in the last year. Back in 2020, in the middle of the Covid calamity, the world appeared to be ending. Everything was shuttered. Traf…

Everyone is looking …

Everyone is looking for a way to save on gas. That’s a big change in the last year. Back in 2020, in the middle of the Covid calamity, the world appeared to be ending. Everything was shuttered. Traffic disappeared. With no demand, oil prices plunged and then dropped to negative values. Oil storage tanks were filled to the brim and there was no place to store the stuff. We never got to the point where gas stations were paying people to fill their cars. But we weren’t far from it. Since then, the Covid restrictions lifted and people started traveling, The highways filled. Oil demand returned…

Nothing is worse than outliving your moneyOutliving your money makes for a sad ending. Your final years spent scraping and saving. A dream Retirement deflated to a life of subsistence. A battle of t…

Nothing is worse tha…

Nothing is worse than outliving your moneyOutliving your money makes for a sad ending. Your final years spent scraping and saving. A dream Retirement deflated to a life of subsistence. A battle of the bills with you on the losing side. Lucky for you a massive Retirement industry is there to save you from that fate and get you sailing off into the sunset like the people in the brochure. But there is another, ghastlier possibility: What if your money outlives you? What if your good health is gone in your sunset years? Or worse, what if YOU are simply, well, gone? All of that carefully nurtured…

Valuations are stretched! 5 great stocks to grab now! A crash is coming! Inflation will eat our returns! Buy and hold! Well which is it? And how can we protect ourselves if things really do go to hell…

Valuations are stret…

Valuations are stretched! 5 great stocks to grab now! A crash is coming! Inflation will eat our returns! Buy and hold! Well which is it? And how can we protect ourselves if things really do go to hell in a hand basket? What kind of investments are best right now? One idea is quality dividend stocks. Why? For the reason that dividend stocks fight inflation. In addition, the right ones can be had at a reasonable price, offer rising income and be good bets for thriving in the ups and downs of the market. The case for dividend stocks Well managed companies are able to grow their earnings year afte…

Always fun to compare yourself to others. Are you a spending savant or a spending savage? Let’s find out! Start by comparing your expenses to the national average and look for improvements by spendi…

Always fun to compar…

Always fun to compare yourself to others. Are you a spending savant or a spending savage? Let’s find out! Start by comparing your expenses to the national average and look for improvements by spending category. The Bureau of Labor and Statistics publishes monster-sized tables that show every kind of information about household income and expenses. The data can be useful as a quick comparison to identify areas of opportunity in your budget. Expenditures are broken down for various income levels and each spending category gets into excruciating detail. Right down to nuts, seeds and cooking oil…

Have you been peeking? Checking your investments. Such fun. With just a click or two, you can see what’s up and what’s down. The bright green confirming your choices, stoking mirages of early reti…

Have you been peekin…

Have you been peeking? Checking your investments. Such fun. With just a click or two, you can see what’s up and what’s down. The bright green confirming your choices, stoking mirages of early Retirement, days on the beach and freedom Moving closer. The panicky red graphs conjuring temporary despair, years more of daily grind and a second career as a Walmart greeter. The drama plays out in a river of dopamine as your body savors the rush of the latest set of numbers and charts. But is there a real benefit checking your investments? And how often is too often? There’s really not much to se…

Retire early, love every minute There is a lot of focus on the FIRE movement (Financial Independence, Retire Early). Lots of ink spilled on homemade cleaning supplies, tin foiling windows and clipping…

Retire early, love e…

Retire early, love every minute There is a lot of focus on the FIRE movement (Financial Independence, Retire Early). Lots of ink spilled on homemade cleaning supplies, tin foiling windows and clipping coupons whilst whilst living in a nano house. All in an effort to mass up cash, exit the rodent race and find freedom. Does the math add up? And if you get there, is there happiness? And, of course, will you run out of money? I think yes, possibly and done right, your cash keeps growing. Retire early, love every minute. Let’s take the pieces one by one: How to retire early Financial wellness is…

How to control your spending? It was shaping up to be a financially prudent month. Until you checked the bank statements. A few “dangs”. A handful of “ugh, forgot about that ones”. And some �…

How to control your …

How to control your spending? It was shaping up to be a financially prudent month. Until you checked the bank statements. A few “dangs”. A handful of “ugh, forgot about that ones”. And some “what was I thinkings?”. Oh, and that was before viewing those 2 other credit card statements. Sadly they all added up to make your month fiscally regrettable. Wouldn’t it be handy to have a list of spending considerations to apply before giving your credit cards a workout? A pre-spending checklist. A kind of monetary mom to control your spending. In fact, there is! Here are some ideas to cont…

Bad money habits are standard equipment for most of us. Not your fault. Great news is that they can be easily upgraded to good ones. And all the details are coming, I promise. But let me back up. Last…

Bad money habits are…

Bad money habits are standard equipment for most of us. Not your fault. Great news is that they can be easily upgraded to good ones. And all the details are coming, I promise. But let me back up. Last week, I ordered a chick pea and kale wrap for dinner. I know, I know. A bit rabbit-ish. Then came the option of fries or salad. Isn’t that one a bit obvious? Who would order the healthiest thing on the menu and then pair it with a basket of fries? Salad it was. And just a glass of ice water to drink. To the outsider, the dinner looks a bit Spartan — pretty bland fare to say the least. Especia…

Looking for a way to reduce loan interest? In a perfect world, we would just pay cash for everything. But sometimes you just need a loan. Maybe you need cash for your business, or Elon wants you to in…

