April 11th, 2025 Jesse Cramer

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Today’s Question Barry wrote in and asked: Jesse – I’ll need about $100,000 per year from my portfolio in retirement. I have $3M in my retirement portfolio. It’s producing about $60,000 in income and dividends for me, meaning I […]

Historians doubt Marie Antoinette ever said, “Let them eat cake.” The apocryphal tale is that upon hearing that French peasants had no bread, she coldly suggested they eat brioche instead – a richer, more expensive pastry. Shame on you, Marie! But historians doubt she ever said it. The quote likely originated decades earlier and was used to criticize […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: The world of financial planning comprises many strategies and tactics, some big and some small. Dollar-cost averaging, sequence of returns, tax-loss harvesting, and the list goes on. Depending on who you ask, the process known as “asset location” could […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Jesse – I’m confused about how “the 4% rule” and other “safe withdrawal rates” can change so rapidly in such a short period of time. If someone had retired in the middle of 2022 (a bear market), their “safe” […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Do you know that scene in Gladiator where Russell Crowe’s character, Maximus, yells to the crowd, “Are you not entertained?!” Yeah, this scene. I’m more interested in Maximus’s next line: “Is this not why you are here?!” You see, the […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: I’m reading Morgan Housel’s recent book, Same as Ever, right now. One of the chapters is called “Best Story Wins.” [While I’m not sure it’s word-for-word the same, this chapter can be read (for free) via Morgan’s blog: https://collabfund.com/blog/story/] Housel’s idea […]

Before the article, here’s what’s happening this week on our podcast, Personal Finance for Long-Term Investors: Reader Phil wrote in last weeK Jesse – I appreciate everything you have to say on stock investing and low-cost, diversified index funds. I also love all the Warren Buffett wisdom you share. But, at least when it comes to […]

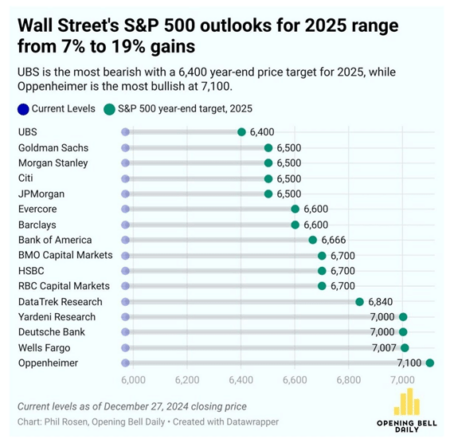

I’ve had a few clients reach out to me over the past couple weeks (the last week of December 2024 & first week of 2025) with similar concerns: “How and why did my account go down at the end of 2024?!” The short answer: accounts are down because the market is down, and the market […]

Have you heard this year’s version of Wall Street’s favorite joke? “We’re going to predict how the stock market does this year!“ Woof. Yikes. Why?! 1-year stock predictions are pointless. We’d all be better off accepting that fact. Risk, Reward, Timelines, and More Time and again, I want to ensure every long-term investor understands the […]

Here’s a fun question from friend-of-the-blog CJ: “I was hanging out with family and friends around Thanksgiving, and I wanted to gauge their opinion on something interesting: Who is more famous globally: Taylor Swift or Cristiano Ronaldo? Almost everyone I asked [for reference, readers: CJ is about 30-years old and lives near me in Western […]