Investing Myths Debunked for Retirees

Do you know what you don’t know? When it comes to Investing, misconceptions can hold you back and hinder your financial success. In this video I uncover the truth behind common investing myths for retirees.

Get ready to enhance your investment knowledge and increase your chances of meeting your Retirement goals!

Don’t fall for these retirement misconceptions!

⏰ TIMESTAMPS

0:37: Social Security isn’t enough

1:03: It is never too late

1:36: What can you do if you haven’t saved enough for retirement

1:48: Risk alignment is crucial for your success

2:25: Taxes matter in retirement

2:48: Quality advice at an affordable price

Reach out to learn more about our wealth management services. Book a call with us today!

▶️ www.sensibleportfolios.com

Subscribe to my channel for more informative videos that empower real people like you:

▶️ @therealpeopleadvisor

Connect with us:

LinkedIn ▶️ https://www.linkedin.com/in/lenaarmuth/

Instagram ▶️ https://www.instagram.com/sensibleportfolios/

Facebook ▶️ https://www.facebook.com/SensiblePortfolios

#RetirementMyths #InvestingTips #RetirementIncome #TaxPlanning #FinancialEducation #SensiblePortfolios #RealPeopleAdvisor

__________________________________________________________

🎥 TRANSCRIPT

You don’t know what you don’t know.

A common adage that relates all too well to investors. Misconceptions about investing can limit your opportunities and lead to poor financial outcomes.

Gaining Clarity and understanding common investing myths will help you be a better investor, more likely to meet your financial goals in retirement.

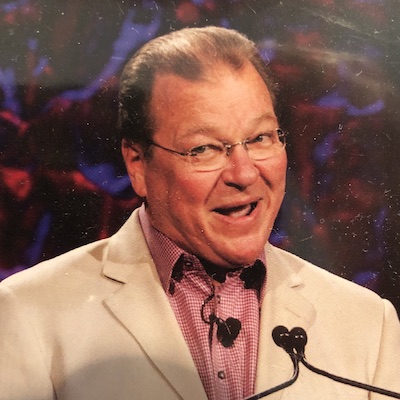

I’m Lena Armuth, the Real People Advisor, I work at Sensible Portfolios and I’m here to teach real people, like you, how to avoid overpaying for financial advice.

Here are investing myths that retirees mistakenly believe:

“Social Security will provide enough retirement income”

Many investors assume that Social Security benefits will be sufficient to cover their retirement expenses. However, this is often not the case, especially as life expectancies continue to increase, along with other challenges like inflation and the rising cost of healthcare.

It is important to have additional sources of retirement income.

“I’m Too Old to Start Investing”

According to a 2019 Survey by the Federal Reserve, the median household retirement savings for Baby Boomers is $134,000.

What does this tell us? Many people aren’t saving enough and are entering retirement wih very little stashed away. While starting early is ideal for retirement savings, it’s never too late to start.

You can still make progress towards your goals by maximizing contributions to retirement accounts.

If you’re 50 and older, consider making catch up contributions as well.

Warning to younger investors: Don’t wait. Start saving, and investing today.

“I Can’t Take Any Risk With My Investments”

If you’re approaching or already living in retirement, you may believe that bond investing is the best and safest option. While bonds provide stability and help preserve your capital, they may not generate enough return to meet your retirement income needs, especially in a high inflationary environment.

A more suitable and appropriate option is to have a diversified investment portfolio that includes a mix of stocks and bonds, and is aligned with your personal tolerance for risk and financial need.

“I Don’t Need to Think About Taxes in Retirement”

You may wrongfully assume that your tax burden will be much lower in retirement because you’ll have less income. This isn’t necessarily true for everyone. If you are required to take minimum distributions from your retirement accounts, you’ll need to consider the tax implications.

A hefty RMD can mean a larger, unexpected tax bill.

“I Can’t Afford A Financial Advisor”

Now, I understand why many people believe in this myth. The traditional wealth manager offers costly advice that many investors don’t have access to.

The thing is you don’t need to pay exorbitant fees to get the help you need. There are plenty of financial advisors, giving quality advice at a reasonable price for people like you and me.

For advice and Retirement Planning that doesn’t break that bank, check out sensibleportfolios.com.

So, there you have it – common myths of baby boomer investors debunked.

I’m Lena, the Real People Advisor. If you haven’t already, subscribe to my channel for alerts on more vidoes like this!