If you’ve ever wondered if it’s possible to pay zero taxes on your investment income, you’ve come to the right place, although the answers may not be what you’re expecting. In this video, I explain to you what a spendthrift trust is, how it is 100% compliant with IRS Code 643(b), which means that investment income into your spendthrift trust is NOT a taxable event! Enjoy!

If you think you’re paying too much in taxes and/or you need to lock down your personal and business assets with 100% lawsuit-proof asset protection, visit Calendly link below and schedule a free one-on-one consultation with me.

www.calendly.com/dohnthornton/30min

If you want to get some more information about this amazing tax reduction and asset protection strategy, go to this website:

https://FinancialFreedom4U.now.site

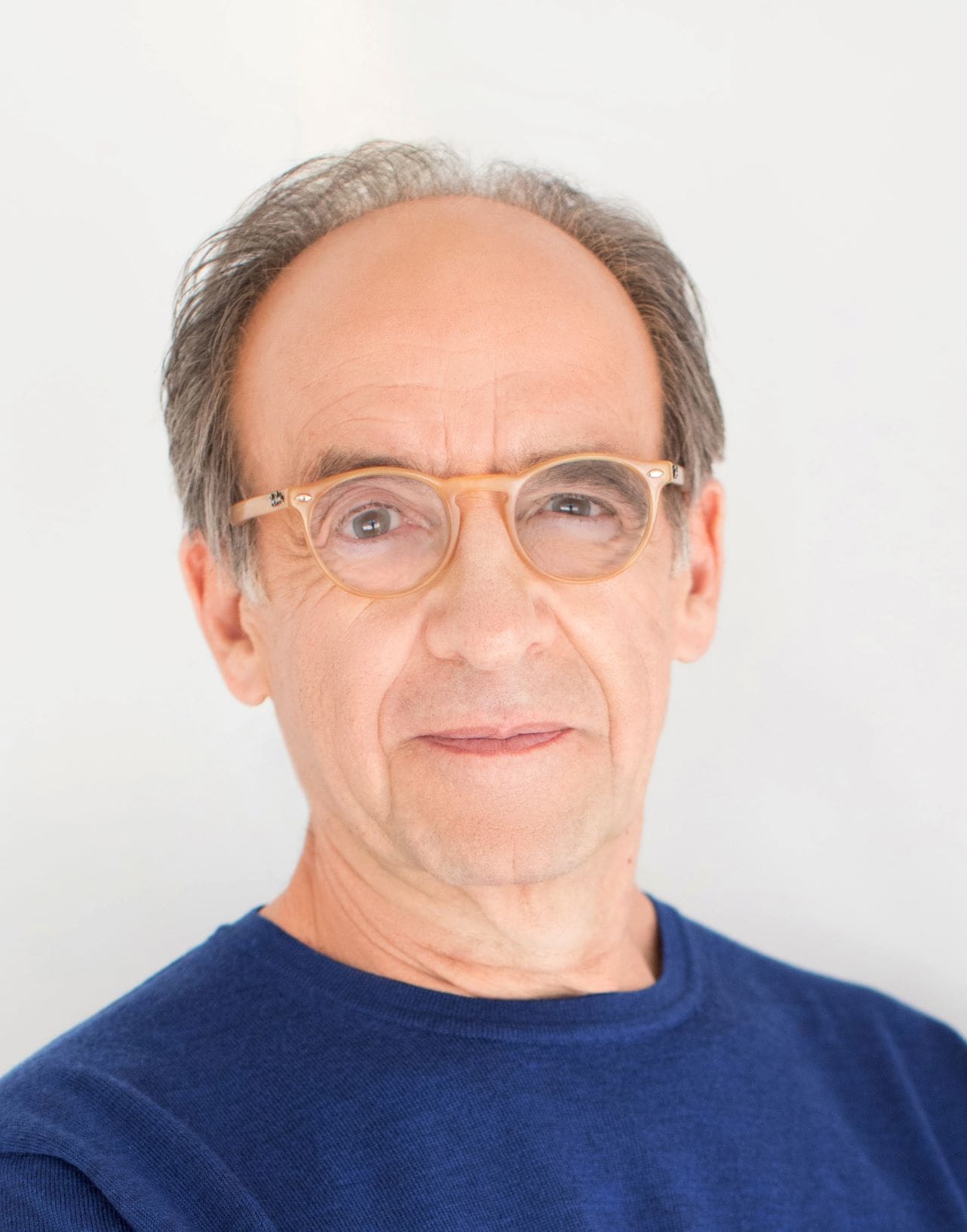

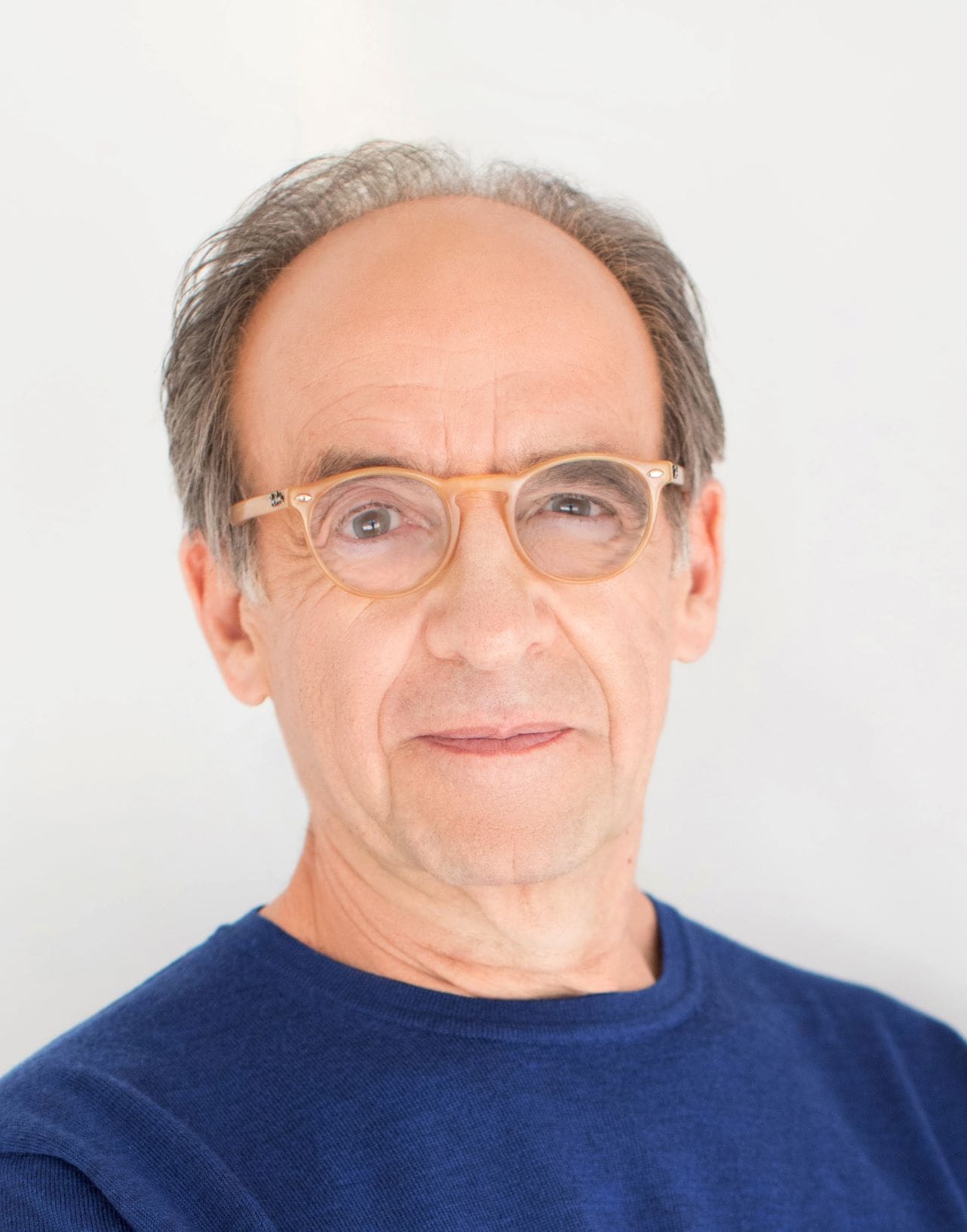

Hi I'm Dohn Thornton. I'm a Senior Trust Specialist, and a real estate investor. To put it in a nutshell, I help anybody not on a W2, legally reduce their taxes by as much as 97%, while getting 100% lawsuit-proof asset protection. I spent 20 years making lots of money in real estate; yes, it just caused me to pay more money in taxes.

After learning about this amazing "Ironclad" trust, this Non-Grantor, Irrevocable, Complex, Discretionary, Spendthrift trust, and how I was able to legally reduce my taxes to ZERO, I started telling people about it. I wrote 5 eBooks about it and started sharing them with people. Next thing I knew, I was getting interviewed on podcasts. But the coolest thing is that people kept sharing their stories with me, and asking me how they could get a trust!

BabyBoomer.org is an online membership community created by and for the Baby Boomer Generation. Boomers, and those who service and support them, are welcome to join our community accessing all general topics.

Notifications