June 5th, 2024 Adam Koós

Join us as we uncover the captivating life journey of animator and illustrator, Phillip O’Rourke, who shares his empowering story of overcoming personal challenges and finding success. Phillip O’Rourke has enthralled audiences with his unique blend of storytelling, art, and music, reflecting his unwavering passion since childhood. His journey chronicles the compelling evolution from doodling […]

As Libertas is on its way to having another record year, I’ve been having to think about delegation, efficiency, cutting out things I don’t need to do, systemization, processes, hiring new staff, and at the end of the day, working smarter – not harder. After all, each of us has just 168 hours per week […]

Navigating the complex landscape of college financial aid can be overwhelming for students and parents. Understanding the sources of financial aid, application processes, and potential pitfalls is crucial for making informed decisions. In this blog, we delve into the key aspects of college financial aid, supported by insights from experienced college planning consultant Amber Gilsdorf. […]

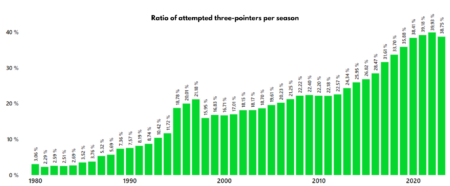

I don’t watch many live sports these days. Life is busy. But I’ve caught a few quarters of NBA playoff basketball, and I’ll watch game replays while sipping morning coffee. If you’re unaware, the NBA has been revolutionized by “Moneyball” ideas over the past decade. The main “new idea” affects 3-point shots. The ratio of […]

If you’re looking for inspiration and guidance in the world of entrepreneurship, look no further. In this blog post, we’ll explore the incredible journey of Kiley Peters, the founder of RAYNE IX, and her mission to empower women in the entrepreneurial landscape. Kiley Peters is dedicated to empowering women in entrepreneurship through programs like the […]

Have you noticed the recent increase in fuel prices? They’re up by more than $0.50 per gallon. Copper has risen by 42%, and food prices have soared by 24%. So, what does this inflation mean for you, other than the fact that everything now costs more? Just a month ago, and since January, experts were […]

We are in the most interesting times. For our personal investment clients and 401(k) clients, there have been many smiles so far this year. We are happy that the markets, broadly, have begun this year on a bullish note. 2023–except for a handful of large AI companies–was a poor year for investors. But today, smiles […]

How important do you feel conducting quarterly reviews and evaluations are for your personal and professional growth? For small businesses and entrepreneurs, the right type of evaluation with revisions lays the foundation for future growth and success. It allows us to build on what is working and eliminate or revise what is not. There was […]

As the phrase goes, “May we live in interesting times”—and indeed, we certainly do. Current Global Economic and Financial Landscape Here’s what’s happening around the globe: An expanding war looms in the Middle East. Russia and Ukraine are entrenched in conflict with no resolution in sight. China’s intentions towards Taiwan are becoming increasingly aggressive, and […]

Paving the way to burden season, a huge number of Americans could owe the IRS thousands on their Government backed retirement installments. While Government managed retirement installments saw a cost for many everyday items change (COLA) of 3.2 percent this year, there could be unseen side-effects on […]