Maximizing Value In Mergers And Acquisitions With Brian Summe

Welcome to Season 4, Episode 10 of Meet the Expert® with Elliot Kallen!

Maximizing value in mergers and acquisitions is a delicate art that requires a deep understanding of both companies involved. Brian Summe, Partner and Chief Revenue Officer at Vesticor, joins the show to discuss how his firm helps founder-driven business owners achieve their exit goals. Brian explains how they assist business owners in navigating various exit strategies, from passing their business to family members to pursuing management buyouts or selling to strategic buyers. He emphasizes the vital role of M&A advisory in providing tailored solutions and navigating the complex sale process, which includes a formal competitive market approach. Tune in and start planning your successful exit strategy today.

Free Consultation: https://prosperityfinancialgroup.com/book-your-appointment/

Visit Us: https://prosperityfinancialgroup.com/

We understand—you’re busy. Between work, family, social, and personal life, it’s all too easy to be consumed by daily duties and lose sight of your financial priorities. But compromising on your financial dreams isn’t an option. That’s where we come in.

At Prosperity Financial Group, we’ll take care of your investment, Retirement, and wealth management strategies so you can show up as the best version of yourself in your work and personal Relationships. Our remote service structure enables us to help you from anywhere, anytime.

Get started: https://prosperityfinancialgroup.com/book-your-appointment/

Listen to the podcast here

Meet Our Guest

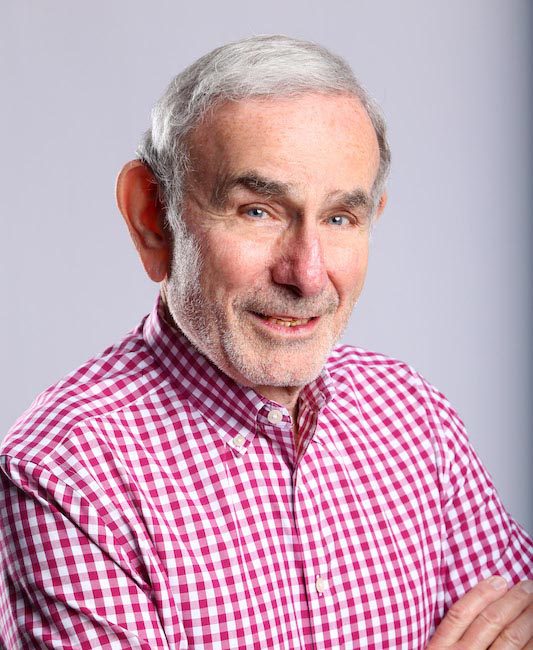

Brian Summe

Brian C. Summe is an accomplished, executive in the financial industry, with extensive experience and proven results over 3 decades, at developing strategy and execution around several verticals:

- M&A Investment Banking, assisting privately held, founder & family owned businesses with exiting/succession options and Growth/acquisition strategies

Sourcing/raising investment capital, all stages, both in the public and private markets

- Business development, sales, revenue generation

Constructing, managing and leading business development teams

- Mr. Summe brings forth a broad knowledge base and subject matter expertise, especially in the areas of M&A advisory, capital raising, asset management and distribution, wealth management and early stage startup Investing.

Over the span of his career, he has successfully sourced, structured, and negotiated multiple deals for business owners looking to transition, exit or grow their business. He has also sourced/raised over $15 billion dollars of investment capital, in both the public and private markets.

Recognized as an author, keynote speaker and consultant, he has partnered and advised private individuals and companies, at all stages, on how to raise capital, develop strategy around creating higher, sustainable, revenue streams, create exceptional service models & delivery systems, and on how to deliver compelling communications to both clients, prospects and investors.

Maximizing Value In Mergers And Acquisitions With Brian Summe

Introduction

In this episode, something different again, we’ve been mixing it up a lot to make it more interesting, we’re going to dedicate this show to business owners, friends, and family of business owners. If you know somebody who owns a company, this is a great show for them. If you own a company, it’s a great show for you. Either way, it doesn’t make a difference. It’s very exciting.