Looking for a way to…

Looking for a way to reduce loan interest? In a perfect world, we would just pay cash for everything. But sometimes you just need a loan. Maybe you need cash for your business, or Elon wants you to invest on the ground floor of his new company. Perhaps you just need funds for a car or other asset. The compounding effect of borrowed loot is nasty, so it makes sense to look for a way to reduce loan interest. One obvious approach is to do a bit of haggling. On a mortgage or a car loan you might be able to shave off a quarter or a half a percent of interest. Worth a try. Or you could try shopping …

How cool would it be to get free iPhones for life? Dream with me for a minute. Imagine brand new free iPhones every other year. And hey, if we are dreaming anyway, how about a free cell phone plan to …

How cool would it be…

How cool would it be to get free iPhones for life? Dream with me for a minute. Imagine brand new free iPhones every other year. And hey, if we are dreaming anyway, how about a free cell phone plan to go along with it? Pretty sweet. Since everyone likes free stuff, let’s add in $200 gift certificates from Starbucks, Lululemon, Starbucks and Chipotle. Even better. But is this really possible? And why would these companies give all of this away for free? More important, how can you get in on the deal? Most personal finance writers would shoot down the idea of new iPhones every other year, fancy…

Slashing housing costs – a tale of two cities I was chatting with a neighbor here in Cleveland and she mentioned that a friend felt that he was shut out of the housing market due to rising prices. S…

Slashing housing cos…

Slashing housing costs – a tale of two cities I was chatting with a neighbor here in Cleveland and she mentioned that a friend felt that he was shut out of the housing market due to rising prices. She leaned in for emphasis and added, “In fact, he got outbid by $25,000 on a house recently”. Being from Toronto originally, I had to suppress a snicker. Although I sympathize with her friend’s plight, it felt like her story was missing a zero. Toronto housing bids regularly jump by hundreds of thousands and often sell for $250,000 or more above asking price. That is more than the price of a…

How to retire richer the lazy way Ok I didn’t get that job at Shopify so no juicy stock options! There are lots of ways to retire richer. You could start selling products in a multilevel marketing s…

How to retire richer…

How to retire richer the lazy way Ok I didn’t get that job at Shopify so no juicy stock options! There are lots of ways to retire richer. You could start selling products in a multilevel marketing scheme (downside: annoyed friends and a garage full of creme rinse, vitamins and car polish). Perhaps you could just pick a new employer with a great stock option plan ( I came in second for a job at Shopify once. Bummer – see stock chart below). Or you could move back home with your parents (Father: “Honey, what’s that smell upstairs?” Mother: “I think it’s our 30 year old.”) Not thr…

Earth day – time to fight some home energy thieves Welcome to Earth Day. It’s our worst one so far! The earth is heating up, oceans are rising and forests are ablaze. What a great blog post openin…

Earth day – time t…

Earth day – time to fight some home energy thieves Welcome to Earth Day. It’s our worst one so far! The earth is heating up, oceans are rising and forests are ablaze. What a great blog post opening! Who’s still with me? It’s hard for us to totally solve these issues as individuals, but we can all do something. Let’s start by slaying some of those home energy thieves. Saving energy helps green the planet, and adds some green to our wallets. And while energy savings may not be the most exciting topic, some quick projects can improve your financial wellness without giving up anything im…

Stay sane during Covid It began with a shock as the virus spread, everything closed and markets crashed. Then things got eerily quiet. For a while doom scrolling kept us busy. Then the scramble to set…

Stay sane during Cov…

Stay sane during Covid It began with a shock as the virus spread, everything closed and markets crashed. Then things got eerily quiet. For a while doom scrolling kept us busy. Then the scramble to set up a home office and learning spaces for the kids. Next came guzzling down Netflix episodes for light drama followed by a US election for even more drama. Most recently we’ve been comparing shots and reactions. But we are all getting weary and it’s time to find new ways to stay sane during Covid. Fine, I mean fun, dining No question our eating has changed a lot. Emphasis on the lot. Where w…

Build wealth like the pros! If you’re on a slower path to wealth than you would like, this is the post for you. No wealth whatsoever? Even better. Let’s get you started. There are the special hack…

Build wealth like th…

Build wealth like the pros! If you’re on a slower path to wealth than you would like, this is the post for you. No wealth whatsoever? Even better. Let’s get you started. There are the special hacks that will help a lot: marrying into money, inheriting a bundle, lottery winnings or working somewhere with a juicy stock option plan. If none of those are in the cards, not to worry. Turns out, there are just 4 factors to tweak to build wealth like the pros. Which one is the biggest issue for you? Read on and let’s find out! Factor 1 – Rate of return As you save money and invest those funds …

Why your investments aren’t growing What an awesome year for investors! The Dow Jones Index is up 58% in the last year. Rank amateurs are striking it rich. Your Uber driver, plumber and urologist ar…

Why your investments…

Why your investments aren’t growing What an awesome year for investors! The Dow Jones Index is up 58% in the last year. Rank amateurs are striking it rich. Your Uber driver, plumber and urologist are all making zillions! Investing has become a way better fad than the Macarena, the Ice Bucket Challenge and even fidget spinners. And everyone is crushing it except, maybe, you. Let’s look at the 5 reasons why your investments aren’t growing and everyone else’s are: 1. Everyone else’s aren’t growing It’s a bit like Facebook. Remember Ronnie’s post about getting demoted at work? No? …