When is the right time to make work optional? What are the real costs of retiring too early or too late? Join us as we challenge conventional retirement Wisdom and unpack the delicate balance between financial Security and life enjoyment. You'll gain practical insights into the pitfalls of the FIRE movement and learn how to avoid compromising health and Relationships in the pursuit of early retirement. By examining diverse client scenarios, we highlight the importance of timing, empowering you to make retirement a choice rather than an obligation, and to enjoy a future filled with confidence and Clarity.

Explore the intriguing world of dynamic retirement spending strategies with us as we Stress the importance of a flexible withdrawal rate. Discover how adjusting your financial plans to accommodate changing market conditions and personal expenses can lead to a vibrant early retirement. The discussion also delves into the benefits of extending your working years slightly, which might significantly impact your financial stability later in life. With guidance from a community of listeners and experts, you'll walk away equipped with the tools to navigate required distributions and adapt your plans for a secure and enjoyable retirement journey.

Create Your Custom Early Retirement Strategy Here

Get access to the same software I use for my clients and join the Early Retirement Academy here

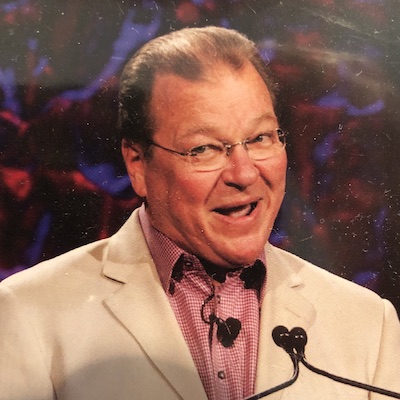

Ari Taublieb, CFP ®, MBA is the Vice President of Root Financial Partners and a Fiduciary Financial Planner specializing in helping clients retire early with confidence.

Ari Taublieb, MBA is the Vice President of Root Financial Partners and a financial planner specializing in helping people navigate an early retirement. I get it...retirement sounds overwhelming (an early retirement may sound particularly overwhelming)! Does it just feel like there's so much to consider and you just want to make sure you're doing everything you can to set yourself up right? If I may ask...why do YOU want to retire early? Do you want to travel? Have you just had enough of work? Do you want to spend more time with family (or on hobbies you've been putting off)? I created this podcast to help you know when work is now optional because you have a financial strategy that tells you when you can retire. You will learn all the investing tips in this financial podcast to set up the right portfolio for your goals. You may love what you do - and if that's you, great! I'm not saying stop working. But, I am saying, wouldn't it be nice to know when you didn't HAVE to work any more? When you would only go to work because you enjoyed it (crazy concept, I know). This is the ultimate retirement podcast (specifically, early retirement!). Retiring early, also known simply as "financial freedom", is having the ability to do what you care most about, MORE!

I don't want you to work unless you ENJOY it (finances aside, for just a moment)! My goal of this podcast is to give you all the tips and strategies so you can retire EARLY. Retirement planning, investing, personal finance, tax strategy, and you'll hear case studies from my clients and exactly how I've helped them navigate the transition into retirement. What are the right investment accounts to have in retirement? I want retirement planning to be simple for you so that you can retire early and maximize your retirement goals. Become a retiree and enjoy everything you've been waiting for your whole life (and start practicing retirement today)! I release new episodes every Monday with all the strategies (you'll learn that I love examples) so you can maximize your return on life (we use money to do this).