We’ve got a partner from Vesticor, Brian Summe, and he’s going to be talking about mergers and acquisitions. This is dedicated to phase three of your business. If you’re looking to sell your company, rather than turn it over to children, which we could talk about why that’s usually not a very good idea. If you’re looking to sell your company, you’re in the third phase.

You started from scratch, you’ve emptied garbage cans, you’ve clawed your way up, and you’ve gotten to phase two where you need to have developed a business. Phase three is now what? I’m in my 60s, 70s, or late 50s. It’s time for me to do something else with my life or dedicate more time to charity and Legacy. We’ll talk about that too, and things like that. Or I am in my 40s and 50s, and I want to be the buyer.

How do I find good companies and maybe good companies in my area? If you need to reach me, I’m at Elliot@ProsperityFinancialGroup.com, or the website is ProsperityFinancialGroup.com, where you can view 60-plus of these episodes on the website, or give me a call at (925) 314-8503. Let’s get started. Brian, welcome.

Thank you for having me, Eli.

M&A For Business Owners

Brian is the Partner and Chief Revenue Officer of Vesticor. Brian, tell us what a mergers and acquisitions person does with business ownership.

A brief history of mergers and acquisitions, we’re a merger and acquisition advisory firm, an investment bank. We cater to those privately held, founder-driven business owners who are looking for optionality, as you mentioned earlier, Elliot, whether they’re going to sell it to their kids, buy out, or do a management buyout.

They may apply an ESOP or just sell their business to somebody that’s desirable. That could be family offices, independent sponsors, another strategic similar, or a private equity firm. We’re the ones who come in and help them achieve whatever they’re looking for, whatever the solution, whatever the partner, or whatever the buyer would be.

Let’s talk about the business owner now, if we can. From a point of view, I own a company. This is the third, fourth, or fifth entity that I’ve started in my lifetime. Let’s use me as an example, even though I’m not selling the company anytime soon. But now I own a financial business or a widget company. I’m 58 or 60. It’s time for me to think about it. My wife said, “You need to slow down a little bit. You’re working too many hours.” All that stuff. What’s going on in my head, and what’s going on at the next step?

Think about this. The business owners are on the proverbial island. That’s why I work with people like you, Elliot, and wealth advisors because when I’m done, when the corporate attorneys, CPAs, the M&A attorneys, and the trust and Estate attorney are done, the only two people standing typically are the business owner and the wealth advisor.

The wealth advisor, when it comes to having a professional M&A to get that optionality that you referenced, they’re on an island. There are not many people who they know other than what they’re doing within their vertical to grow their business, but it’s a child to them. The CPA and the attorney, no matter how good they are, the wealth advisor doesn’t give them options.

We sit down and say, “What are you trying to accomplish?” If you were the business owner, Elliot, and you had a magic wand and you wanted to transition out of this business, what would the perfect scenario look like? We walk them through that. We’re very Socratic, but we also want to make sure that their desires are cloaked in reality.

There’s a process, whether a large investment bank like Morgan Stanley or Vesticor does a $10 million deal. The algorithm, the process, and the timeline are the same. Everybody’s got the same I’s and T’s. It’s just finding a good advocate for the business owner to find the desirable solution. That requires a lot of asking questions.

M&A Expert And Business Broker

We’re talking with Brian because 60% of our clients own or have owned companies. We have that entrepreneurial bent and flair. It’s in our blood. My dad and his dad were entrepreneurs. There’s a little bit of entrepreneur in your blood. I would make a terrible McDonald’s Franchise owner because I can make a better hamburger than a quarter-pounder with cheese.

I just can’t sell billions and billions of them. Entrepreneurs like to do it their way. There are lots of flavors of entrepreneurship because franchise owners are entrepreneurs. They just have a formula that they like to follow versus somebody like myself who prefers to create the roadmap rather than follow the roadmap, and that’s different. What’s the difference between a business broker and an M&A expert?

I get that asked all the time. A business broker, for the most part, serves a purpose. Most of them are micro, small companies, and Lifestyle businesses that are not going to get a lot of love or attraction from financial buyers, be it strategic or PE firms. What they do differently is they never take anything to market in a formal competitive process. They put together a little thesis and then they listed it on a company like BizBuy.com and they hoped somebody would buy it, with a hope.

