U.S. Economic Slowdown: Correction or Meltdown?

There is no question that the U.S. Economy is beginning to slow down. I pride myself on being an observer of many things around me. I’ve noticed that restaurants are emptying and have available tables at lunch and dinner when last year it was almost impossible to get a quick reservation. At Peet’s Coffee yesterday, there was no line for coffee. A recent visit to Target in San Ramon revealed a relatively empty store. Recent reports indicate that the American consumer has accumulated too much credit card debt and is starting to pull back, which isn’t necessarily a bad thing. How does an economic slowdown affect your finances?

Market Movements, Trends, and Volatility

In the equity markets, the NASDAQ and many tech stocks are now down by more than 10% from their highs just a few months ago, a scenario we refer to as a “correction.” The last several weeks have been quite volatile, and our political landscape mirrors this instability. Now we are in August, historically the worst month of the year, followed by October. With temperatures over 100°F in most of the country, consumers are staying away from shopping, which raises energy bills and reduces available cash. The American consumer is the backbone of the economy. When consumer spending shifts to only necessities, we enter a recession and layoffs occur.

Economic Slowdown Indicators and Federal Reserve Actions

There is pressure on the Federal Reserve to lower interest rates to facilitate a “soft landing.” U.S. Treasury Bills, a guide to economic activity and a major ingredient in bank CDs, have dropped by almost 0.5% in the last two weeks. Despite this, I am not entirely bearish. I consider myself a bullish consumer and financial advisor, believing that tomorrow will be better than yesterday. In spite of the negative news surrounding the tech sector, elections, and tax rates, I believe we will end the year higher than where we are today, though not by much.

Factors Supporting Optimism

- Election Year Dynamics: Both parties need the economy to be strong when they take office to avoid a malaise. Historical precedents include the major recessions under George Bush (2001-2002) and Ronald Reagan (1981-1982), when interest rates soared to almost 20% and the consumer stopped dead in their tracks. These were large pain points for all Americans, and many haven’t forgotten the word “stagflation.”

- Consumer Resilience: Americans and global consumers are still strong with a huge desire to enjoy life, eating out, and traveling. We may pull back, but stopping right now just isn’t in the cards.

- Market Volatility: We are in a period of major volatility, with short-term major swings in the equity markets, not a protracted down period.

- Expected Layoffs and Housing Market Trends: Layoffs have been coming for a long time, and the housing markets are cooling down. This presents an opportunity for young buyers to afford homes again, which they have been priced out of. Real estate impacts will vary locally, so expect urban centers like San Francisco, Oakland, Los Angeles, and Chicago to feel more pain than many.

Your Investment Strategy

As an investor, if you agree with my assessment, periods like this represent buying opportunities. The backbone of the U.S. equity markets is still Technology, and short-term corrections, though painful, can be healthy. Given my belief that markets will be higher by December 31st with a new President, I advise maintaining a cautious watch-and-see approach. Patience is your friend during these times.

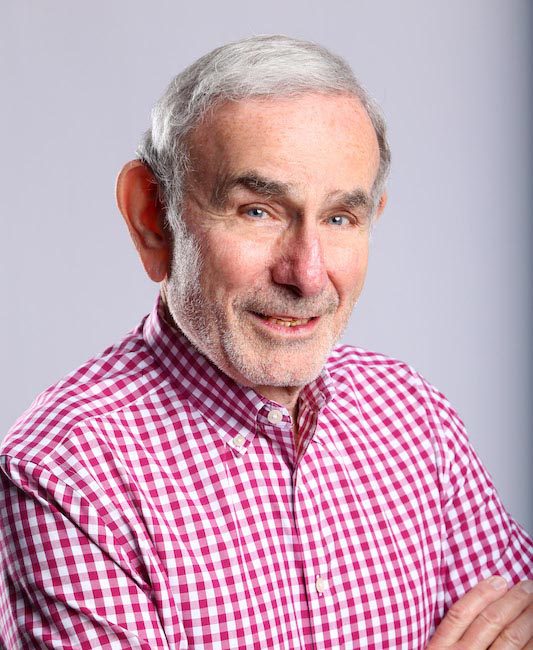

For more information and to schedule a personal or Zoom consultation, please call me at 925-314-8503 or email me at elliot@prosperityfinancialgroup.com. We monitor portfolios and markets every day, and in the 24-hour news and business cycle, there is plenty to see.

Enjoy the rest of your summer.

Elliot

The post U.S. Economic Slowdown: Correction or Meltdown? appeared first on Prosperity Financial Group | San Ramon, CA.