How To Manage a Sudden Lump Sum from an Inheritance

Inheriting Money, especially during a loss, can be overwhelming, with so many emotions to process. On average, people inherit around $46,200 in their lifetime, though that figure can vary widely depending on your family’s Estate. Although inheritance may offer a sort of financial support for some, receiving a large sum of money while still mourning may be overwhelming.

Sorrow is a very strong feeling that often distorts even the noblest ideas. You may want to use the inheritance to honor your loved one, but the weight of loss can make practical financial decisions difficult. That’s why allowing yourself time to process your emotions and consulting a financial advisor firm is essential before deciding what to do with inheritance money.

To ensure financial Security, here are suggestions for losing a loved one.

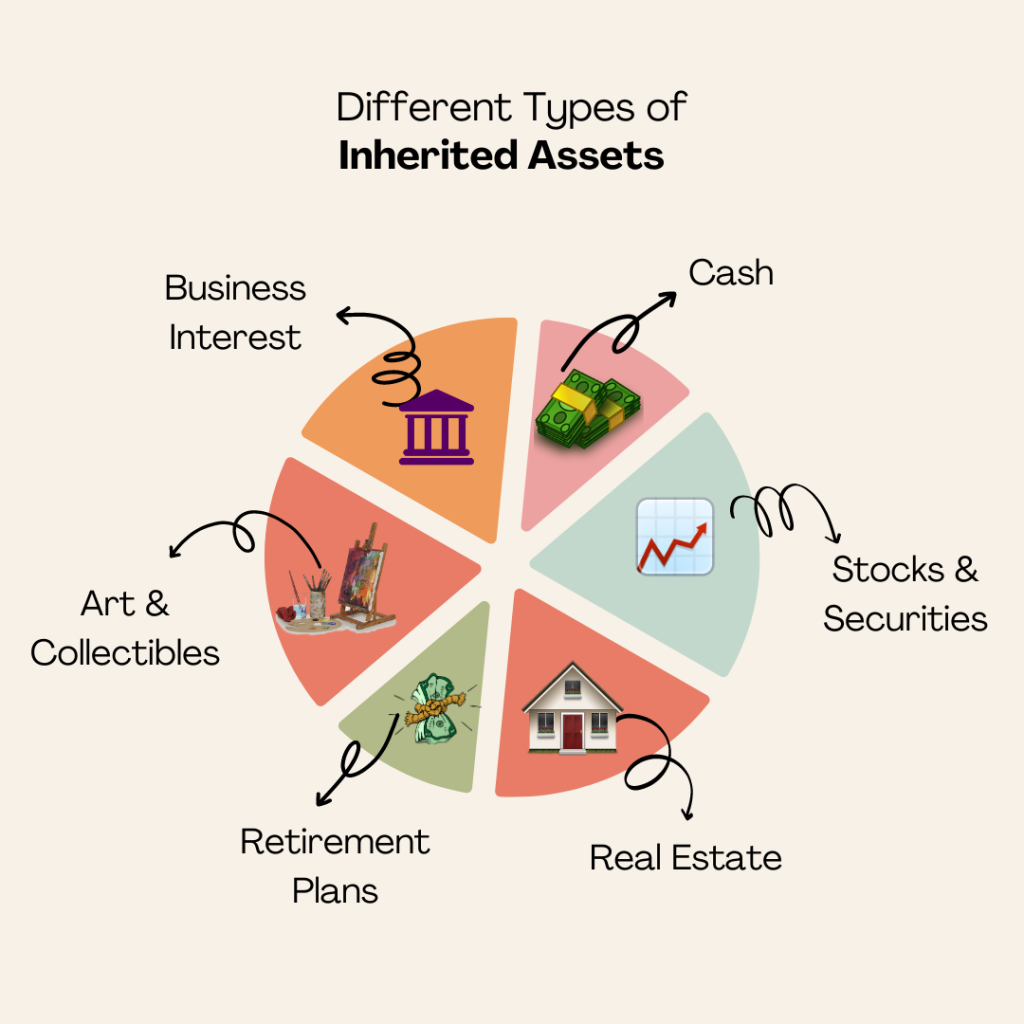

Understand Your Inheritance

You will want to know how much the total is worth as well as what all makes up that number in respect to assets and accounts or properties you are inheriting. For instance, getting a 401(k) is not the same as inheriting a house.

Make sure to specify from where the inheritance is being inherited. It could be part of a family trust, an estate, or a Life insurance policy. If you receive a life insurance policy, you might need to call the insurance company to file a claim.

Taking these steps will give you a clear picture of what you’re working with and help you make informed decisions about what to do with a large inheritance.

Assess the Situation

Get immediate bills and insurance covered, and give yourself time to breathe. Avoid making big decisions like selling your home, quitting your job, or adjusting investments while you’re still grieving. These choices are best made with a clear head and professional help. Emotionally vulnerable individuals are particularly vulnerable to costly investment mistakes and predatory lenders.

It’s wise to meet with a financial advisor to get financial assistance for widows, a tax expert, and an attorney to understand how your loved one death may impact your finances. You may need to downsize, return to work, or adjust your Retirement withdrawals. Think through it and take your time before making any irreversible decisions.

