Creditors Adapt to Current Consumer Habits for Business Growth

Photo by Geralt via Pixabay

Attract the Right Job or Clientele:

Creditors Adapt to Current Consumer Habits for Business Growth

Business owners and creditors must adapt to rapidly changing consumer habits to succeed in today’s market. As preferences shift toward digital experiences and a stronger focus on financial wellness, the credit industry must evolve to meet these new demands.

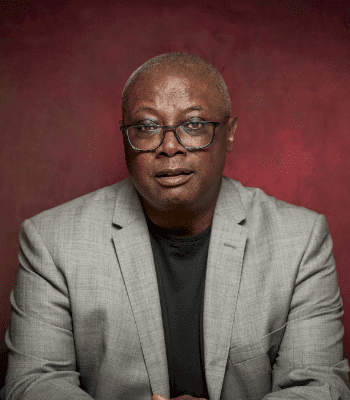

Bradley Tompkins provides our guest blog with insights concerning how creditors can adapt to current consumer habits to grow their businesses and remain competitive in this evolving environment. He is Chief Information Officer at Vergent LMS, overseeing the company’s product and Technology initiatives. He supervises customer implementations and vendor integrations to help ensure that Vergent’s platform consistently performs at a high level for all users and partners.

_________________________________________________________________________________________________________________

Adapt to Current Consumer Habits for Business Growth

Image by Digital Artist

Make the Shift to Digital Experiences

One of the most significant changes in consumer behavior is the preference for digital experiences. From online shopping to digital banking, consumers increasingly value convenience and speed. This trend is no different in the credit industry, where borrowers expect seamless digital interactions.

Embrace Digital Platforms

To keep pace in our digital world, creditors must embrace digital platforms for loan applications, approvals, and management. They must offer a user-friendly online interface where consumers can easily apply for credit, check their loan status, and make payments. Additionally, implementing mobile apps can further enhance the user experience, allowing borrowers to manage their credit on the go.

Leverage Data Analytics

Digital platforms also allow creditors to gather and analyze consumer data, offering insights into borrowing patterns and preferences. Through data analytics, creditors can tailor their offerings to meet the specific needs of different customer segments. For example, personalized loan offers based on a borrower’s credit history and financial behavior can enhance the customer experience and increase approval rates.

Promote Eco-friendliness

Transitioning to digital platforms also promotes eco-friendliness by reducing the need for paper-based processes. By encouraging digital statements and online transactions, creditors could significantly reduce paper waste, contributing to environmental sustainability. This shift appeals to eco-conscious consumers and aligns with broader efforts to reduce carbon footprints and promote green practices.

Focus on Financial Wellness

In addition to digital preferences, modern consumers are more focused on their financial health than ever. They seek to understand their credit options better and make informed decisions that align with their long-term financial goals.

Provide Educational Resources

Providing educational resources is a powerful way to build trust with borrowers. Creditors can offer webinars, blog articles, and interactive tools that help consumers understand credit scores, interest rates, and loan terms. This empowers consumers while also positioning the creditor as a trusted advisor.

Offer Transparent Communication

Transparency is vital to building trust. Communicating loan terms, fees, and repayment schedules helps borrowers make informed decisions. Avoiding hidden fees and complex jargon can also differentiate a creditor in a crowded market.

Adapting to New Payment Preferences

The way consumers prefer to make payments is also evolving. Offering flexible payment options can cater to a broader audience by allowing borrowers to choose the one that best fits their Lifestyle. Popular modern payment methods include:

• Digital wallets:

Services such as Apple Pay, Google Wallet, and PayPal have become popular for their convenience and Security. These platforms allow users to make payments with a simple tap or click, eliminating the need to carry physical cards.

• Bank transfers:

Direct bank transfers, including services such as Zelle and ACH transfers, offer a straightforward and secure way for consumers to make payments directly from their bank accounts.

• Cryptocurrency:

As digital currencies, such as Bitcoin and Ethereum, gain mainstream acceptance, offering cryptocurrency payment options can appeal to tech-savvy borrowers. This method provides an additional layer of privacy and can attract a niche market of Crypto enthusiasts.

• Contactless payments:

With the rise of contactless payment technology, more and more consumers are using RFID-enabled cards and devices to make quick, touch-free payments.

• Subscription-based payments:

Offering a subscription-based model for recurring payments can streamline the process for creditors and borrowers. This method can be easily managed through automated billing systems.

Implementing Consumer Loan Management Software

Investing in consumer loan management software is crucial to effectively managing the changing landscape. This technology streamlines the loan lifecycle — from application to repayment —and provides a comprehensive view of borrower data. Key benefits include:

Improved Automation and Efficiency

Consumer loan management software can automate many aspects of loan processing, reducing the time and effort required for manual tasks. Automation can handle routine activities such as application processing, credit checks, and payment tracking, freeing staff to focus on more strategic tasks.