Not just Vesticor, but all M&A firms, we have a very formal competitive process, Elliot, where we’re taking the objectives to market in that formal competitive process. We’re looking for desirable, using our proprietary database of buyers, strategic, family offices, independent sponsors, and private equity firms. We look at that in a rifle-like manner to find the best solution or partner that meets all, if not most, of the objectives of the business owner.

As a business broker, you go out and you find buyers for that business owner.

The business broker does more of a listing. In a lot of states, I think even in California, you can’t even be a business broker unless you have a Real Estate license because there tends to be real estate involved with every operation. They work with SBA loans under $5 million. I call on business brokers when it comes to a certain level of business. They seek out M&A firms like Vesticor to help them sell the business because they know it’s not going to sell if they just listed it on some BizBuy.com, if you will.

If I’m the business owner here, I’m doing this first person so everybody can understand it. I now have reached a stage where I want to sell my financial or widget company. I’ve interviewed you, and you’re going to be my M&A firm. That’s how this works, correct? You’ve explained to me why I shouldn’t pass this business along to my children because my children want to be the beneficiaries of the Money, not necessarily run the company.

We both know that by the third generation, a company is done. Not in every case. There have been companies that have been around for 150 years, but for the most part, that’s how it works. We have this conversation about what is next for me. I want to talk about that because we are in a behavioral Finance world as financial advisors with two companies pushing a billion dollars.

We’re in that world where you ask, “What are you going to do for the rest of your life?” M&A people don’t have that conversation for the most part because you want to make the transaction. I get it. I want to keep the business owner as a client or make my client. I get that too. That’s a long-term relationship situation versus a transaction. You’ll understand that.

Psychological Aspects Of Selling

I’m always concerned, as I just spoke to a very good friend who’s now 80 and sold the business. He said, “Monday is the same as Wednesday. It’s the same as Saturday. It’s all blended in. I don’t do anything different. We just go out to lunch or dinner, and that’s it. We come home.” How do we deal with that psyche that we don’t want to die two years after selling your company?

I’ll take a couple of things with that. I designed a very unique business and service model, and other M&A firms are just as capable of what we do. Just like the ten dentists in your local area, Elliot, who pull out Wisdom teeth the same way, you’re looking for somebody that you can trust and who has advocacy. The reason I work a lot with intermediaries, especially with wealth advisors and professionals like you, is because you are the one, more than the attorney or the accountant, who is there before the sale and then post-sale, because you are involved with everything.

We pride ourselves, and we say this jokingly, but we create tax problems, and it’s for Elliot and the accountants to figure out the tax problems. I designed a very unique service model where we provide resources, time, energy, and bandwidth to these business owners, even when they’re not ready to exit. Sometimes they’re not.

Unfortunately, I don’t know if you know this, but one and a half trillion dollars was done in U.S. businesses bought and sold last year, 2023. One and a half trillion, and that was an off year. To be transparent, that was both the operation and the real estate, which is about 20% of that. Sadly, unexpectedly, and this is why you’ve done so well with preparing business owners, 40% of the time, the business is triggered to sell unexpectedly due to death, disability, or divorce.

Then there are a couple of other ones called “Distress.” The company’s doing well, but it’s not making money, and they have to sell it, or there’s disagreement among owners. You’ve had that as an entrepreneur, you understand that. There’s always “Dig a well before you’re thirsty.” I found that if I provide resources through intermediaries like you, the CPA, or the attorney before they sell, or when they’re not even ready to sell, it helps them to prepare when they are ready to sell. I think that’s paid off for us in droves because of that model.

You bring up a good point there, Brian, and as a business owner or a high-net-worth professional, you want to build a team around you. I need an M&A company that I trust, that’s going to help me sell. That key word is trust because as a financial advisory firm, we are trying to exude trust 24 hours a day because that’s the difference between firms and people.

