Richard Vinhais: From Passion to Profit. The Power of Collectibles as Alternative Assets

- Richard Vinhais: From Passion to Profit. The Power of Collectibles as Alternative Assets Alex Escobar and Aziz Yousuf 1:14:04

Collectibles have become a popular alternative investment offering pleasure and potential profits. From rare coins to sports memorabilia, they provide a unique way to diversify portfolios. Richard Vinhais will guide you through the captivating world of collectibles as an alternative asset and share valuable insights and experiences. Join in for an exciting exploration of this investment landscape.

Recap of the Episode

[00:00:24]

This episode explored the captivating realm of collectibles. From baseball cards to fine art, these items hold immense value and ignite passions. Scarcity is pivotal in their worth, distinguishing them from utility-based assets. The guest shared strategies for understanding their value and building Relationships within these passionate communities. Their business focuses on insuring collectibles, while fractional ownership platforms provide accessible entry points for all budgets. We continue to uncover asset classes with lower buy-ins, expanding investment opportunities for a wider audience.

About the Guest

[00:06:16]

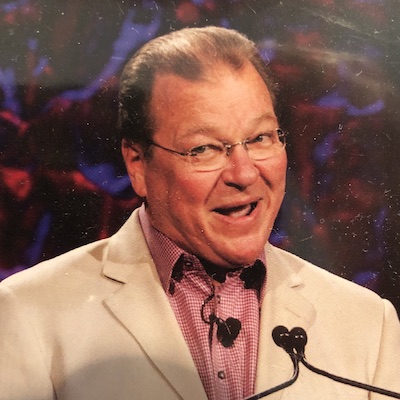

Today’s guest is Richard Vinhais, CEO at WAX, an experienced professional with a diverse background in corporate consulting and venture-backed startups. Richard’s journey took an unexpected turn when his lifelong passion for collecting, particularly watches, led him to uncover the increasing value of collectibles as alternative assets. Coming from a frugal upbringing as a first-generation American, Richard offers a unique perspective on navigating this evolving market and the exciting opportunities it presents.

How Richard Ended Up in WAX

[00:18:48]

Richard Vinhais found himself at WAX Insurance after a chance encounter with a friend in the watch-collecting community. Initially skeptical, he took a risk and invested in valuable ticket stubs. This led to raising half a million dollars from others who believed in the venture. His prominent venture capitalist friend recognized Richard’s potential and convinced him to join WAX Insurance. Now, Richard embraces the challenges of insuring collectibles in a rapidly growing market, offering an alternative investment option beyond the stock market.

How to Become Knowledgeable about Watches

[00:52:32]

To become knowledgeable about watch collecting, join passionate communities, follow influential blogs like Hodinkee, and engage with experienced individuals. Platforms like WatchRecon and Chrono24 reveal pricing trends, while groups like RedBar offer connections with like-minded enthusiasts. Engaging with these communities is a rewarding experience for collectors of watches and other collectibles.

Top Collectibles in the Market

[01:00:38]

Top collectibles in the market now include Michael Jordan’s memorabilia like sneakers and jerseys, valuable trading cards such as the 1952 Mickey Mantle tops card, spirits and wine, collector cars reaching astronomical values, notable auction sales at Sotheby’s, and the consistently hot market for fine art, with prices reaching multi-million dollar levels. Stay informed about auction trends to gauge the interests of speculators and the areas where investments are being made.

Taxes & Insurance on Collectibles

[01:05:01]

Collectibles may have tax implications, leading some collectors to store valuable items in tax-free locations. WAX offers vaulting services for watches and sports memorabilia, providing clients with more options. Insurance rates vary based on location and collection size, with discounts available for larger collections with proper Security measures.

Jewelry has higher insurance rates due to the risk of loss during transportation. Artwork and collector cars, which are typically stationary or driven infrequently, have lower rates. Insurance premiums reflect the risk profile of each item.

Resources:

Website: https://www.wax.insure/

Instagram: Instagram

LinkedIn: LinkedIn