Tax on Investment

When you inherit stocks, mutual funds, or other taxable investments, you get a “step-up in basis,” meaning the asset’s value is reset to its worth on the date of the original owner’s death.

For example, if your father bought shares at $75 and they were worth $575 when he passed, your new cost basis is $575. You won’t owe any taxes if you sell the stocks immediately, but if you hold on to the shares, you’ll owe taxes (or be eligible to claim a loss) on the difference between $575 and the sale price.

Be sure to notify the investment custodian of the date of death to claim the step-up benefit.

This tax break can help you fund short-term goals, like paying off debt or a home down payment, or you can reinvest wisely to avoid a large tax bill.

How Much Inheritance is Taxable

It all depends on the kind of assets you inherit

| Type of Asset | How It’s Taxed |

| Cash and Brokerage Accounts | Assets other than cash are subject to income taxes if sold for more than their value at the time of your loved one’s death. |

| Real Estate and Other Tangible Assets | Real estate and other tangible property are subject to income taxes if sold for more than their value at the time of your loved one’s death. |

| Pre-Tax and Tax-Deductible Retirement Accounts (Traditional IRAs, 401(k)s) | You pay your federal ordinary income tax rate on withdrawals; in many cases, the account must be emptied within 10 years of the original account owner’s death. |

Though the ruling is set to expire in 2025, for now, the Tax Cuts and Jobs Act has enacted a high exemption limit for federal estate taxes. If your loved one passed away in 2023, their estate could potentially be transferred tax-free if it is worth less than $12.92 million.

However, estate tax planning is crucial for affluent families to minimize the financial impact. States like Washington and Hawaii have some of the highest estate taxes, while others have a flat-rate structure.

The states that currently have either an estate tax, inheritance tax, or both include:

- Connecticut

- Hawaii

- Illinois

- Iowa

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Nebraska

- New Jersey

- New York

- Oregon

- Pennsylvania

- Rhode Island

- Vermont

- Washington

- Washington, D.C.

Look Into Survivor Benefits

If you inherit a tax-deferred retirement plan, like a traditional IRA, taxes will be due when you withdraw the funds. Spouses have the option to roll the funds into their own IRAs and delay distribution taxes- until they’re 73. However, the rules may differ depending on the relationship with the deceased.

For instance, if you inherit from a parent or sibling, you must follow specific guidelines that can be complex. Generally, any withdrawals from an inherited traditional IRA will be taxed as ordinary income. The rules for inherited retirement plans are complicated and in flux, so review the tax requirements carefully.

If you Inherit a Traditional IRA

If you inherit an IRA from someone other than your spouse, the ten-year rule applies, meaning you must withdraw the funds within ten years. There are exceptions for minor children and disabled heirs, so it’s important to check if you qualify.

The amount of tax you owe depends on whether the original account owner had started taking required minimum distributions (RMDs). In 2020, the IRS introduced penalties for missed RMDs, which were later reduced from 50% to 25% under the SECURE 2.0 Act. Given the complexity of these changes, it’s best to consult a tax professional before you designate how you will receive RMDs.

Emergency Fund and Contingency Planning

Imagine losing your job tomorrow. Would you have enough savings to cover a few months of expenses?

A recent study found that the median emergency savings for Americans is around $5,000, with some having even less. With so many financial priorities competing for attention, it’s no surprise that building an emergency fund often gets pushed aside, but it’s essential. It protects you from having to dip into your investments or 401(k), which could reduce future retirement income and incur penalties.

Using your inheritance to strengthen your emergency fund is a smart move. Aim for six months’ worth of expenses—or more if you’re self-employed. This safety net is a key part of a secure financial future.

Get Financially Organized

If your family member handled your finances, it’s understandable to feel overwhelmed. But don’t worry—you’ll get the hang of it. Here’s how you can do it.

- The first step is to assess where you stand financially.

- Take stock of your new income sources, such as your salary and any benefits you may receive from your spouse.

- Then, look at any new expenses, like funeral costs, and adjust your budget accordingly.

Creating a new monthly budget can help you regain control. A trusted financial advisor can walk you through this process, helping you prioritize your short-term needs and long-term goals. As life changes, so do your financial priorities, so having expert guidance is key to moving forward with confidence.

Update Your Own Policies

Like most individuals, one of your family members is likely listed as the beneficiary on many of your legal and financial documents and may have been named as your power of attorney or executor of your estate. It’s important to update these documents as soon as possible to ensure everything is in order.

For any joint accounts, like bank accounts, auto loans, or mortgages, you’ll need to contact these companies to transfer them into your name. This will help simplify your financial situation and give you greater control over your finances.

Don’t Do It Alone

As you adjust to your new normal, it’s natural to have questions about managing your finances. Remember, you’re not alone in this journey. Seeking guidance from a trusted professional can help you find Clarity during this challenging time.

At Prosperity Financial Group, we specialize in giving financial advice for inheritance. Our team offers personalized advice in investment planning, tax strategies, and wealth management to help you secure your financial future.

Don’t hesitate to reach out—schedule a consultation with us today and start planning for long-term success. Since your risk profile is likely to change, a financial advisor can also help you understand the importance of risk management and estate planning as you move forward.

The post How To Manage a Sudden Lump Sum from an Inheritance appeared first on Prosperity Financial Group | San Ramon, CA.