5 Biggest Retirement Fears and How to Overcome Them

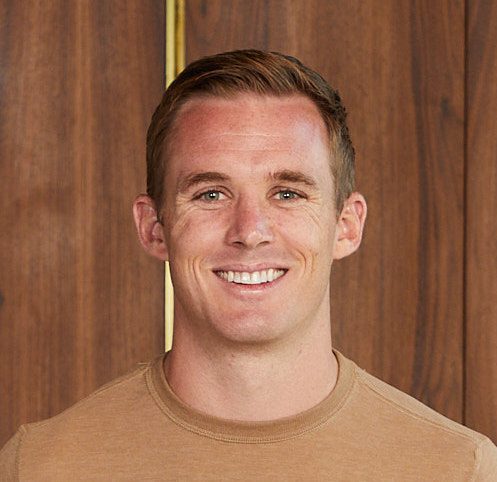

- 5 Biggest Retirement Fears and How to Overcome Them James Conole, CFP® 17:17

Retirement is an exciting milestone, but it often comes with common fears. With proper planning, these concerns can be addressed to ensure a fulfilling and secure new chapter. Here are five major retirement fears and strategies to overcome them:

Fear of Outliving Savings

- Optimize your Social Security strategy (e.g., delay benefits for higher payouts or collect earlier to reduce portfolio withdrawals).

- Save adequately by identifying your retirement goals and creating a tailored savings plan.

- Conduct a test run of retirement expenses to ensure your projections align with reality.

Fear of Losing Purpose

- Identify valuable aspects of work, such as routine, connection, and productivity, and replace them with meaningful activities.

- Engage in social clubs, Volunteering, hobbies, or fitness routines to maintain structure and fulfillment.

Fear of Healthcare Costs

- Educate yourself on Medicare and supplemental policies, and consult with experts for personalized advice.

- Utilize a Health Savings Account (HSA) to save tax-free for medical expenses.

- Understand tax strategies for managing medical costs.

Fear of Loneliness

- Build and maintain Relationships through community activities, clubs, or social groups.

- Be intentional about creating a support network and consider location carefully when planning retirement.

Fear of Long-Term Care Expenses

- Explore long-term care insurance options to mitigate potential costs.

- Assess whether your financial assets (e.g., property, pensions, portfolios) can cover care if needed.

By addressing these fears with thoughtful preparation, you can enjoy a secure, purposeful, and fulfilling retirement.

Questions answered:

How can I overcome the fear of outliving my savings in retirement?

What can I do to maintain purpose and connection after retiring?

Submit your request to join James:

On the Ready For Retirement podcast: Apply Here

On a Retirement Makeover episode: Apply Here

Timestamps:

0:00 – Outliving savings

4:45 – Losing purpose

6:59 – The wrong healthcare coverage

10:25 – Feeling lonely

12:39 – Affording long-term care

14:43 – Wrap-up

Create Your Custom Strategy ⬇️