Enhanced Customer Experience

With integrated customer relationship management (CRM) features, loan management software can enhance the borrower experience. It allows for personalized communication, timely payment reminders, and easy access to account information, contributing to higher customer satisfaction and loyalty.

In Conclusion: Creditors Adapt to Current Consumer Habits for Business Growth

Adapting to current consumer habits is not just about staying competitive; it’s about building lasting Relationships with borrowers. By embracing the right strategies, creditors could not only meet the needs of today’s consumers but also position themselves for future success in a continually changing market. The better approach is to test ideas individually to monitor the results accurately. Accordingly, when you adapt to current consumer habits for business growth, you increase the likelihood of exceeding expectations and experiencing the results you desire.

Resources:

McKinsey: Industries-consumer packaged goods/our insights per the state of the U.S. Consumer https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-state-of-the-us-consumer

For more Insights, Visit Elinor’s Amazon Author Page

Communicate to Attract Interest

Be A Story-Teller

“Believe, Become, Empower”

Related Blog Stories:

Sales Tips: Adapt to Current Consumer Habits for Business Growth

1. Inquire of prospects why they chose to speak with you to

ensure the conversation is on the right track.

2. At the beginning of each conversation with a client, inquire how they like working with you to seek out areas of improvement.

3. Before incorporating a new approach, ensure it fits in with everything else you do.

4. Monitor all aspects of business for ongoing improvement.

5. Embrace your unique style to ensure it is included in all procedures.

6. Confer with other specialists in your field to realize techniques you may be overlooking.

7. Be willing to adjust elements of your new idea for a better outcome.

8. Upon adopting any strategy you see others using, adjust it to your unique style.

9. Realize where you may maximize the effort for a robust

outcome by adapting to current consumer habits for business growth..

10. Today’s insights are provided to help you achieve the Smooth Sale!

RESOURCES FOR PERSONAL AND BUSINESS GROWTH:

Advisorpedia Publishes information to help advisors build their practice, and those interested in the markets choose investments and find inspiration.

BabyBoomer – A trusted media source that collects and curates all the news and resources, plus offers a wide variety of excellent courses for the Baby Boomer generation.

BizCatalyst360 Provides a life, culture, and business new media digest as a hub of creative expression and personal growth.

CatCat: Build your future one skill at a time.

ContactOut is a web-based platform that enables users to search for contact information and uncover contact details, including email addresses, phone numbers, and other personal data.

Executives Diary Magazine Features leaders from varying fields sharing their inspiring stories, including Elinor Stutz.

Fedica Enables you to realize your followers’ interests and create tailored content to encourage returning and referring clientele.

Greg Jenkins Consulting LLC – Helping organizations realize the value of diversity to build inclusive, evolving, high-performing cultures.

Growth Hackers – Helping businesses globally grow with lead generation, growth marketing, conversion rate optimization, data analytics, user acquisition, retention, and sales.

Humanology International Institute – The institution that develops and safeguards humanology as a discipline worldwide.

Inclusion Allies Coalition: “Everyone is welcome here.” Learn more to train teams and join the advocacy program.

Internet Advisor: Find the right internet service among 2083 providers across 36,380 cities. Plus, Cellphonedeal compiles excellent deals on phones, plans, and prepaid to furnish you with the best options in your area.

Inspired Movie Inspiration is a game changer for most; apply to an inspiring guiding light in conjunction with Producer/Director of the Inspired movie Patryk Wezowski,

Kred Connect with top-rated influencers to learn from and grow your networks.

LinktoEXPERT “It is not who you know – who knows you and what your expertise can do for them, plus understand the value of hiring you.”

Lotus Solution LLC Helps organizations create diversity and inclusion to ensure fairness and work through customized consulting, training, and keynote speeches.

Onalytica: Find relevant influencers for your brand.

SalesPop! Purveyors of Prosperity; How to Compete against Yourself to Excel in Your Career.

Simma Lieberman, “The Inclusionist,” helps develop inclusive leaders from the inside out to champion diversity and build equitable, inclusive cultures at every level.

Yoroflow offers a comprehensive suite of digital workplace platforms to help you streamline your day-to-day operations, manage your finances, and grow your business.

Vunela Provides a unique opportunity to view Videos and read articles by World Leaders.

Win Win Women is the world’s only interactive network and an international community for women. Women WIN when they receive solutions + Experts WIN when they provide solutions = Win Win Women.

The post Creditors Adapt to Current Consumer Habits for Business Growth appeared first on SmoothSale™.