By Linda Ballou, NABBW’s Adventure Travel Writer

Since Covid hit our shores, Travel insurance has become more important than ever. While it is true flight delays have lessened, flights are still a huge variable when you travel. Travel delays, as well as trip interruptions and cancellations, are not just frustrating and inevitable, they can be life altering. Which means that choosing to have travel insurance could not only protect your budget should you have to rebook at the last possible minute due to flight cancellations, but can also be lifesaving, should you have a health emergency outside — or even inside — of the U.S.

Since Covid hit our shores, Travel insurance has become more important than ever. While it is true flight delays have lessened, flights are still a huge variable when you travel. Travel delays, as well as trip interruptions and cancellations, are not just frustrating and inevitable, they can be life altering. Which means that choosing to have travel insurance could not only protect your budget should you have to rebook at the last possible minute due to flight cancellations, but can also be lifesaving, should you have a health emergency outside — or even inside — of the U.S.

First off, not everyone realizes that Medicare will not cover you for travel related injuries incurred outside the States — and might not even cover you if you get hurt within the country. As an outdoor adventure traveler, I learned the hard way that you can get hurt within the U.S. and have to pay for your rescue.

On the top of the fourth day of a five day horse pack trip in the High Sierras, I was doing a little birding. Looking up instead of where I was walking, I tripped and fractured my ribs. This event required a helicopter rescue. Who knew birding could be so dangerous? (For more on my experience of Falling in the Footsteps of John Muir go to this episode of my podcast on BabyBoomer.org.)

Because of this experience, I now always get emergency medical evacuation insurance wherever I go. You might ask why would I willingly pay this extra expense up front? My answer is that I’ve learned that if I have an accident and need to be airlifted — or just need an ambulance to get myself to the nearest emergency facility – – neither my medical insurance — or yours — will likely cover this. Medicare will not cover it. In fact, Medicare will not cover any medical needs outside of the U.S.

According to various sources, including recent articles from BusinessInsider, US News, USAToday, and Forbes, I’ve below listed — in no particular order — what I see as eight of the top-rated travel insurance companies. The decision on which you might select should be based on your needs, anticipated activities and your destination…

Consumer Advocate.org provides this list of reputable companies with the option to compare prices and coverage. These companies differ from one another in terms of their coverage limits, exclusions, deductibles, premiums, and customer service. Travelers should compare different plans and read the fine print before buying travel insurance.

Interestingly, travel guru, Peter Greenberg’s choice, Medjet, is not on either of those lists. If you travel frequently, you can purchase an annual membership from Medjet to cover all of your travel needs without having to book separately for each trip.

I was advised not to use the insurance company affiliated with the tour company you are using. The thought is the tour company could go out of business and you would be stuck with no coverage. I question this Wisdom, as a good company would have a good insurance company that they are familiar with, in case you need them in an emergency. With all of this in mind, it is up to you to decide which company and how much coverage, and what type you need. Whatever you do, don’t allow the risks involved with travel keep you from checking places off your Bucket List!

Happy Travels…

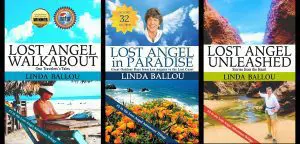

Adventure travel writer, Linda Ballou, is the author of three novels and numerous travel articles appearing in national publications. Linda’s Lost Angel Walkabout-One Traveler’s Tales is the first installment in her Lost Angel Adventure trilogy. It is an armchair traveler’s delight filled with adventure to whet your wanderlust. Linda loves living on the coast of California and has created a collection of her favorite day trips for you in Lost Angel in Paradise. Lost Angel Unleashed, the third book in her travel series, is travel memoir that takes you on her most meaningful journeys and some destinations to die for… Learn more at www.LostAngelAdventures.com

You can learn more about her works of fiction at www.LindaBallouAuthor.com

Notifications