I need an M&A firm. I need a good attorney who gets it, correct? I need a CPA, not just a tax preparer. I need a CPA who gets it, who deals with these situations, and who can help me with the taxes. I also want to make sure that I’m not so consumed with the taxes because I’ve had this happen, that I forget about the opportunity in front of me to make a lot of money and decide the taxes are number one. Am I saying that properly, Brian?

Yes, think of it this way. The business owner has many people, especially the three major intermediaries, which are the wealth advisor, the CPA, and the attorney in whatever capacity. All M&A firms are that proverbial missing professional link. We pick up where everybody leaves off, such as yourself, the attorney, or the accountant.

Mergers and acquisition firms are the proverbial missing professional link that picks up where everyone else leaves off.

We provide where those other professionals can’t, and that is to take the objectives to market in that formal competitive process. It does require a team, it does require planning, and it’s not somebody waking up one day saying, “I’m going to sell.” We do have to dig a well before we’re thirsty, especially when 40% are triggered by sales due to death, disability, divorce, etc.

I had a scenario that happened, and I want to bring this up to you because it happens too often in business, and I’m sure you’ve seen it. A client of mine sold his business for three payments of $5 million. That’s $15 million he sold it for. A vast majority of that was going to be taxable. In the first year, he came to me and said, “What should I do? I’m getting $5 million.” I said, “Take a million of it and pay your taxes. That leaves you with $4 million of after-tax money.”

He said, “I hate that idea. That’s a million dollars to the IRS.” I said, “But you’re walking away with 4 million in your pocket, and you’re gone. You don’t have to think about it. No strings attached, nothing.” He went to a CPA firm because he didn’t like my answer. The CPA firm convinced him to create a charitable foundation. He had never been that charitable in his life. They told him to save all that money on $5 million by putting it in a charitable donation program, a trust.

It’s an Irrevocable trust now, and he would owe nothing in taxes based on that first installment. He said, “I’ll just pay taxes on the second and third installments.” I said, “I think you’re doing an injustice to yourself because you’re counting your chickens before they hatch. You don’t have the second and third payments yet.” 50% of us know that many of these large percentages end up back in front of a judge or a mediator because the seller feels they got shorted, the buyer feels they got shorted, whatever it is.

Of course, in the second year, about 15 months into this, the company said, “We’re having some financial problems. We’re suspending payments to you indefinitely for the other two-thirds.” So he’s having to take them to court. In the meantime, his wife got wind of what he did because she didn’t know about all this stuff.

She’s filing for divorce, saying that he misused their money among other things. I don’t want to say that’s the only reason, but she claims he misused their money. You can see how fast that got ugly, and he may never collect the remaining $10 million. He will have taken the bulk of the profit from the first third and put it in an irrevocable trust that he doesn’t have access to.

Was it Will Rogers or Mark Twain who said, “I’ve never seen a man go broke paying capital gains tax?” The concept is, that none of us are getting out of this alive, but we also know we’re going to be paying taxes. What a lot of business owners forget, and even everybody tries to jump out of their lane. Again, we try to stay out of that. This is why you are important, Elliot, and why the accountants or the tax attorneys are important.

We create the tax problem. Now, when you sell a business, not 100%, but almost every time, it’s an asset sale. There’s not much you can do. It’s a capital gain. You can do the deferred sales trust, you can do some of those life insurance isolates, but you’re just deferring it. With the property, you can do a 1031 exchange and try to save taxes there.

It’s hard to get around when you sell a business for $40 million and it’s an asset sale, it’s a capital gain. You could defer it over a couple of years based on payment by the buyer, but this is all that matters. What matters is, before you have to sell, hopefully, you’re not one of those 40% that’s triggered to sell unexpectedly. It’s working with people like you to build out an idea or a plan, but give them options so they can make an informed decision.

If they had enough information, and they shared it with, in this case, the person you’re talking about, with his wife, they probably wouldn’t be getting a divorce. I don’t know, I can’t say that, but it’s, “Dig a well before you’re thirsty.” The tax situation is a byproduct of what takes place, but the main thing is saying that our job is to find out what their objectives are and how long they’re going to still work.

