How To Help Your Aging Parents Manage Their Fixed Income

We are all taking care of our aging parents. Unfortunately, some of them are living on such a fixed income that it feels almost impossible to help them meet their needs and cater to some of their wants. Fortunately, with a bit of financial rearranging, they can have it all. Here are a few things you might suggest that can put them on the right track.

Home refinancing

Interest rates are historically low. And if one of your parents is a veteran, they may be able to refinance with a VA IRRRL (Interest Rate Reduction Refinance Loan), which typically has fewer out-of-pocket costs and flexible eligibility. It is essentially a streamlined loan for those who already have a VA mortgage. The biggest benefit is that they are quick to close and, depending on the amount of equity your parent has in their home, can give them a lower mortgage payment so that they have extra cash available at the end of each month.

Medicare upgrade

If your parents worked the majority of their adult lives and they’ve already reached 65, they have Medicare. But traditional Medicare, despite low cost, may actually be the wrong plan for your parents’ medical needs. Start looking into Medicare Advantage plans; open enrollment, which is when your senior loved ones can make changes, begins in October. An Advantage plan is similar to private insurance, may cost the same as what they have now, and can give them access to a wide range of medical professionals at a potentially lower rate.

Getting cozy with coupons

Coupons are like cash you don’t have to earn, and they can help your Aging parents save a pretty significant chunk if they don’t mind doing their research. Many of their favorite stores, including Walgreens, offer great prices online on everything from beauty products to health supplements. Not only can they find great deals directly on the website, but deal sites often offer cash back when a purchase is made via a special link.

Budgeting fun

Many seniors don’t have the cash to take an extended vacation. But, one of the greatest freedoms that come along with Retirement is having the time to see the world. Talk to your parents about what they would like to do, and then look at their budget to see what kind of funds they have available. They may not be able to Travel abroad, but they can visit US National Parks, which rank #1 on The Senior List’s best senior travel destinations this year. For the more adventure-minded seniors, a home exchange is another budget-friendly way to experience different parts of the country (or world) at a much lower cost.

Show them the money

For some, it might not be enough to simply talk about ways to save. It’s not uncommon for older folks to want to live the way they did when they had a regular income. You may need to create a monthly expense spreadsheet to show them exactly how much Money they have and where it’s going. This can give them a new perspective on their spending habits. Something else you can do is open a bank account just for discretionary spending. You might, for example, deposit $100 per month into it for dining out or other nonessential Entertainment.

Budgeting when you get older is different than when you’re in your 20s, 30s, and 40s. When you are living off Social Security and savings, you have to be intentional with the way you spend. As the adult child of seniors in this situation, you can help your aging parents get a grip on their income without sacrificing quality in the best years of their life.

Image from Pexels

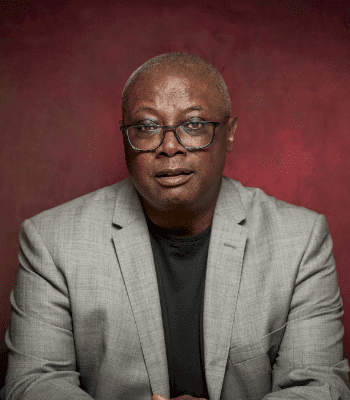

Andrea Needham created Elders Day

to remind everyone that getting older isn’t synonymous with slowing

down. Everyone has their own pace, but age shouldn’t be what stops you

from fulfilling dreams, goals, and desires.

Great points Andrea

Thank you!

For more information about caring for your aging parents, please consider purchasing my course, Caring for Your Aging Parents, from Teachable.com. It takes a couple of hours to go through, however, you can just hit play and listen while you go about other business.