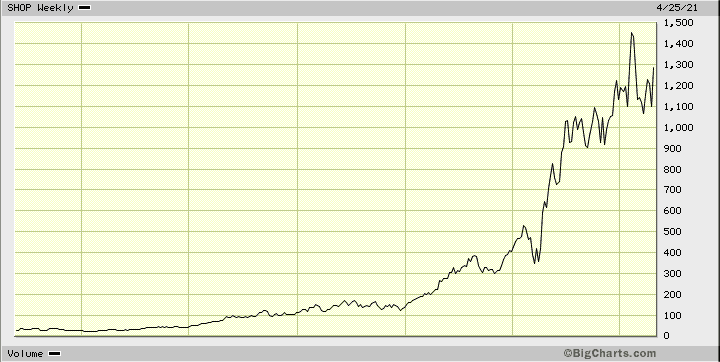

There are lots of ways to retire richer. You could start selling products in a multilevel marketing scheme (downside: annoyed friends and a garage full of creme rinse, vitamins and car polish). Perhaps you could just pick a new employer with a great stock option plan ( I came in second for a job at Shopify once. Bummer – see stock chart below). Or you could move back home with your parents (Father: “Honey, what’s that smell upstairs?” Mother: “I think it’s our 30 year old.”)

Not thrilled with any of those options? In a perfect world, you could just plant yourself in a chair, do some scrolling and mouse clicking and have a few hundred grand gradually added to your Retirement fund. Sound a little too good to be true? In fact, not only is it possible, I just did it and you can too! No tricks, no clickbait, stay with me on this and I’ll show you how to retire richer.

Last post I did some energy saving projects and laid out how we will save about $1,300 a year on gas and electricity right here at Cashflow Cookbook headquarters. Which is not bad, but those ideas take some work. Insulating and weatherstripping and whatnot. What if we could save more than twice that without lifting a screwdriver?

Turns out, the answer was right there, hiding in our car insurance policy. Who knew?

It was hard to watch this year’s Super Bowl without seeing those Zebra car insurance ads. (Being a Browns fan it was hard to watch the Super Bowl anyway. Soooooo close, we coulda been there! Next year!) Seemed like they popped up after every Buccaneer touchdown. Could comparing car insurance really be as easy as it looks on TV? Turns out it kind of is!

Way back in the 2010’s, comparing car insurance rates was a painful process of making calls or reentering your car and driver data on multiple sites. Now it’s much easier with comparison sites. We looked at 2 comparison sites here in the USA, Zebra and Insurify. Both had a snappy interface and let you quickly add cars and drivers to suit. Even with 3 cars and 3 drivers it only took 15 minutes per site. Their results were similar, although Insurify had more options and two quotes that were much lower than what Zebra offered in their “displayed quotes”. In Canada check out ratehub.ca and rates.ca.

I used our actual data for 3 drivers and 3 vehicles. Our current insurance is with GEICO and we pay $141.60 a month. Having that policy handy sped up the process of entering all of the information. Using the same policy parameters, Here are the results from Zebra:

The Zebra options were limited with just 3 companies showing actual quotes. The rest promised “one more click to quote”. Well that’s what they promised. The “get quote” companies dragged me through traffic ticket data, annual miles driven and even that accident where I hit a deer a couple of years back. I was hoping to forget that. Some of the companies require you to pretty much re-enter all of your data (Talking ’bout you, Progressive!). The good news is that after all the work, Progressive did deliver on their promise of being cheaper than GEICO. In fact, they were the cheapest overall at just $502 for 6 months, or $83.66/month.

The cheapest “displayed quote” on Zebra was $164 which was more than the $141 we are paying with GEICO. Not exactly a win. On Zebra the gold was in the undisplayed quotes. Still, who wants to do the extra work? On to Insurify to see how their engine works:

Over at Insurify we had lots more options. Have a look at all this goodness!

Huge swing in prices from a high of $331 to a low of $97. A difference of $234 a month. Worth a few mindful moments with your browser. One of the interesting options is Clearcover – a digital provider with a slick app. (They don’t even want to know from paper). They claim that they can settle your, well, claim in as little as 13 minutes. Hello disruption! And with 489 Google reviews averaging 4.5 stars, apparently they are doing something right!

Although Insurify had the edge in my situation for the displayed quotes, it might be worth the extra 15 minutes to run your scenario through both of them. And check the “get quote” options just to be sure.

The remarkable thing is that the prices varied by almost 4x going from lowest to highest. That is even more than the 2.5x difference when we were trying to find out if premium vodka is worth it. So this is a pretty easy and painless way to save some monthly cash.

If we take the $248 monthly savings between the low rate (Progressive) and the high rate (Safeco) seen on the two sites and invest it at 7% you would have:

Given that the average American retires with just $200,000 of total net worth, here is a way to triple that with just 15 minutes of work. If you’re wondering how to invest those savings and earn 7%, you can learn about that here. People often ask how to get started with building wealth. Answer…This! Good luck and let me know how this worked for you.

Is there a rate comparison engine that you like better? Let me know in the comments below.

Photo credit Marcel Friedrich at Unsplash

var mailchimpConfig = {

baseUrl: ‘mc.us16.list-manage.com’,

uuid: ‘8fa9e4de4e566a5267677869a’,

lid: ‘0e7abc7fec’

};// No edits below this line are required

var chimpPopupLoader = document.createElement(“script”);chimpPopupLoader.src = ‘//s3.amazonaws.com/downloads.mailchimp.com/js/signup-forms/popup/embed.js’;chimpPopupLoader.setAttribute(‘data-dojo-config’, ‘usePlainJson: true, isDebug: false’);var chimpPopup = document.createElement(“script”);chimpPopup.appendChild(document.createTextNode(‘require([“mojo/signup-forms/Loader”], function (L) { L.start({“baseUrl”: “‘ + mailchimpConfig.baseUrl + ‘”, “uuid”: “‘ + mailchimpConfig.uuid + ‘”, “lid”: “‘ + mailchimpConfig.lid + ‘”})});’));jQuery(function ($) {document.body.appendChild(chimpPopupLoader);$(window).load(function () {document.body.appendChild(chimpPopup);});});

Notifications