The Ping Pong Moves of Time

Note: This article first appeared at Rethinking65.

Neighborhood gatherings, both planned and spontaneous, are common in my 55-plus community. Residents bring lawn chairs along with their beverages of choice and snacks and set up in someone’s driveway to enjoy a little fellowship.

My wife and I recently grabbed our stuff and joined one of these get-togethers. It was eye-opening. Of those assembled, we were the only ones closer to 55 than 75. We still work. We’re soon to be grandparents, but many others had multiple grandchildren, some in their teenage years. The conversations ranged from local to global.

Listen to the article:

Kevin is a successful advisor to high-net-worth individuals who faces an all-too-common challenge: Some of his retired clients don’t stay retired. According to a recent study by Paychex, 20% of retirees consider returning to work at some point.

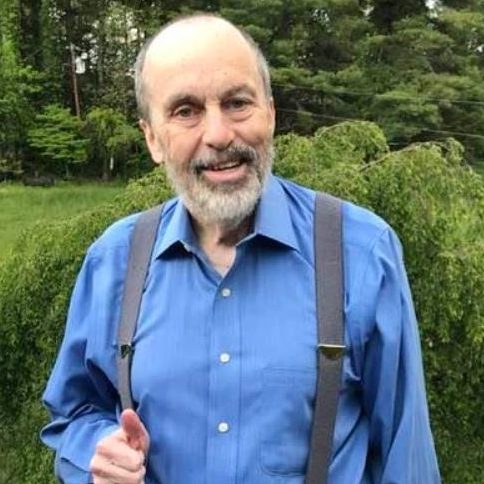

When I asked him about it, Kevin sighed, leaned back in his chair and replied, “David, I have two types of clients in Retirement. The first decides to Travel a lot and spend time with their grandkids. The second starts out in retirement, gets bored and then comes back to me to say they went back to work.”

Kevin has learned to expect the unexpected when it comes to the decisions clients make when they choose to retire. He and the team adapt when needed. It’s like ping pong. Clients volley Lifestyle change his way. He returns with a viable solution.

But what if you could “hold serve” by proactively tossing options to a client before retirement? What if you could identify signs or behaviors that help you help the client while they are still in their career? It would save you time and, better yet, save your client’s time in the execution of a retirement plan.

In table tennis, there are a variety of defined shots that allow the player to dictate the style and pace of play. You can apply these same techniques when trying to understand the feelings and emotional attitudes that may disrupt or adjust any financial strategy.

The Block

In ping pong, blocking allows one player to use the other’s force against them and is done immediately after the bounce so for maximum control and speed. An advisor can gently lifestyle block by shifting the clients focus from just finances to a sense of purpose in life tied back to the financial strategy.

Help the client come to terms with their relationship to their work and how much of their identity and sense of purpose is tied to their career. Clients who strongly define themselves by their work may struggle to adjust to retirement. The more they unblock their feelings, the better you are able to serve them.

The Drop Shot

The drop shot bounces close to the net and several times on the other side before the other player has a chance to play their shot. Data collected from my Retirement Time Analysis (RTA) assessment reveals that over 28% of participants do not plan to have an active social life in retirement. The lifestyle drop shot highlights the reality of career-generated social interactions. It is your opportunity to gauge whether work Relationships are the most important ones in your client’s life.

Clients who lack strong social connections outside of work may experience loneliness in retirement. This is your chance to drop in a healthy dose of reality.

Take the Retirement Time Analysis for FREE!

Our exclusive 12-page self-assessment tool aims to uncover opportunities

that become the framework to build a custom approach, intended with

your unique needs in mind.

The Backspin

A table tennis finesse shot, the backspin, is a defensive twist: You strike downward on the ball causing it to rotate backward. A lifestyle backspin is your opportunity to change the direction of a conversation from personal back to professional to bring Clarity for all aspects of life.

Discuss your client’s daily and weekly routines. Clients who are accustomed to a structured schedule may struggle with the unstructured nature of retirement. The more they understand the importance of greater planning and coordination tied to personal life, the less chance that a post-career lifestyle spins its way to boredom and monotony.

The Lob

The lob is a defensive shot used against high-speed balls, where the ball (usually with a spin) is returned very high in the air. In my work with clients, it still surprises me how many couples head into retirement not having had detailed discussions on what each of them want to do together, but also alone. A lifestyle lob lets you pose this scenario, allowing them to reflect before having to answer.

Understanding the dynamics of the client’s relationship with their spouse or partner and how they envision spending more time together in retirement provides you with the “assist” to then ask deeper questions to clear the air for you and them.

Putting It All Together

Watch any ping-pong match. The serve usually starts out slow, and the pace begins to pick of pace quickly. At some point, the players are well back from the table, firing shots back and forth at breakneck speeds.

Your goal as a financial advisor is to keep things slow and closer to the table. You want to block the discussion away from just finances and into a better lifestyle understanding. This offers you the ability to drop in the importance of social connections beyond just work. When lifestyle structure is only focused on career, you can spin them back to the importance of designing a robust personal life. Finally, when spouses don’t appear to be on the same page, you can lob them into realizing partners may not be on the same retirement lifestyle page.

David Buck is the author of the book The Time-Optimized Life, owner of Kairos (Time) Management Solutions, LLC. Learn how to apply the concepts of proactively planning and using your time. Take the Time Management Analysis (TMA), the Retirement Time Analysis (RTA), or all the other free resources offered to help bring more quality time into your life.

The post The Ping Pong Moves of Time first appeared on Infinity Lifestyle Design.