Our job is to get the most money for them in this transaction. We have to build that investment thesis. Who would buy it? Why would they buy it? Can they process it? Can they duplicate it? The more money we make for them, the bigger the asset sale, and the bigger the capital gains. What you do with that, whether it’s a deferment or whether you do a couple of things presale, that’s up to professionals like you.

Business Structure For Sale

You brought up a good point about digging a well. I want to talk about that. Before I do, let me ask you a question because I get asked this all the time: C Corp, S Corp, LLC, which entity is the most advantageous to sell if you’re the business owner?

A lot of times, I’d say the LLC or the S Corp. Sometimes with a C Corp, you have, and again, I’m not going to claim to be a tax person, I probably shouldn’t even go in that direction with you, but at the end of the day, it’s still going to be an asset sale. If it’s a Security sale or a stock sale, you can do an election to avoid being double-taxed.

However, at the end of the day, the process is still the same, Elliot. The tax attorneys are not going to convert it from an LLC to an S Corp. You’re going to do the sale, but there are IRS elections that can change so you’re not double-taxed. The outcome is exactly what you and I have tended to do, which is an asset sale.

We were talking with Brian Summe of Vesticor, who is an M&A expert for businesses that want to be sold, or if you’re in the market to buy, they’re going to find that too. You mentioned a word, and we’ll end on this note because this has been good. You can tell people how to reach you, which is important because if you’re a business owner, you need to have a conversation with Brian to understand what he does and the value he brings to the table.

That’s important to do with firms like his. If you need referrals for Brian or attorneys, reach out to me. I have been around for 30 years and have contacts there. Brian would not be on my show if he wasn’t extremely credible and talented at what he does. You mentioned a good phrase here, Brian, “Dig a well before you’re thirsty.” How many years out do I need to think about hiring you or having a conversation with you before I want to sell my entity?

There’s never a timeline for planning. There are all kinds of industry adages out there that say at least three years because a lot of times, nobody knows what to prepare. If you do a quality of earnings, how could we have increased EBITDA in those two years to get a higher price value for our company? I would say a good benchmark is at least two to three years in advance because what you’ll find is a lot of these folks are underinsured.

There’s never a timeline for planning.

Let’s say there are several owners on the equity stock. They might have their key man policies that haven’t been reviewed, and they’re underinsured. You and I started a company 10 years ago, Elliot, and it’s worth $20 million, and we only have a half-million-dollar term life insurance on each other. If you die, I’m the one stuck with paying your estate $9.5 million that I don’t have if I don’t have it from an insurance policy.

There are also things like not just key man policies, but also buy-sell policies that are outdated. It takes time where, let’s say, Elliot, you want to move out of California and move to Florida, Texas, or Nevada, a non-income tax-paying state. It takes a year to domicile. I would give a number, two to three years, to go over many different variables.

This has been great, Brian. We’re having a conversation about M&A for business owners. Brian is an expert again in that marketplace when it comes to M&A. We’re experts in behavioral finance, managing portfolios, and what to do with your assets. We want to talk to you before you get this windfall so we can at least plan better for it.

Of course, you need an attorney just to make sure you’re doing the right thing here. Brian, how do people reach out to find you?

The company is Vesticor.com. They can reach me by email, mine is BSumme@Vesticor.com.

Again, business owners, something to think about if you’re in your 40s, it’s something to prepare to do. If you’re in your 60s, it’s something to think about for the next phase of your life. If you’re like me and you’re trying to create a legacy for your family that includes charity and giving, that takes some good planning to do.

If you’re just somebody who wants to hand down cash to your kids or your spouse, that’s another thing, another way of planning, or just doing the right thing in the marketplace. Reach out to us at Elliot@ProsperityFinancialGroup.com, and we’ll hook you up with Brian and an attorney as well, and we look forward to seeing you again. Thanks, everybody.

Important Links

- Brian Summe – LinkedIn

- BSumme@Vesticor.com

- Vesticor

The post Maximizing Value In Mergers And Acquisitions With Brian Summe appeared first on Prosperity Financial Group | San Ramon, CA.